Transportation Expenses Definition How They Work and Taxation

Transportation Expenses: Definition, How They Work, and Taxation

What Are Transportation Expenses?

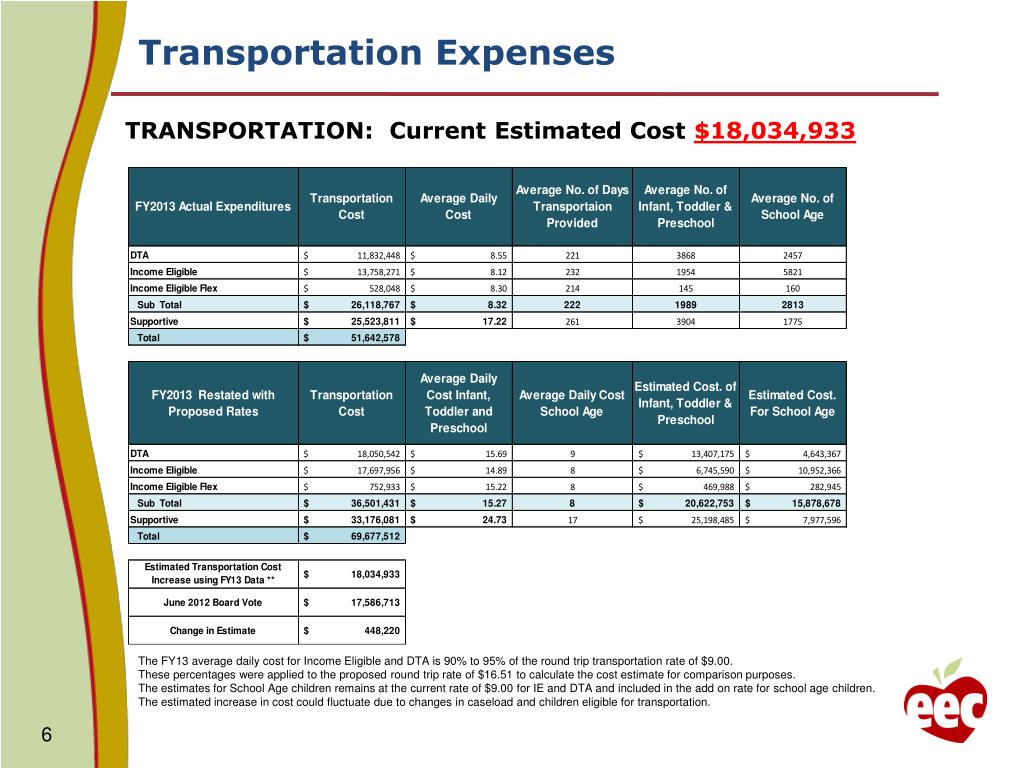

Transportation expenses refer to costs incurred by an employee or self-employed taxpayer who travels for business purposes. These expenses are a subset of travel expenses, which include taxi fare, fuel, parking fees, lodging, meals, tips, cleaning, shipping, and telephone charges that employees may claim for reimbursement. Some transportation expenses may be eligible for a tax deduction.

Key Takeaways

– Transportation expenses are a subset of travel expenses and include costs of business transportation.

– Expenses like fuel, parking fees, lodging, meals, and telephone charges can be claimed as transportation expenses.

– These expenses may be deducted for tax purposes, subject to restrictions and guidelines.

How Transportation Expenses Work

Transportation expenses include costs related to business travel by company employees. Employees can claim the cost of travel, hotel, food, and other related expenses as transportation expenses. These expenses may also apply to traveling from home to a temporary workplace in certain circumstances. However, commuting to and from the office does not count as a transportation expense.

Transportation expenses are narrow in scope and only cover the use and maintenance of a car used for business or travel by rail, air, bus, taxi, or any other means of conveyance for business purposes. They may also refer to deductions for businesses and self-employed individuals when filing taxes. However, transportation expenses only qualify for tax deductions if they are directly related to an individual’s primary business.

Taxpayers must keep good records of travel expenses and provide receipts and other evidence when claiming tax deductions or reimbursement.

Special Considerations

According to the IRS, travel or transportation expenses are the necessary expenses incurred when traveling away from home for business, profession, or job purposes. Traveling away from home refers to duties that require an individual to be away from their tax home for a substantially longer period than a regular workday and to sleep or rest to meet the demands of their work while away from home.