Money Market Hedge Definition Strategy Process and Example

Money Market Hedge: Definition, Strategy, Process, and Example

What Is a Money Market Hedge?

A money market hedge is used to lock in the value of a foreign currency transaction in a company’s domestic currency. It helps a domestic company reduce exchange rate or currency risk when conducting business transactions with a foreign company. The process involves depositing funds into a money market, the financial market of highly liquid and short-term instruments.

Money Market Hedge Explained

The money market hedge allows the domestic company to lock in the value of its partner’s currency in advance of an anticipated transaction. This creates certainty about the cost of future transactions and ensures the domestic company will pay the desired price.

Key Takeaways

– A money market hedge is a tool for managing currency or exchange-rate risk.

– It allows a company to lock in an exchange rate ahead of a transaction with a party overseas.

– Money market hedges can offer flexibility, such as hedging only half of a transaction’s value.

– Money market hedges are usually more complicated than other forms of foreign exchange hedging, such as forward contracts.

Without a money market hedge, a domestic company would be subject to exchange rate fluctuations that could dramatically affect the transaction’s price. While changes in exchange rates could make the transaction less expensive, they could also make it more expensive and possibly cost-prohibitive.

A money market hedge offers flexibility in the amount covered. For example, a company may only want to hedge half of an upcoming transaction’s value. The money market hedge is also useful for hedging in exotic currencies, such as the South Korean won, where few alternate methods for hedging exchange rate risk exist.

Money Market Hedge Example

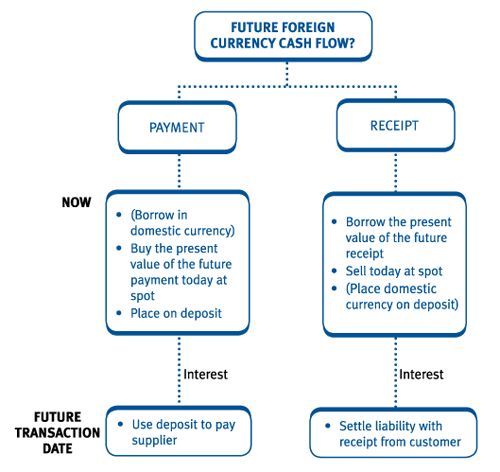

Suppose an American company needs to purchase supplies from a German company in six months and must pay for the supplies in euros. The company could use a money market hedge to lock in the value of the euro relative to the dollar at the current rate. This way, even if the dollar weakens relative to the euro in six months, the U.S. company knows exactly what the transaction cost is going to be in dollars and can budget accordingly. The money market hedge would be executed by:

– Buying the current value of the foreign currency transaction amount at the spot rate.

– Placing the purchased foreign currency on deposit with a money market and receiving interest until payment is made.

– Using the deposit to make the foreign currency payment.

Money Market Hedge vs. Forward Contract

If a U.S. company cannot or does not want to use a money market hedge, it could use a forward contract, foreign exchange swap, or simply take a chance and pay whatever the exchange rate happens to be in six months. Companies may choose not to use a money market hedge if they perform a large number of transactions because it is typically more complicated to organize than a forward contract.