Millennials Finances Investing and Retirement

Millennials: Finances, Investing, and Retirement

Millennials, born between 1981 and 1996, are also known as Generation Y (Gen Y). They are the largest generation in American history. This generation grew up in a digital world and is considered digital natives. They value technology and have had a significant impact on the growth of Silicon Valley and other tech hubs.

The millennial generation is the most ethnically and racially diverse in U.S. history. They tend to have progressive political views and voting habits and are less religiously observant than previous generations.

Key Takeaways:

– Millennials, or Gen Y, are the largest generation in American history.

– Millennials face financial challenges, such as stagnant wages and high student loan debt.

– They have different career and retirement goals compared to previous generations.

– Millennials prioritize immediate financial well-being and long-term financial goals.

Millennial Economic Picture:

Millennials face an uncertain economic future, as they have experienced stagnant wages, the Great Recession, and the impact of the coronavirus pandemic. The job market has improved, but wage stagnation remains an issue. Millennials also carry a significant amount of debt, mainly from student loans.

Work and Income:

Millennials start with lower household incomes due to the increasing wealth gap. Many have turned to the gig economy, and the pandemic pushed more jobs to remote work. Despite challenges, the median income for a millennial household is $71,566.

Becoming Financially Independent:

Millennials prioritize day-to-day living expenses and focus on immediate financial well-being. They recognize the importance of income-driven independence and look to broaden their earning capacity through education and work experience.

Getting Out of Debt:

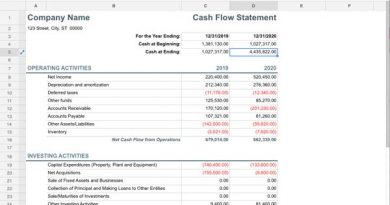

Paying off student loan debt is challenging, but millennials can leverage funds to begin building a retirement nest egg. While having debt is not always bad, it is crucial to establish a good credit history and manage debts responsibly.

Saving for a Big Purchase:

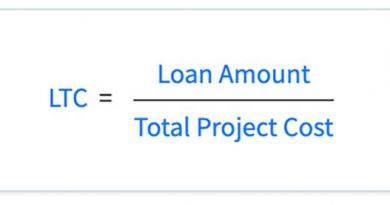

Millennials save for big-ticket items such as homes, but stricter lending guidelines make it necessary to have a substantial down payment. Traditional savings accounts may not provide the best returns, so exploring other investment options is recommended.

The Millennial Life View:

Millennials have different career trajectories and retirement goals compared to previous generations. They prioritize pursuing their ambitions while they’re young and prioritize work-life balance. Some millennials plan to work indefinitely because they are passionate about their jobs. Long-term disability insurance is a smart financial move for the future.

Entrepreneur for Life:

Millennials see themselves working forever, driven by a passion for their work. They value a flexible work schedule and work-life balance and want to avoid being tied to one company. Saving for retirement is still essential, as unforeseen circumstances may require a safety net.

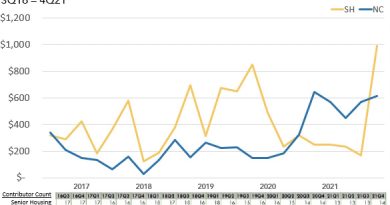

How Millennials Invest:

Millennials embrace technology and use social media tools to make investing easier. They leverage online platforms and mobile apps to follow stock picks, find financial planners, and monitor their investments. Robo-advisors are popular among this generation.

What Age Range Is Millennial?

Millennials were born from 1981 to 1996.

Where Did the Name Millennial Come From?

Millennials were named for being the first generation to come of age in the new millennium.

How Much Money Do Millennials Make?

According to the U.S. Census Bureau, millennials earn a median pretax income of $71,566 in their households.

The Bottom Line:

Millennials are planning for retirement, although their approach may differ from previous generations. They prioritize financial independence, immediate well-being, and work-life balance. Saving for the future and remaining hopeful about their financial futures are common among millennials.