Mileage Allowance What It is How It Works

Contents

- 1 Mileage Allowance: What It is, How It Works

- 1.1 What Is the Mileage Allowance?

- 1.2 How the Mileage Allowance Works

- 1.3 IRS Regulation of Mileage Allowance

- 1.4 Deductibility of Moving and Medical Travel

- 1.5 What Is the Mileage Allowance?

- 1.6 Is Using the Mileage Allowance Mandatory?

- 1.7 How Does the IRS Determine Its Mileage Allowance?

- 1.8 The Bottom Line

Mileage Allowance: What It is, How It Works

Lea Uradu, J.D. is a Maryland State Registered Tax Preparer, State Certified Notary Public, Certified VITA Tax Preparer, IRS Annual Filing Season Program Participant, and Tax Writer.

What Is the Mileage Allowance?

“Mileage allowance” is the term the IRS uses to refer to deducting expenses car owners accrue while operating a personal vehicle for business, medical, charity, or moving purposes. For 2024, the IRS allows you to deduct $0.67 per mile for business use, $0.14 for charity use, and $0.21 for certain medical and moving uses (for 2023, it’s $0.655, $0.14, and $0.22, respectively).

Key Takeaways

- The mileage allowance is a fixed amount set by the IRS that you can deduct for using your car for business, medical, charity, or moving purposes.

- You can choose not to use the mileage allowance and instead deduct the actual costs of using your vehicle, but you must have documentation for them.

- The IRS bases its mileage allowance on an annual study of the costs of operating a car.

How the Mileage Allowance Works

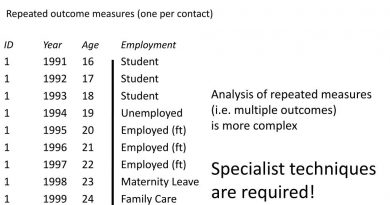

Taxpayers have the option of using the IRS mileage allowance to calculate the costs of owning and operating a car for tax-deductible purposes during a given tax year, but it’s not required. Taxpayers also have the choice of calculating the actual costs of using their vehicle. If you choose this approach, you must have documentation to prove the validity of your cost estimates.

IRS Regulation of Mileage Allowance

The IRS arrives at its suggested mileage allowance for business and medical and moving purposes based on an annual study of the fixed and variable costs of operating a car. The rate for medical and moving purposes is based only on the variable costs.

If you deduct mileage as a business expense on your income taxes, the travel must be strictly for business purposes, and commuting to and from work does not count. Qualified business driving includes traveling to meet clients face-to-face, out-of-town business trips, or trips to buy supplies. Miles combined with personal travel, such as running errands, are not deductible.

The tax deduction for moving to a new home was eliminated starting in 2018 for all but active-duty military members.

Deductibility of Moving and Medical Travel

A taxpayer may claim a mileage allowance for travel associated with obtaining medical care and, in restricted cases, moving a principal residence. If you deduct mileage for medical care, those miles must be strictly related to the medical care and essential to accessing it.

The tax deduction for moving expenses was eliminated as of 2018 unless you are a member of the armed forces on active duty and must move due to a military order. If that is the case, you must meet distance and time tests articulated in the Tax Cuts and Jobs Act of 2017. The distance between your new job and old home must be more than 50 miles farther than your previous job’s location, and you must work full time for at least 39 weeks during the initial 12-month period of your relocation.

What Is the Mileage Allowance?

The mileage allowance is a fixed amount set by the IRS that you can deduct per mile for business, medical, charitable, and, in some cases, moving costs attributed to your car.

Is Using the Mileage Allowance Mandatory?

No. You may deduct actual costs if you prefer, but you need proper documentation to back them up.

How Does the IRS Determine Its Mileage Allowance?

The IRS conducts an annual study of the costs of running an automobile to determine its average amount.

The Bottom Line

The mileage allowance is a method devised by the IRS to help you deduct allowable expenses for using your car. The tax agency calculates the average cost annually and allows you to use it in calculating your deduction. If you prefer, you may deduct the actual cost rather than the IRS’s suggested amount, but you will need receipts to document it. Personal costs mixed with business, medical, charitable, or moving costs cannot be deducted.