Max Pain Explained How It s Calculated With Examples

"Max Pain Explained: How It’s Calculated, With Examples"

"What Is Max Pain?"

Max pain is the strike price with the most open options contracts, causing financial losses for the largest number of option holders at expiration.

"The maximum pain theory" states that most traders who hold options contracts until expiration will lose money.

Key Takeaways:

– Max pain is the strike price with the most open options contracts, causing financial losses for the largest number of option holders at expiration.

– The maximum pain theory states that options gravitate towards a max pain price, causing the maximum number of options to expire worthless.

– Max pain is calculated by summing the dollar values of outstanding put and call options for each in-the-money strike price.

"Understanding Max Pain"

According to the maximum pain theory, the price of an underlying stock tends to gravitate towards its "maximum pain strike price"—the price where the greatest number of options will expire worthless.

Option writers hedge their contracts to remain neutral, buying or selling shares of stock to drive the price towards a closing price that is profitable for them.

About 60% of options are traded out, 30% expire worthless, and 10% are exercised. Max pain is the point where option buyers stand to lose the most money, while sellers may reap the most rewards.

Critics are divided on whether the tendency for the stock price to gravitate towards the max pain strike price is a matter of chance or market manipulation.

"Calculating the Max Pain Point"

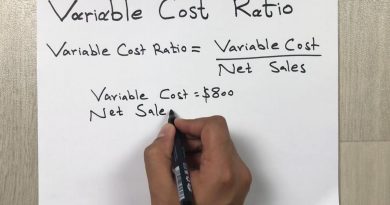

Max pain is calculated by summing the outstanding put and call dollar value for each in-the-money strike price.

For each in-the-money strike price:

1. Find the difference between the stock price and strike price.

2. Multiply the result by the open interest at that strike.

3. Add together the dollar value for the put and call at that strike.

4. Repeat for each strike price.

5. The highest value strike price is the max pain price.

Because the max pain price can change frequently, it is not easy to use as a trading tool. However, note when there is a significant difference between the current stock price and the max pain price, as there could be a tendency for the stock to move closer to max pain as expiration approaches.

"Example of Max Pain"

For example, suppose stock ABC options are trading at a strike price of $48, but there is significant open interest at strike prices of $51 and $52. The max pain price will settle at either one of these two values because they will cause the maximum number of options to expire worthless.