Underlying Security What it is How it Works Example

Contents

Underlying Security: What it is, How it Works, Example

What Is Underlying Security?

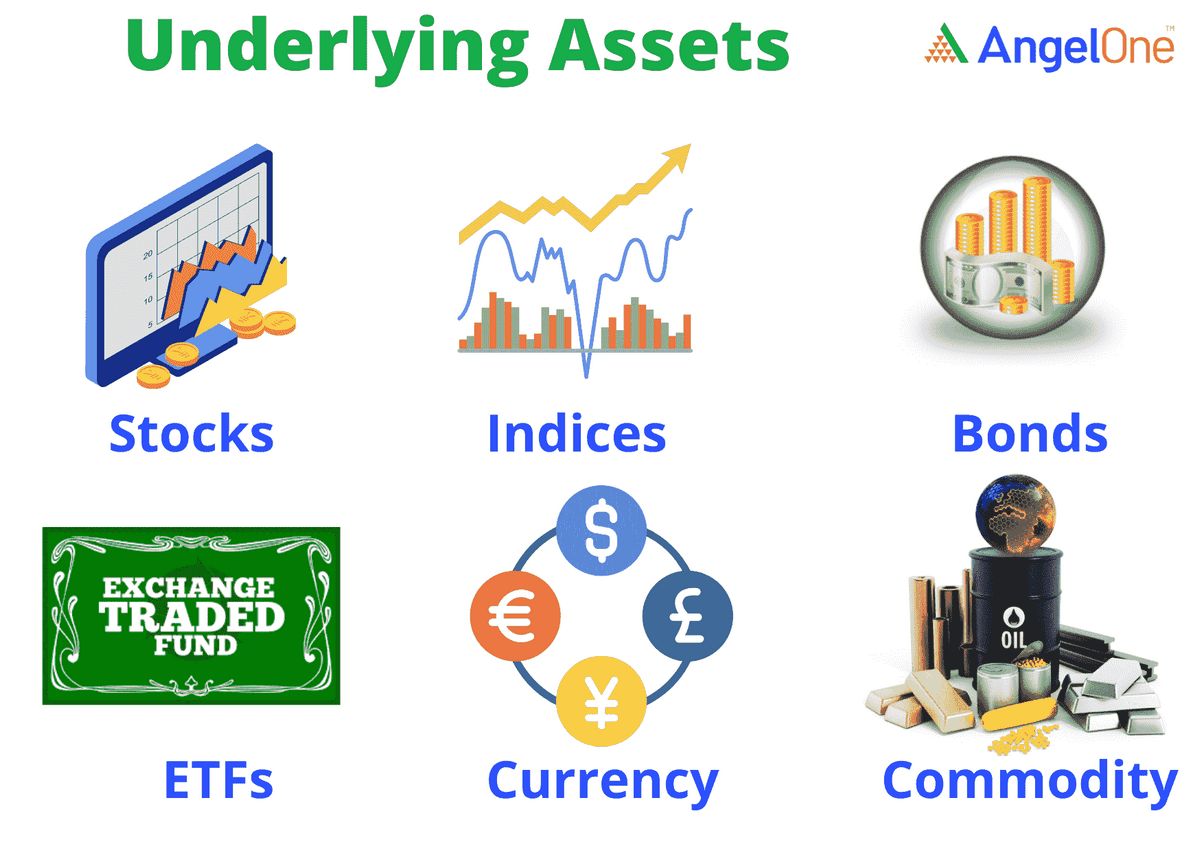

An underlying security is a stock or bond on which derivative instruments, such as futures, ETFs, and options, are based. It is the primary component of how the derivative gets its value.

Key Takeaways

- An underlying security is a stock or bond on which derivative instruments, such as futures, ETFs, and options, are based.

- In most cases, the underlying security is the item delivered in the derivative contract.

- Traders use derivatives to speculate on or hedge against the future price movements of the underlying security.

Understanding Underlying Security

In derivative terminology, the underlying security is often referred to as "the underlying." It can be any asset, index, financial instrument, or another derivative. Collateralized debt obligations (CDOs) and credit default swaps (CDS), which played a central role in the Financial crisis of 2008, are derivatives dependent on an underlying.

The role of the underlying security is to be itself. If there were no derivatives, traders would simply buy and sell the underlying. However, in derivatives, the underlying is the item delivered in the derivative contract. The exception is when the underlying is an index or when the derivative is a cash exchange swap.

There are many widely used and exotic derivatives, but they all have one thing in common: their basis on an underlying security or asset. Price movements in the underlying security affect the pricing of the derivative based on it.

For example, a call option on Alphabet, Inc. (GOOGL) stock gives the holder the right, but not the obligation, to purchase Alphabet stock at a specified price. Here, Alphabet stock is the underlying security.

Traders use derivatives to speculate on or hedge against the future price movements of the underlying. The complexity of a derivative affects the degree of speculation and hedging. For instance, options on futures are bets on the future price of the futures contract, which is itself a bet on the future price of the underlying.

Underlying Security Example

Suppose we want to buy a call option on Microsoft Corp. (MSFT). Buying a call gives us the right to buy MSFT shares at a specific price during a certain period. Generally, the value of the call option increases with an increase in the share price of MSFT. MSFT is the underlying security in this case.

The underlying is crucial to the pricing of derivatives. The relationship between the underlying and its derivatives is not always linear. For instance, the further the strike price of an out-of-the-money option is from the current price of the underlying, the less the option price changes per unit of movement in the underlying.

Additionally, the derivative contract may be written to have a direct or inverse correlation to the price of the underlying security. A call option has a direct correlation, while a put option has an inverse correlation.