Value Line Composite Index

Contents

Value Line Composite Index

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

What Is Value Line Composite Index?

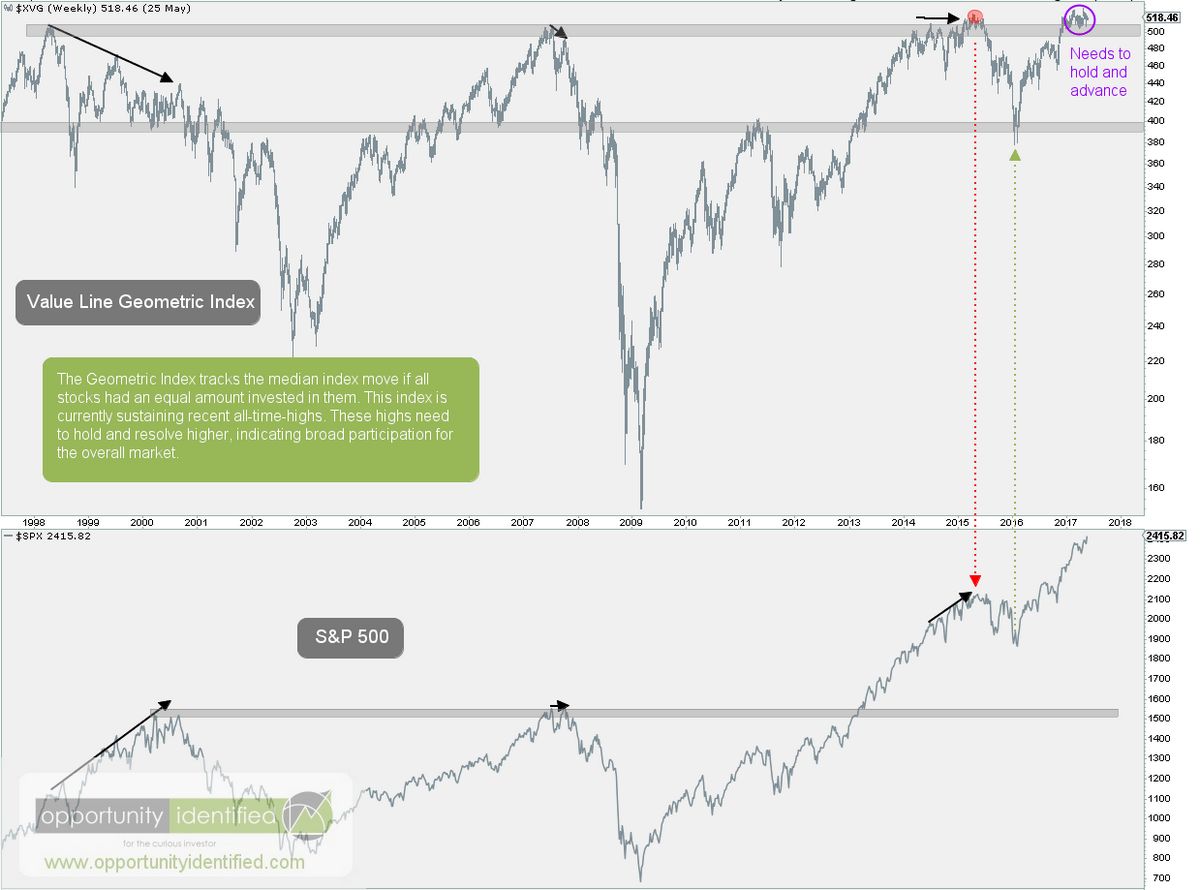

The Value Line Composite Index is a stock index containing approximately 1,700 companies from the NYSE, American Stock Exchange, Nasdaq, Toronto, and over-the-counter markets. The index has two forms: The Value Line Geometric Composite Index (equally weighted) and the Value Line Arithmetic Composite Index (mirroring changes if a portfolio held equal amounts of stock). These indexes are published in the Value Line Investment Survey, created by Arnold Bernhard, the founder and CEO of Value Line Inc.

Key Takeaways

- The Value Line Composite index contains a mix of roughly 1,700 stocks from the major North American market indexes.

- There are two forms to the index—the Value Line Geometric Composite Index and the Value Line Arithmetic Composite Index.

- The Geometric Composite Index is equal-weighted, uses a geometric average, and has a daily change closest to the median stock price change.

- The Arithmetic Composite Index uses an arithmetic mean, with the daily change in the index reflecting a portfolio consisting of stocks in equal amounts.

Understanding Value Line Composite Index

The "Value Line" refers to a multiple of cash flow that Bernhard would superimpose over a price chart to normalize the value of different companies. Value Line is a respected investment research firm with a strong performance record. Its model portfolios have generally outperformed the market over the long run.

The Value Line Composite Index is composed of the same companies as The Value Line Investment Survey, excluding closed-end funds.

The number of companies in the Value Line Index fluctuates based on factors including additions or delistings on exchanges, mergers, acquisitions, bankruptcies, and the coverage decisions made by Value Line. The goal is to create a broad representation of the North American equity market. Delisting or movement of companies on the exchanges are not factors in the Value Line Index methodology, whether using geometric or arithmetic calculations.

1961

The year that the original Value Line Geometric Composite Index was launched.

The Value Line Geometric Composite Index

This is the original index, introduced on June 30, 1961. It is equally weighted, using a geometric average. The daily price change is found by multiplying the ratio of each stock’s closing price to its previous closing price and raising that result to the reciprocal of the total number of stocks.

The Value Line Arithmetic Composite Index

This index was established on February 1, 1988, using the arithmetic mean to closely mimic the change in the index if you held a portfolio of stocks in equal amounts. The daily price change is calculated by adding the percent change of all the stocks and then dividing by the total number of stocks.