Loss And Loss-Adjustment Reserves To Policyholders Surplus Ratio Overview

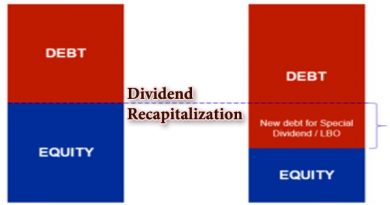

Loss and loss-adjustment reserves to policyholders’ surplus ratio is the ratio of an insurer’s reserves for unpaid losses, including the cost of investigation and adjusting for losses, to its assets after accounting for liabilities. It is also known as the reserves to policyholders’ surplus and is usually expressed as a percentage.

This ratio helps regulators identify insurers who rely too heavily on reserves to cover losses. If the ratio is too high, it can indicate trouble for the insurer. If filed claims exceed the estimated reserve amount, the insurer will have to use profits to pay them out.

Insurance companies set aside reserves to cover potential liabilities from claims. These reserves are based on actuarial projections and may be adequate or fall short. Insurers aim to comply with contract benefits, prevent fraudulent claims, and make a profit. They need a high enough reserve to meet projected liabilities. A higher loss and loss-adjustment reserves to policyholders’ surplus ratio indicates greater reliance on policyholder surplus and a higher risk of insolvency.

Regulators monitor this ratio as an indicator of solvency issues. A ratio below 200% is considered acceptable. Ratios higher than this suggest insurers may be dipping into reserves too much.

Insurers submit their financial information to regulators annually, including changes to reserves for losses and loss adjustment expenses. If there are changes to these reserves, the loss and loss-adjustment reserves to policyholders’ surplus ratio is adjusted accordingly. This reserve acts as an insurance company’s rainy day fund and ensures long-term coverage. Regulators evaluate insurers based on this ratio to assess financial solvency.

In conclusion, the loss and loss-adjustment reserves to policyholders’ surplus ratio is a crucial measure of an insurer’s financial stability.