Long-Term Liabilities Definition Examples and Uses

Contents

- 1 Long-Term Liabilities: Definition, Examples, and Uses

- 1.1 What Are Long-Term Liabilities?

- 1.2 Understanding Long-Term Liabilities

- 1.3 Examples of Long-Term Liabilities

- 1.4 How Long-Term Liabilities are Used

- 1.5 What Are Long-Term and Short-Term Liabilities?

- 1.6 What Is the Current Portion of Long-Term Debt?

- 1.7 Where Are Long-Term Liabilities Listed on the Balance Sheet?

- 1.8 The Bottom Line

Long-Term Liabilities: Definition, Examples, and Uses

What Are Long-Term Liabilities?

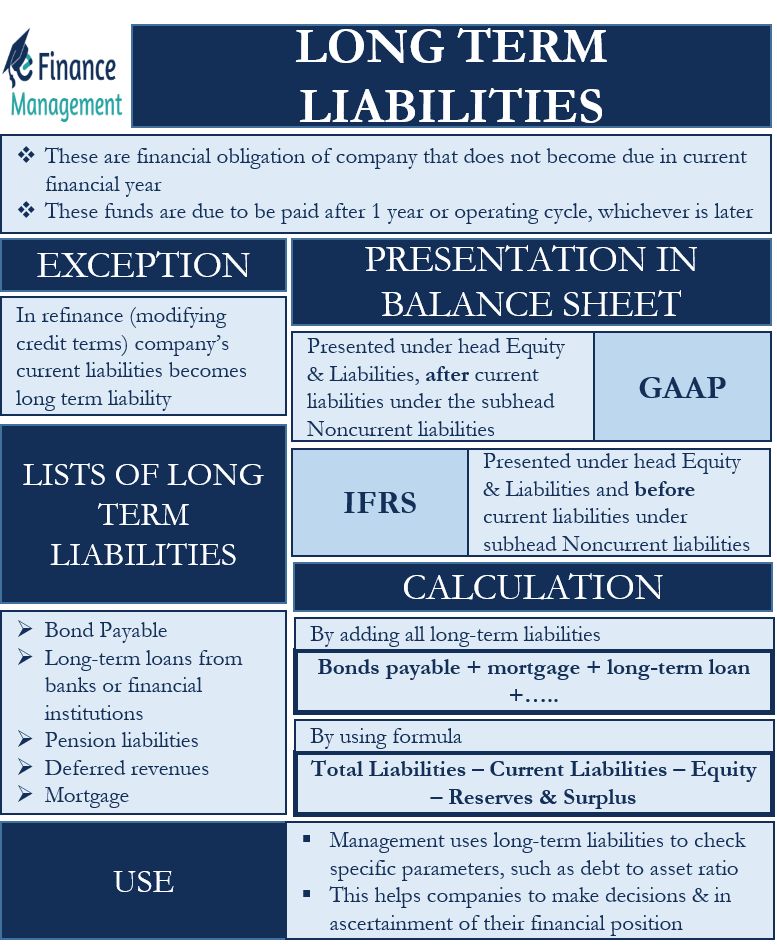

Long-term liabilities are a company’s financial obligations that are due more than one year in the future. The current portion of long-term debt is listed separately on the balance sheet to provide a more accurate view of a company’s current liquidity and its ability to pay current liabilities. Long-term liabilities are also called long-term debt or noncurrent liabilities.

Key Takeaways

- Long-term liabilities are due more than one year in the future.

- They are separately identified on the balance sheet.

- While short-term liabilities must be paid with current assets, long-term liabilities can be repaid through a variety of current and future business activities.

Understanding Long-Term Liabilities

Long-term liabilities are listed on the balance sheet after current liabilities, in a section that may include debentures, loans, deferred tax liabilities, and pension obligations. They are obligations not due within the next 12 months or within the company’s operating cycle if it is longer than one year. A company’s operating cycle is the time it takes to turn inventory into cash.

However, there are some exceptions to this general rule. If a company has current liabilities that are being refinanced into long-term liabilities, and there is evidence that the refinancing has begun, then it may report current liabilities as long-term liabilities because after the refinancing, the obligations are no longer due within 12 months. Additionally, a liability that is coming due may be reported as a long-term liability if it has a corresponding long-term investment intended to be used as payment for the debt. However, the long-term investment must have sufficient funds to cover the debt.

Examples of Long-Term Liabilities

The long-term portion of a bond payable is reported as a long-term liability. Since a bond typically covers many years, it is mostly long term. The present value of a lease payment that extends past one year is a long-term liability. Deferred tax liabilities typically extend to future tax years, in which case they are considered long-term liabilities. Mortgages, car payments, or other loans for machinery, equipment, or land are long-term liabilities, except for the payments to be made in the coming 12 months.

Tip

The portion of a long-term liability, such as a mortgage, that is due within one year is classified as the current portion of long-term debt on the balance sheet.

How Long-Term Liabilities are Used

Long-term liabilities are useful for management analysis through financial ratios. The current portion of long-term debt is separated because it needs to be covered by liquid assets, such as cash. Long-term debt can be covered by various activities, such as a company’s primary business net income, future investment income, or cash from new debt agreements.

Debt ratios compare liabilities to assets. The ratios may be modified to compare total assets to long-term liabilities only. This ratio is called long-term debt to assets. Long-term debt compared to total equity provides insight into a company’s financing structure and financial leverage. Long-term debt compared to current liabilities also provides insight regarding the debt structure of an organization.

What Are Long-Term and Short-Term Liabilities?

Long-term liabilities are typically due more than a year in the future. Examples of long-term liabilities include mortgage loans, bonds payable, and other long-term leases or loans, except for the portion due in the current year. Short-term liabilities are due within the current year. Examples of short-term liabilities include accounts payable, accrued expenses, and the current portion of long-term debt.

What Is the Current Portion of Long-Term Debt?

The current portion of long-term debt is the part of a long-term liability that is due in the current year. For example, a mortgage is long-term debt because it is typically due over 15 to 30 years. However, your mortgage payments that are due in the current year are the current portion of long-term debt. They should be listed separately on the balance sheet because these liabilities must be covered with current assets.

Where Are Long-Term Liabilities Listed on the Balance Sheet?

A balance sheet presents a company’s assets, liabilities, and equity at a specific date. The company’s assets are listed first, liabilities second, and equity third. Long-term liabilities are presented after current liabilities in the liability section.

The Bottom Line

Long-term liabilities or debt are obligations on a company’s books that are not due within the next 12 months. Loans for machinery, equipment, or land are examples of long-term liabilities, whereas rent is a short-term liability that must be paid within the year. A company’s long-term debt can be compared to other economic measures to analyze its debt structure and financial leverage.