Lottery Bond What it is and How it Works

Lottery Bond: What it is and How it Works

What Is a Lottery Bond?

A lottery bond is a government bond issued by the United Kingdom’s National Savings and Investments. This type of bond gives the holder a chance to win a monthly drawing for a tax-free cash prize and allows the government to raise money. The bonds do not pay interest but encourage saving.

Key Takeaways:

- A lottery bond is a government bond that gives the holder a chance to win a monthly drawing for a tax-free cash prize.

- Lottery bonds are called premium bonds in the United Kingdom.

- U.K. lottery bonds are backed by the government and encourage saving.

How Lottery Bonds Work

A bond is a debt security. Bond issuers sell them to raise money from investors who receive interest payments at regular intervals. These investments come in various shapes and sizes, including corporate, municipal, and government bonds.

Lottery bonds are one type of government bond sold in the United Kingdom through the post office of the National Savings & Investments, a government-owned savings bank. Introduced in 1956, they were used to reduce inflation and generate investments from individuals who weren’t interested in saving.

U.K. lottery bonds, also known as premium bonds, are worth £1 and have a minimum investment of £25. The maximum amount is £50,000. Investors can receive tax-free prizes every month, where the odds of winning are 24,000 to 1. The interest rate is 3.70%, which is the annual prize fund rate.

These investments are designed for individuals who want to win tax-free prizes of up to £1 million and have the minimum amount to invest. Investors can also purchase lottery or premium bonds for children under the age of 16. But they are not geared toward people who:

- Want a steady income stream

- Expect guaranteed returns

- Are worried about inflation

A lottery bond also refers to a type of commercial surety bond that establishments with lottery machines must purchase to prevent abuse of the state lottery system.

Special Considerations

Lottery bonds are also sold in countries outside the United Kingdom. After the British government issued them to promote savings, other countries followed suit, such as New Zealand with its lottery bond called Bonus Bonds.

When New Zealanders buy Bonus Bonds, their money is pooled with other bondholders and invested in fixed-interest assets and cash equivalents. The interest earned on these investments funds the prizes awarded to winners and maintains the principal investment value of the non-winners bonus bonds.

New Zealand stopped issuing new Bonus Bonds as of Aug. 25, 2020, due to a drop in the prize pool caused by the low interest rate environment.

Lottery bonds were widely used during the 19th century and were issued by states, municipalities, and companies like the Panama Canal Company and the Suez Canal Company with state backing.

How to Win With Lottery Bonds

The National Savings and Investments uses a machine called Electronic Random Number Indicator Equipment or ERNIE to generate winning bond numbers each month. The machine uses quantum technology to randomly draw numbers. It takes the machine 12 minutes to come up with each month’s winners.

The number of prizes allotted each month varies based on the total number of participants. The table below shows the available prizes:

| Prize Band | Value of Prize |

| Higher (10% of prize fund) | £1 million |

| £100,000 | |

| £50,000 | |

| £25,000 | |

| £10,000 | |

| £5,000 | |

| Medium (10% of prize fund) | £1,000 |

| £500 | |

| Lower (80% of prize fund) | £100 |

| £50 | |

| £25 |

The National Savings and Investments has given out 621 million prizes to bondholders since the first drawing in June 1957 worth about £25.7 billion.

U.K. lottery bondholders can cash in their bonds at any time.

Example of Lottery Bonds

Lottery bonds are common in the United Kingdom, but they are also available in other countries. For instance, Sweden’s National Debt Office issued lottery bonds to reduce the central government’s debt. The bonds were considered a form of tax arbitrage by wealthy investors for many years.

Drawings took place two to three times per year. Prize amounts had a fixed or floating base and were tax-free. Bonds came with a face value of SEK 500 to SEK 1 000 and matured between one to five years. The government paused its lottery bonds in 2016 with no plans to continue the program, and the final bonds matured in 2021.

How Do Lottery Bonds Work?

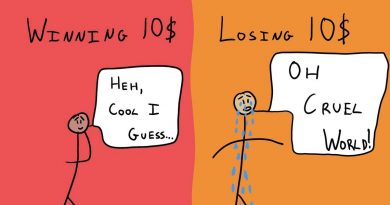

Lottery bonds are government-issued debt securities that allow governments to raise money for various reasons. They work like a lottery ticket and are meant for individuals who aren’t necessarily interested in saving their money. Investors purchase bonds with a nominal amount and are entered into a draw for tax-free prizes instead of receiving interest payments. The number and amounts of prizes are determined by the total number of bonds issued. Investors can usually cash in their bonds at any time.

What’s the Purpose of a Lottery Bond?

Lottery bonds are issued by countries to spur investment from the general public. They can help reduce government debt or ease inflationary concerns. These bonds are meant for individuals who aren’t normally interested in saving but may be interested in winning a tax-free prize. For example, investors have the chance to win £1 million through monthly drawings if they purchase U.K. lottery bonds.

Who Can Buy U.K. Lottery Bonds?

U.K. lottery bonds, also called Premium Bonds, are available for legal residents of the United Kingdom who are over the age of 16. They can be purchased at a post office or online through the National Savings & Investments website using a debit card issued by a British bank. Bonds can be purchased on behalf of people under 16. Anyone living outside the U.K. should check local regulations regarding the eligibility to hold these bonds.

The Bottom Line

Lottery bonds are typically designed for people who aren’t savers but want a small, risk-free investment with the potential to win a tax-free prize. These bonds have a nominal value and require a small investment. They are available for purchase in many countries, notably in the United Kingdom, but not in the United States.