What Are Fibonacci Time Zones How the Indicator Works in Trading

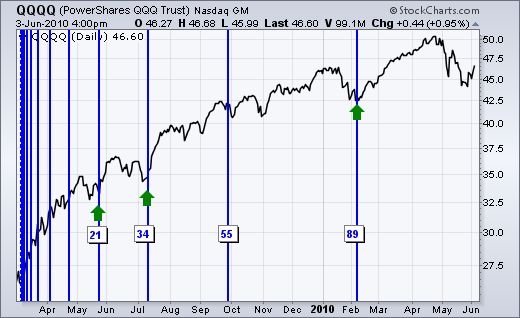

Fibonacci time zones are a technical indicator that uses vertical lines on a price chart to predict potential swing highs, lows, or reversals. These lines are based on Fibonacci numbers and indicate areas of time that could be significant.

Key takeaways:

– Fibonacci time zones represent potential areas of importance based on time, not price.

– The indicator is based on the Fibonacci number sequence, which gives us the Golden Ratio.

How Fibonacci Time Zones Work:

– Fibonacci time zones are determined by adding Fibonacci numbers to a selected start date.

– Traders may choose to avoid the first five numbers and start drawing lines 13 or 21 periods after the starting point.

– Some charting platforms allow customization of the starting point and time representation.

What Fibonacci Time Zones Tell You:

– Fibonacci time zones suggest that after a high or low, another significant swing could occur a specific number of periods later.

– Price may or may not adhere to the time zones, and a different starting point may yield better results.

– Fibonacci time zones can confirm trades or analysis, but further analysis is required to determine the magnitude of price moves.

Fibonacci Time Zones vs. Fibonacci Retracements:

– Fibonacci time zones predict future time periods, while Fibonacci retracements indicate areas where price could pull back.

– Retracements are based on Fibonacci numbers and provide support or resistance levels.

Limitations of Using Fibonacci Time Zones:

– The starting point selected for Fibonacci time zones is subjective and varies among traders.

– The indicator does not provide information on the magnitude of price moves or pinpoint exact turning points.

– It is recommended to combine Fibonacci time zones with trend and price action analysis, as well as other technical and fundamental indicators.