Mortgage Bond Definition How They Work Pros and Cons

Contents

Mortgage Bond: Definition, How They Work, Pros and Cons

What is a Mortgage Bond?

A mortgage bond is backed by real estate holdings or real property, such as equipment.

Key Takeaways

- A mortgage bond is backed by real estate holdings or real property.

- In a default situation, mortgage bondholders can sell the underlying property to compensate for the default.

- Mortgage bonds tend to be safer than corporate bonds and typically have a lower rate of return.

Understanding Mortgage Bonds

Mortgage bonds offer protection because the principal is secured by a valuable asset. In a default, mortgage bondholders can sell the underlying property to compensate for the default and secure payment of dividends. However, due to this safety, mortgage bonds usually yield a lower rate of return than traditional corporate bonds backed only by the corporation’s ability to pay.

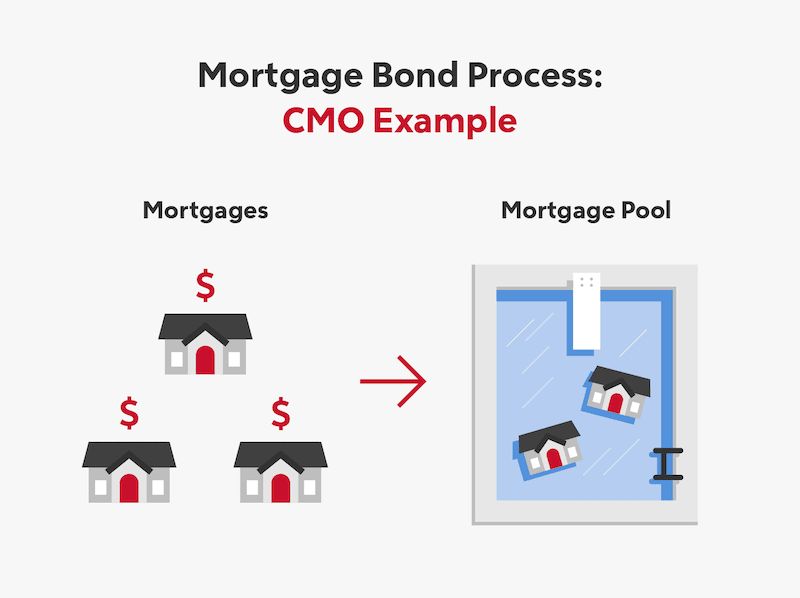

When a person buys a home and finances the purchase with a mortgage, the lender rarely retains ownership of the mortgage. Instead, it sells the mortgage on the secondary market to another entity, such as an investment bank or government-sponsored enterprise (GSE). This entity packages the mortgage with other loans and issues bonds with the mortgages as backing.

When homeowners pay their mortgages, the interest portion of their payment is used to pay the yield on these mortgage bonds. As long as most homeowners in the mortgage pool keep up with their payments, a mortgage bond is a safe and reliable income-producing security.

Advantages and Disadvantages of Mortgage Bonds

A disadvantage of mortgage bonds is that their yields tend to be lower than corporate bond yields because securitization makes them safer investments. An advantage is that if a homeowner defaults, bondholders have a claim on the value of the homeowner’s property. The property can be liquidated to compensate bondholders. Mortgage bonds are also safer investments than stocks.

In contrast, investors in corporate bonds have little to no recourse if the corporation is unable to pay. As a result, when corporations issue bonds, they must offer higher yields to entice investors to shoulder the risk of unsecured debt.

$2.1 trillion

The amount held in mortgage-backed securities by the Federal Reserve.

Special Considerations for Mortgage Bonds

One major exception to the general rule that mortgage bonds represent a safe investment became evident during the financial crisis of the late 2000s. Leading up to this period, investors realized they could earn higher yields by purchasing bonds backed by subprime mortgages—mortgages offered to buyers with poor credit or unverifiable income—while still enjoying the supposed security of investing in collateralized debt.

Unfortunately, enough of these subprime mortgages defaulted to cause a crisis during which many mortgage bonds defaulted, costing investors millions of dollars. Since the crisis, there has been heightened scrutiny over such securities. Nevertheless, the Fed still holds a sizable amount of mortgage-backed securities (MBS) like mortgage bonds. As of Feb. 2021, the Fed held around $2.1 trillion in MBS, according to the Federal Reserve Bank of St. Louis.

Unfortunately, enough of these subprime mortgages defaulted to cause a crisis during which many mortgage bonds defaulted, costing investors millions of dollars. Since the crisis, there has been heightened scrutiny over such securities. Nevertheless, the Fed still holds a sizable amount of mortgage-backed securities (MBS) like mortgage bonds. As of Feb. 2021, the Fed held around $2.1 trillion in MBS, according to the Federal Reserve Bank of St. Louis.