Trend Definition Types Examples and Uses in Trading

Contents

Trend: Definition, Types, Examples, and Uses in Trading

What Is a Trend?

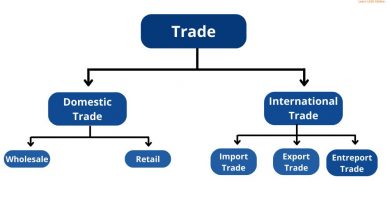

A trend is the direction of a market or an asset’s price. In technical analysis, trends are identified by trendlines or price action that show higher swing highs and higher swing lows for an uptrend, or lower swing lows and lower swing highs for a downtrend.

Traders often trade in the same direction as the trend, while contrarians seek reversals or trade against the trend. Uptrends and downtrends occur in all markets, such as stocks, bonds, and futures. Trends also occur in data, such as monthly economic data that rises or falls from month to month.

Key Takeaways

- A trend is the direction of the price of a market, asset, or metric.

- Uptrends are marked by rising data points, such as higher swing highs and higher swing lows.

- Downtrends are marked by falling data points, such as lower swing lows and lower swing highs.

- Many traders trade in the same direction as the trend, attempting to profit from it.

- Trendlines, price action, and technical indicators can help identify and predict trend reversals.

How Trends Work

Traders identify trends using technical analysis tools like trendlines, price action, and technical indicators. For example, trendlines show the direction of a trend, while the relative strength index (RSI) indicates the strength of a trend at any given point.

An uptrend is marked by an overall increase in price. Although there will always be oscillations, the overall direction needs to be higher for it to be considered an uptrend. Recent swing lows should be above prior swing lows, and the same goes for swing highs. The breakdown of this structure may indicate a loss of momentum or a reversal into a downtrend. Downtrends consist of lower swing lows and lower swing highs.

While the trend is up, traders may assume it will continue until there is evidence to the contrary. This evidence could include lower swing lows or highs, the price breaking below a trendline, or bearish technical indicators. During an uptrend, traders focus on buying to profit from price rises.

When the trend turns down, traders focus on selling or shorting to minimize losses or profit from price declines. Most downtrends do eventually reverse, as the declining price attracts bargain hunters. This can lead to the emergence of an uptrend.

Trends also play a role in fundamental analysis. Fundamental analysts monitor changes in revenue, earnings, or other business and economic metrics. For example, trends in earnings per share and revenue growth can indicate positive or negative trends.

A period of time with little overall upward or downward progress is called a range or trendless period.

Using Trendlines

Trendlines are commonly used to identify trends. They connect a series of highs (downtrend) or lows (uptrend). Uptrends create support levels for future price movements, while downtrends create resistance levels. Trendlines also show the overall trend direction.

Trendlines may need to be redrawn as the direction changes. For example, during an uptrend, the price may temporarily fall below the trendline, but that doesn’t necessarily mean the trend is over. The price may continue rising after moving below the trendline, requiring the trendline to be redrawn accordingly.

Trendlines alone should not be relied upon to determine the trend. Professionals also consider price action and other technical indicators. In the example above, a drop below the trendline alone isn’t a sell signal. However, if the price also falls below a prior swing low and/or technical indicators turn bearish, it might be.

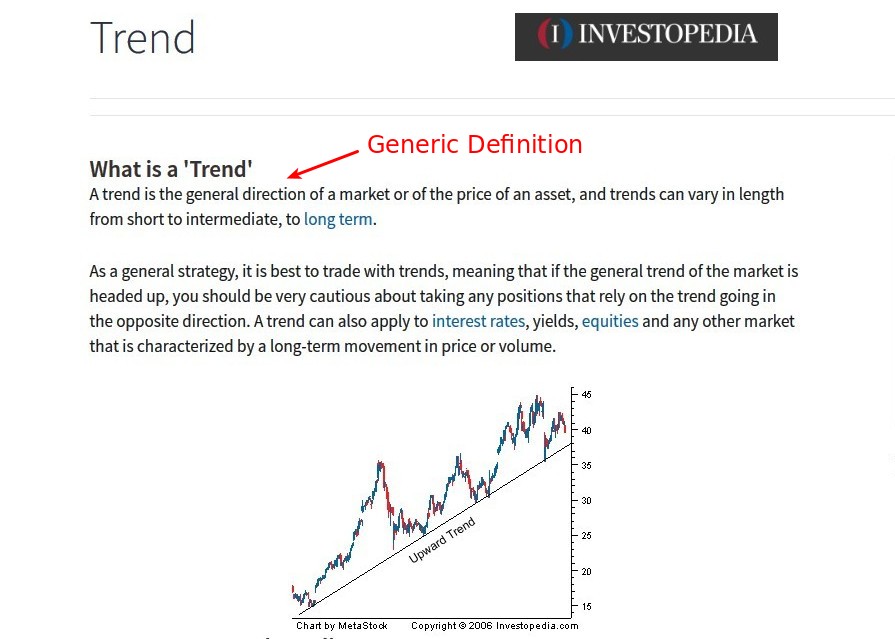

Example of a Trend and Trendline

The following chart shows a rising trendline alongside an RSI reading that suggests a strong trend. Despite oscillations, the overall progress is upward.

As the rising trend loses momentum, selling pressure increases. The RSI falls below 70, followed by a large down candle that brings the price to the trendline. The next day, the price gaps below the trendline, confirming the downward move. These signals could have been used to exit long positions and initiate short trades, as there was evidence of a trend reversal.

As the price declines, it attracts buyers looking for lower prices. Another trendline (not shown) could be drawn along the falling price to anticipate a bounce. This trendline would have been broken in mid-February as the price quickly reversed and moved higher.