What Is a Bond Fund How It Works Benefits Taxes and Types

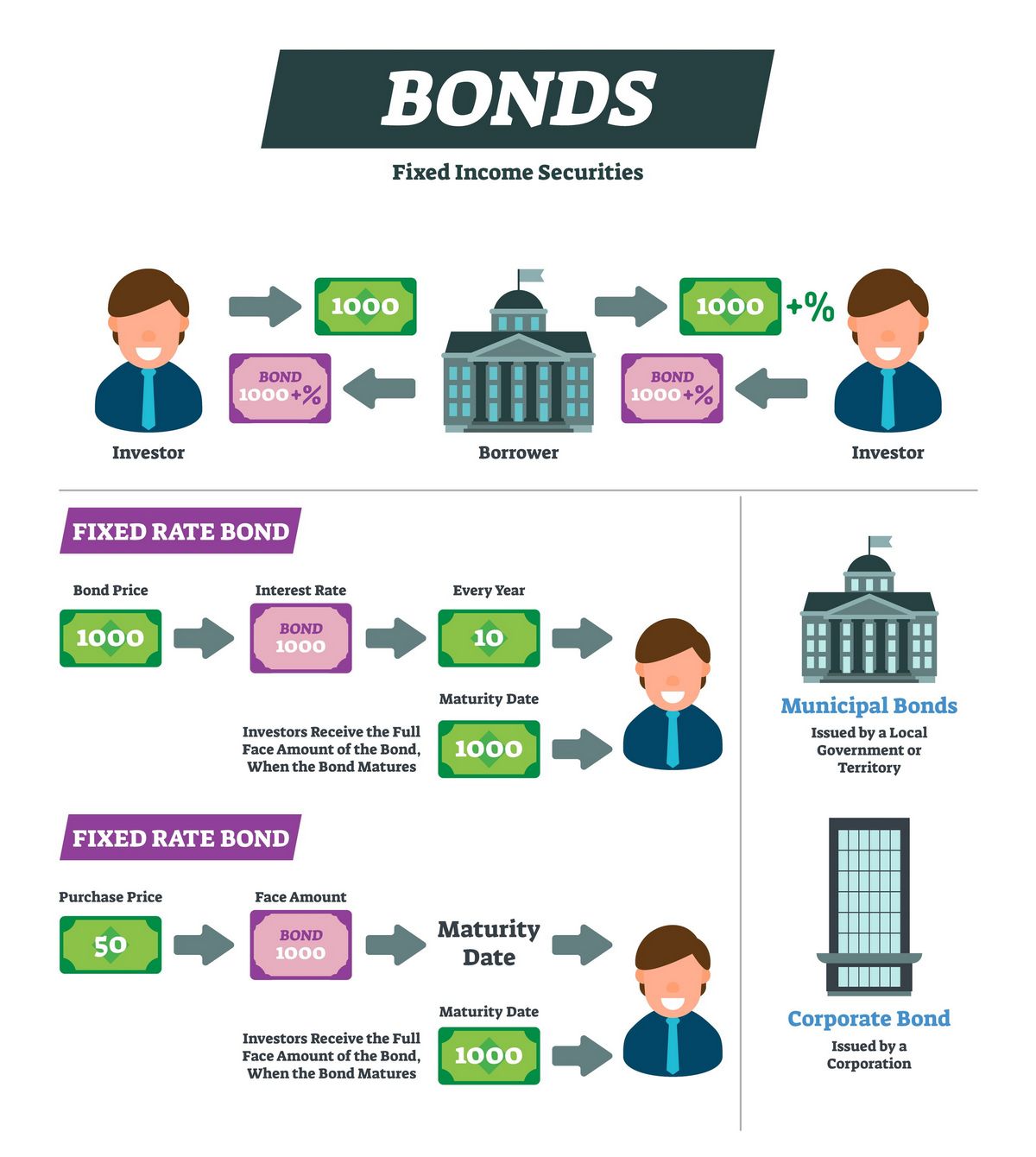

Bond funds, also known as debt funds, are pooled investment vehicles that primarily invest in bonds (government, municipal, corporate, etc.) and other debt instruments like mortgage-backed securities (MBS). Their main objective is to generate monthly income for investors.

Both bond mutual funds and bond exchange-traded funds (ETF) are available to most investors.

Key Takeaways:

– A bond fund invests in fixed-income securities.

– Bond funds provide instant diversification for investors with low required minimum investment.

– Long-term bonds have greater interest rate risk than short-term bonds due to the inverse relationship between interest rates and bond prices.

Understanding Bond Funds:

A bond fund is a mutual fund that solely invests in bonds. It is a more efficient way for investors to invest in bonds compared to buying individual bond securities. Bond funds do not have a maturity date for repayment of principal, causing the principal amount to fluctuate.

Investors in a bond fund indirectly participate in the interest paid by the underlying bond securities held in the mutual fund. Monthly interest payments vary based on the mix of different bonds in the fund.

Bond fund investors entrust their money to a portfolio manager who buys and sells bonds according to market conditions and rarely holds bonds until maturity.

Types of Bond Funds:

Most bond funds are comprised of specific types of bonds (corporate, government) and further classified by time period to maturity (short-term, intermediate-term, long-term).

Some bond funds specialize in safe bonds like U.S. government bonds. These bonds are considered to have the highest credit quality and are not subject to ratings. However, they offer the lowest potential return.

Other bond funds invest in high-yield or junk bonds, which are more volatile but offer higher potential returns. Some bond funds have a mix of different bond types to create multi-asset class options.

Bond Fund Benefits:

Bond funds provide several benefits, including ease of participation, instant diversification, and access to professional portfolio managers who analyze market conditions and creditworthiness.

Investors only need to pay the annual expense ratio, covering marketing, administrative, and professional management fees, instead of dealing with transaction costs associated with purchasing individual bonds.

Special Considerations:

Bond funds can be sold at any time for their current market net asset value (NAV), potentially resulting in a capital gain or loss. Individual bonds may be harder to sell.

Investors in higher tax brackets may benefit from tax-free municipal bond fund investments, helping them achieve a higher after-tax yield.

Long-term bonds carry greater interest rate risks than short-term bonds due to the inverse relationship between interest rates and bond prices. Changes in interest rates greatly impact the net asset value (NAV) of bond funds with longer-term maturities.

Bond ETFs:

Bond ETFs, introduced in 2002, replicate bond indices and provide lower fees compared to mutual funds. They are traded throughout the day and operate similarly to closed-end funds.

Bond ETFs are purchased through a brokerage account and must be traded on the open market when an investor wishes to sell. The fund company does not purchase the shares like open-ended mutual funds.