Local Exchange Trading System What it Means How it Works

Local Exchange Trading Systems (LETS) are economic organizations that facilitate the exchange of goods and services within local communities. These systems use locally created units of value as currency, which can be traded or bartered for goods and services. LETS members see these systems as cooperative schemes that maximize purchasing power while benefiting both members and the community.

Key Takeaways:

– LETS are bartering systems in local communities.

– The LETS movement peaked in the 1990s.

– The movement is based on five governing principles: cost of service, consent, disclosure, equivalence to the regional currency, and interest-free credit.

LETS allow members to participate in the local economy without relying on traditional currency. Members earn and spend credits by conducting business with each other.

LETS are guided by five fundamental principles:

– Cost of service – members’ accounts cover administrative costs.

– Consent – trading is voluntary.

– Disclosure – all members can see account balances and turnover.

– Equivalence to the regional currency – local dollars are considered equal to Canadian dollars (or another local currency).

– All interest-free – debts do not incur interest and credits do not earn interest.

These principles, along with membership fees, transaction logs, and a member directory, ensure an organized and efficient exchange.

LETS members are given accounts and listed in a directory of offered and requested services. The currency used, called green dollars, is equivalent to federal currency within the LETS but is not physically exchanged. Instead, green dollars function as units of account. When a member completes a service for another member, their accounts are updated accordingly.

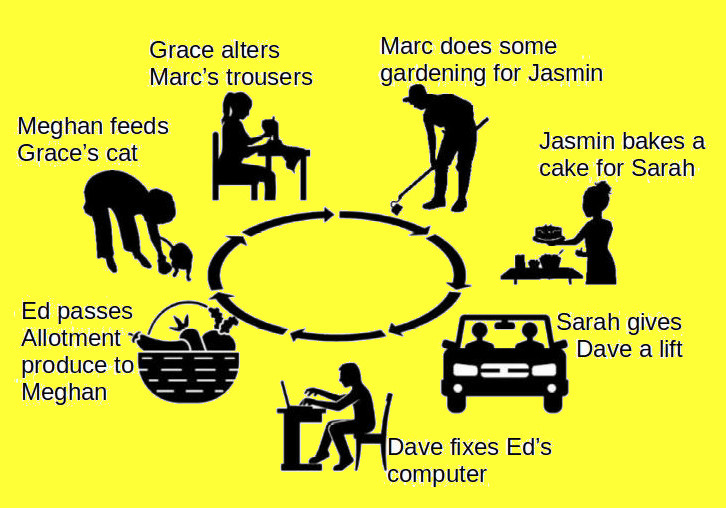

Transactions in LETS do not always involve an exchange of units. Members can repay services by providing a service in return, rather than paying with green dollars.

Special Considerations:

– LETS groups typically consist of 50 to 150 members, with a small core group leading the movement. The use of local currency has evolved to include voucher systems backed by dollars and time-based currency.

– The LETS movement has not kept up with technology due to financial constraints and concerns about system decentralization caused by the internet.

– Transitioning to a LETS system may be challenging for some as it differs from conventional currency, which pays interest to savers and charges it to borrowers. LETS incentivize immediate consumption of goods and services without incurring interest costs for delayed reciprocation.

Example of a Local Exchange Trading System:

– Mary wants her house painted and hires John for the job. After completion, John’s account is credited with the corresponding value from Mary’s account. John can then use these green dollars elsewhere. The system also allows people to spend even without credits by earning them through job completion.