Vienna Stock Exchange WBAG Meaning History

Vienna Stock Exchange (WBAG): Meaning, History

Contents

What Is the Vienna Stock Exchange (WBAG)?

The Vienna Stock Exchange is the sole securities exchange in Austria and operates the market data hub for Central and Eastern European markets. It is operated by Wiener Börse AG and is considered a customer and market-oriented company that plays a vital role in Austria’s capital market.

The Vienna Stock Exchange runs the securities exchange and the Energy Exchange Austria (EXAA), a Central European energy exchange also headquartered in Vienna.

Key Takeaways

- Founded in 1711, the Vienna Stock Exchange is the sole securities exchange in Austria and one of the oldest in the world.

- The exchange’s trading schedule is Monday through Friday from 8:55 a.m. to 5:35 p.m.

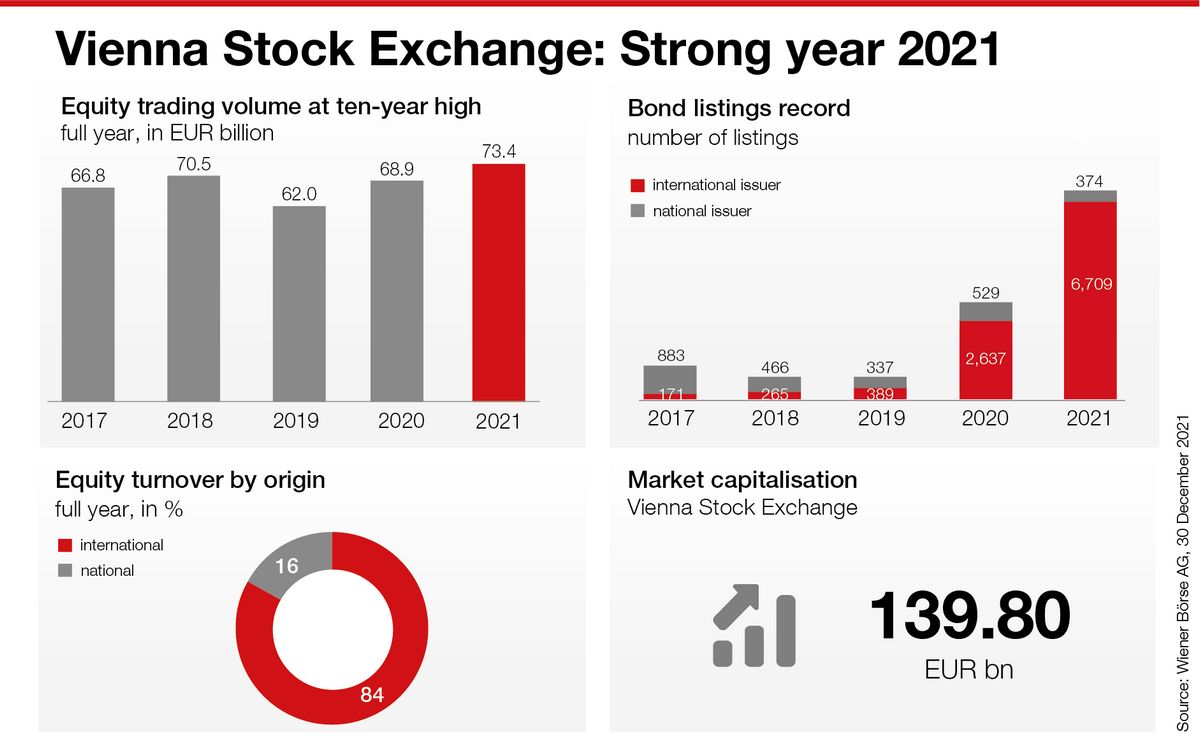

- As of June 2020, the Vienna Stock Exchange had a market capitalization of over 90 billion euros, 85 trading members, 117 ETFs, and more than 140 indices.

Understanding the Vienna Stock Exchange (WBAG)

The Vienna Stock Exchange operates the equity and bond markets in Austria, as well as a market for trading in structured products. It provides services such as index development and management, as well as financial market seminars and training. The exchange’s trading schedule is Monday through Friday from 8:55 a.m. to 5:35 p.m.

As of June 2020, the Vienna Stock Exchange had a market capitalization of over 90 billion euros, 85 trading members, 117 ETFs, and more than 140 indices.

The Vienna Stock Exchange considers corporate social responsibility a key part of its business. It has a CSR policy and contributes to the environmentally, socially, and economically sustainable development of Austria. The exchange has two strategic goals: strengthening the home market and advancing investment culture in Austria, and continuing its cooperation network in Central and Eastern Europe (CEE) to encourage international investors to look at the local markets of Central and Eastern Europe. The stock exchange group’s five cornerstones are securities trading and listing, market data, index calculation, IT services, and Central Securities Depository.

History of the Vienna Stock Exchange

Founded in 1771 by Empress Maria Theresa, the Vienna Stock Exchange is one of the oldest in the world. Initially, it served as a marketplace for trading bonds, bills of exchange, and foreign currencies. Trading of shares began in 1818, with the Austrian National Bank being the first corporation to be listed on the exchange.

During World War I, the Vienna Stock Exchange closed until the end of 1919. After the war, the exchange experienced a strong revival, which abruptly ended in March 1934. The global economic crisis and bank collapse had an impact on exchange trading during these years, although the Stock Market Crash of 1929 in the United States had little effect.

In 1938, Austria’s incorporation into the Deutsche Reich led to Wiener Börse losing its independence. Limited stock market trading persisted until just before the end of World War II.

The exchange reopened in 1948 after the war. Although the stock market was not as robust, the bond market recovered in 1952. Bond market trading grew until a turnaround in 1985 when an American analyst drew attention to the potential of the Austrian capital market, triggering a stock boom.