What Does Quotation Mean in Finance and Why Are They Important

Contents

- 1 What Does Quotation Mean in Finance and Why Are They Important?

What Does Quotation Mean in Finance and Why Are They Important?

Ariel Courage is an experienced editor, researcher, and former fact-checker. She has performed editing and fact-checking work for several leading finance publications, including The Motley Fool and Passport to Wall Street.

What Is Quotation?

Quotations refer to the sale price of a stock, bond, or any traded asset. In addition, asset classes also quote the bid and ask price that determines the final sale price. The bid is the highest price a buyer is willing to pay, while the ask is the lowest price a seller is willing to accept.

Stable, liquid assets usually have narrow bid-ask spreads. However, during systemic concerns like geopolitical events or market downturns, the bid and ask prices may divert. Volatility and uncertainty affect the supply and demand mechanisms underlying quotations.

Key Takeaways

- Quotations signify the sale price of any traded asset.

- Quotations include high, low, open, and close values for a given day.

- Asset classes quote the asking price that determines the final sale price and the original bid.

- A bid is the highest price a buyer is willing to pay, and the ask is the lowest price a seller is willing to receive.

- Volatility in the markets affects the supply and demand mechanisms underlying quotations.

How Quotation Works

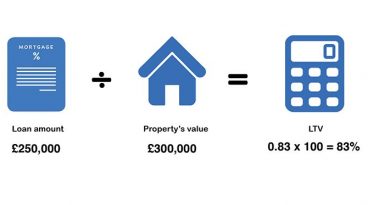

Quotations represent two pieces of information for most asset classes: the price an investor would pay to purchase an asset at a particular moment (the lowest price "asked" by sellers) and the price an investor would receive for the same asset if they sold it (the highest "bid" by potential buyers). The difference between the two represents the liquidity cost incurred when trading an asset since the investor must buy at the bid price and sell at the asking price.

As an asset’s price falls, the bid and ask prices diverge. This wider spread can make assets less liquid and difficult to trade during market volatility.

Quotations also include high, low, open, and close values for a given day. These data points provide context about the asset’s movements. Sharp changes between the open and close signal strong upward momentum and an interesting trading opportunity.

Types of Quotations

Stock prices are commonly associated with quotations, but many other asset classes record quotes of the last traded price.

Fixed Markets

Fixed income markets quote the bid and ask prices of a bond during regular trading hours. Bond quotes also showcase the bond’s par value and yield to maturity.

Bonds are quoted at a par value of $1,000, and the price is quoted as a percentage of its par value. For example, if a corporate bond is quoted at 97, it means it is trading at 97% of face value, or $970 to buy the bond.

Par Value

Par value, also known as nominal value or face value, is often converted to a numeric value and multiplied by 10 to determine a bond’s cost. Par value refers to the bond value when it was originally issued, typically $100 or $1,000. It determines the bond’s maturity value and the amount of interest paid, which is also referred to as the bond’s coupon rate.

Stock quotes may be the first consideration when trading, but additional information, usually technical indicators, is used before placing orders.

Futures and Commodities

Futures contracts and commodities use quotes to provide relevant information to investors. The buyer of a futures contract agrees to purchase the asset at a predetermined price in the future.

Investors use futures contracts to hedge trades or speculate on market movements. An example of a quotation for a futures contract is purchasing oil at $80 a barrel in one year. The buyer is obligated to purchase the oil at $80 a barrel, and the seller is obligated to sell it. Traders make an initial margin payment rather than placing the entire trade amount with the brokerage.

Example of a Quotation

Apple Inc. (AAPL) is a heavily traded public company. Due to the extreme liquidity of AAPL stock, trading it is simple, with narrow bid-ask spreads. For example, AAPL closed at $165 a share. The day’s range might be $161 to $167, but it closed at $165.

During the day, buyers wanted to buy AAPL stock, and sellers wanted to sell. If AAPL was trading at $163 at 10:30 am, a buyer would see the bid-ask spread, which in this example would be $162.99 for the bid and $163.01 for the ask. The buyer pays the seller the ask, and the transaction is complete.

When referring to a quote, people are usually referring to the last trade price of the stock. This is also the first and largest number seen when researching stocks.

Frequently Asked Questions

How Do You Read a Stock Quote?

A stock quote can be read in different parts. The "quote" represents the stock’s trading price. The bid price shows what sellers are selling the stock for, and the ask price shows what price buyers will pay. The difference between the bid and ask price is where market movers make their profits.

What Are Real-Time Quotes for Stocks?

Real-time quotes for stocks are updated "real-time" by sophisticated trading platforms. They are commonly used by day traders engaging in high-frequency trading. However, some criticize this style of trading for favoring those with the most powerful technology.

What Is a Nominal Quotation?

A nominal quotation is a hypothetical price at which a share of stock or other security might trade. Traders use them to determine if they should place a trade in the future. They are preceded by the prefixes For Your Information (FYI) or For Valuation Only (FVO). They are the opposite of a firm quotation, which is the current real quotation of the security.

What Is an Interdealer Quotation System?

An interdealer quotation system (IQS) organizes price quotes by brokers and dealer firms to provide investors with accurate and relevant information. There are multiple IQSs, each with its own specialization. In the United States, the Nasdaq, the Nasdaq’s SmallCap Market, and its Over-the-counter Bulletin Board (OTCBB) platform are integrated into the same IQS.

The Bottom Line

Finding a securities quotation is simple and usually the first number seen. If you only want to know the price of a stock, that is enough information. However, if you intend to trade, consider other aspects within the quotation, such as the bid/ask spread and last trade time execution. Quotations are regularly updated, but some trading platforms may be faster than others.