RICS House Price Balance What It is How It Works

Contents

RICS House Price Balance: What It is, How It Works

What Is the RICS House Price Balance?

The RICS House Price Balance is a housing survey published by the Royal Institute of Chartered Surveyors (RICS) in the United Kingdom. It is conducted monthly and based on opinions about housing price trends from a sample of property surveyors in the U.K. The survey is included in the RICS monthly Housing Market Survey and is considered a leading indicator of the country’s housing market and overall economy.

Key Takeaways

- The RICS House Price Balance is a housing survey published by the Royal Institute of Chartered Surveyors in the United Kingdom.

- The survey predicts the expected monthly change in national house prices.

- The survey’s figure is calculated as the proportion of surveyors reporting a rise in housing prices minus the proportion reporting a fall in prices.

- Economists and investors use the RICS House Price Balance to predict consumer spending.

- A positive net balance indicates price increases, while a negative net balance implies price decreases.

Understanding the RICS House Price Balance

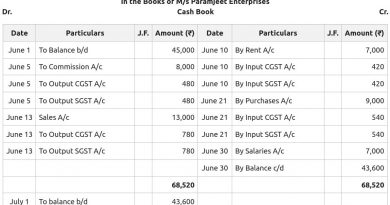

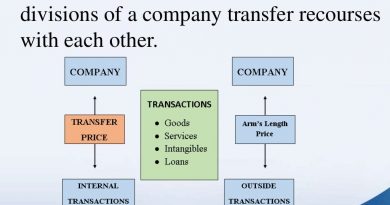

RICS is a globally recognized professional organization based in the United Kingdom. It provides insight into the national housing market and other areas such as land management, development, construction, real estate, and infrastructure. The housing price balance figure is calculated by subtracting the proportion of surveyors reporting a fall in prices from the proportion reporting a rise in prices. The survey covers various aspects, including average price changes, expected price changes, inventory of unsold homes, and surveyors’ opinions on current price levels.

- The survey covers average price changes for rentals and home sales for the last three months.

- It also includes expected price changes over the next three-month, 12-month, and five-year periods.

- The survey considers changes in the inventory of unsold homes.

- Surveyors’ sentiments about current price levels are also included in the survey.

A positive net balance indicates a robust housing market, while a negative net balance suggests a fragile housing market.

For example, if out of 300 surveyors, 150 reported price increases, 50 reported no change, and 100 reported price decreases, the net house price balance would be +17. This example illustrates that a net positive balance signifies rising prices, indicating a robust housing market.

Foreign exchange traders closely monitor the reported figure as it often leads to immediate fluctuations in the valuation of the British pound (GBP) relative to other currencies.

Special Considerations

The RICS House Price Balance is a monthly survey that reflects the strength of the U.K. housing market. It is widely observed by the media, economists, and investors, providing an indication of the circulation of money within the British economy. Factors influencing real estate prices include economic growth, population growth, the supply of new housing, and interest rates. The housing market is closely linked to consumer spending, a significant driver of gross domestic product (GDP). When real estate prices rise, homeowners gain confidence and are more likely to borrow against the value of their homes. Conversely, when prices fall, spending decreases, mortgages are at risk of default, and the banking system and entire economy are exposed to potential risks.

Real-World Example of the RICS House Price Balance

The RICS House Price Balance regularly reported negative net balances for many years. However, according to the June 2021 survey, surveyors observed dwindling demand and supplies, resulting in price increases throughout the United Kingdom, particularly in Yorkshire & the Humber, Northern Ireland, and Wales.

In September 2022, the price balance was +53.0, which was positive but lower than the forecast of 64.5 and below the previous balance of 63.0, indicating a softening of house price pressure in the UK.