What Is a Bear Trap

A bear trap is a technical pattern that occurs when the price action of a stock, index, or another financial instrument signals a reversal from an uptrend to a downtrend. Prices may move higher, only to encounter fundamental resistance or change, prompting bears to open short positions. A bear is an investor or trader who believes that the price of a security will decline. A bearish investment strategy attempts to profit from the decline, often using a short position.

A short position borrows shares or contracts of an asset from a broker through a margin account. The investor sells the borrowed instruments to repurchase them at a lower price, hoping to profit from the decline. However, if the timing of the decrease in price is incorrect, the risk of getting caught in a bear trap increases.

Key Takeaways:

– A bear trap is a false technical indication of a reversal from an uptrending market to a downtrending one.

– Bear traps can occur in all asset markets.

– Bear traps can take the form of a downside market correction amid an overall bullish move.

– Traders need to be cautious about their position size in case the overall uptrend reasserts itself.

Bear Trap vs. Bull Trap:

There are two types of traps to look out for: bear traps and bull traps. Which one is occurring depends on the overall market conditions and trends.

Bear Trap:

A bear trap occurs when there is a bearish correction or reversal amid an overall uptrend. A downward correction sees shorting temporarily overcoming buying pressure, leading to a short-term price fall. The decline may fail at recent price highs in the uptrend. Traders might take short positions to profit on falling stock prices, but when buyers begin seeing prices drop and increase their buying activity, the market won’t support prices falling further and rapidly resumes its uptrend.

Bull Trap:

A bull trap is when an overall downward trend and a short-term bullish trend in price occurs. Like a bear trap, this short-lived uptrend can trick traders into positions that can cause losses. In a bull trap, traders might take long positions because the market falsely indicates a reversal is underway. When the market resumes its downward trend, traders are left holding stocks that are losing value.

Causes of a Bear Trap:

Bear traps generally occur when investors and traders notice a price trend appearing to reverse. Reasons for price drops can include government report releases, geopolitical events, company press releases, rumors of a recession, or anything that creates doubt and fear of loss. Investors begin selling, causing prices to drop. The false trend can last several trading periods, leading to more short positions. When the price hits a support level, buyers start flocking to the asset, increasing demand and causing a trap for bear traders.

Identifying a Bear Trap:

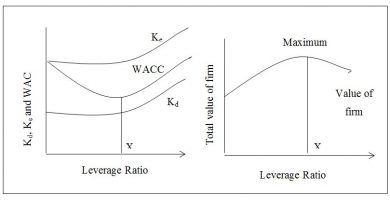

Short sellers cover positions as prices rise to minimize losses. After short-sellers purchase the instruments required to cover their short positions and buyers start buying, the downward momentum of the asset decreases. A subsequent increase in buying activity can initiate further upside, fueling price momentum. Fundamentals are critical in identifying a bear trap, even for technical traders. If none of the important fundamentals have changed, expect only a limited Bear Trap correction. If the fundamentals have changed, there’s no reason the downward trend shouldn’t continue. A bear trap may signal an opportunity to get short on a corrective bounce if the trend is your friend.

How to Avoid a Bear Trap:

– Observe trading volume: Low volume may indicate a temporary price change.

– Use your trading tools: Put options and stop orders can minimize losses in a short downtrend.

– Utilize technical analysis: Fibonacci retracements, relative strength index, and volume indicators can help predict the legitimacy and sustainability of current price trends.

– Pay attention to candlestick indicators: Patterns like Evening Star, Bearish Engulfing, and Three Black Crows can help identify a bear trap.

Real-World Example:

Bear traps can be found in stocks during overall market uptrends. For example, in the bear trap image above, ConocoPhillips’ stock price trended up before falling. It dropped rapidly, traded at support, rebounded, and continued rising. Traders who took short positions during the decline would have been caught in a bear trap if they hadn’t placed stop orders or taken other action to ensure they weren’t snared in the trap.

How to Trade a Bear Trap:

Consider using a short position and placing a stop order in case of reversal. If the fundamentals still look good, consider entering a long position during the downtrend to profit on the upside.

Is a Bear Trap Bullish?

A bear trap is short-term bearish but long-term bullish because it usually occurs in a bullish market trend.

What Is Bull Trap vs. Bear Trap?

A bull trap is the opposite of a bear trap. Traders might assume a downward trend is reversing and begin taking long positions, only to watch the market resume its downward trend.

The Bottom Line:

Bear traps can be frustrating for traders. It’s tough to identify a bear trap until after it forms and your position moves against you. Hopefully, you have placed a stop-loss order to prevent panic when the trend reverses course. Remember to always be cautious and consider trading tools and technical analysis when navigating the market.