What Does Undervalued Mean Definition in Value Investing

Contents

What Does Undervalued Mean? Definition in Value Investing

What Is Undervalued?

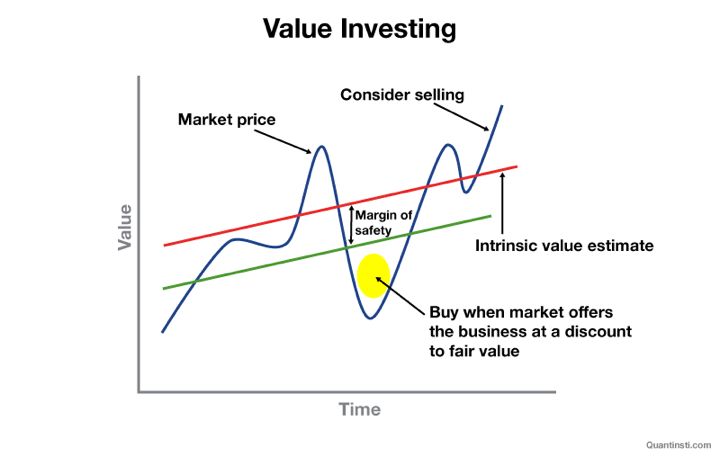

Undervalued is a financial term referring to a security or investment selling below its true intrinsic value. The intrinsic value of a company is the present value of its expected free cash flows. Evaluating an undervalued stock involves analyzing its financial statements, fundamentals, and cash flow to estimate its intrinsic value.

In contrast, an overvalued stock is priced higher than its perceived value. Buying undervalued stocks is a key aspect of Warren Buffett’s value investing strategy.

Key Takeaways

- An undervalued asset has a market price lower than its intrinsic value.

- Buying undervalued stock is called value investing.

- Considering a stock undervalued means believing its market price is "wrong" based on information not available to others or a subjective evaluation.

Understanding Undervalued

Value investing is not foolproof. There is no guarantee that an undervalued stock will appreciate or an exact way to determine its intrinsic value. When someone calls a stock undervalued, they are essentially saying they believe it is worth more than its current market price, although this is subjective and may not be based on rational business fundamentals.

An undervalued stock is considered priced too low compared to industry averages, presenting an opportunity for value investors to acquire them for potentially higher returns at a lower cost.

Whether a stock is truly undervalued depends on interpretation. An inaccurate valuation model or improper application can mean a stock is already properly valued.

Value Investing and Undervalued Assets

Value investing is an investment strategy that seeks undervalued stocks or securities in the marketplace to purchase or invest in. By acquiring assets at a low cost, investors expect to increase the likelihood of a return.

Additionally, the value investing methodology avoids buying overvalued items in the marketplace to avoid unfavorable returns.

Undervaluation, Subjectivity, and Efficient Markets

The belief that a stock can be persistently undervalued (or overvalued) in a way that consistently yields above-market returns contradicts the concept of fully efficient markets. Efficient markets would quickly adjust prices to reflect the intrinsic value if it were ascertainable from financial statements.

In other words, if markets are efficient, finding a truly undervalued stock would be near impossible unless one has inside information. Therefore, an investor who believes a stock is undervalued is making a subjective judgment opposing the rest of the market (excluding insider information). The success of value traders who consistently outperform the market challenges the efficient market hypothesis.

Value Investing vs. Values-Based Investing

Values-based investing involves buying shares in companies aligning with an investor’s personal values, differing from value investing focused on underpriced stocks. This strategy considers personal beliefs even if market indicators don’t support profitability. It includes avoiding investments in companies with unsupportable products and directing funds to favored ones.

For example, an investor against cigarette smoking but supportive of alternative fuel sources would invest accordingly. This investing approach prioritizes whether the product and sector align with the investor’s values.