What Does Plain Vanilla Mean Definition in Finance

Contents

- 1 What Does Plain Vanilla Mean? Definition in Finance

- 1.1 What Is Plain Vanilla in Finance?

- 1.2 Understanding Plain Vanilla

- 1.3 Plain Vanilla Instruments

- 1.4 Plain Vanilla vs. Exotic Options

- 1.5 Plain Vanilla and Dodd-Frank

- 1.6 What Is a Plain Vanilla Interest Rate Swap?

- 1.7 What Are Plain Vanilla Foreign Exchange Options?

- 1.8 What Is a Plain Vanilla Strategy?

- 1.9 The Bottom Line

What Does Plain Vanilla Mean? Definition in Finance

Rajeev Dhir is a writer with 10+ years of experience as a journalist in broadcast, print, and digital newsrooms.

What Is Plain Vanilla in Finance?

Plain vanilla is the most basic version of a financial instrument, such as options, bonds, futures, and swaps. It is the opposite of an exotic instrument, which alters the components of a traditional financial instrument, resulting in a more complex security.

Key Takeaways

- Plain vanilla is the most basic version of a financial instrument with no special features.

- Options, bonds, and other financial instruments can be plain vanilla.

- Plain vanilla is associated with low risk, while exotic instruments are associated with higher risk.

- A plain vanilla strategy was necessary after the financial crisis of 2007, leading to the creation of the Dodd-Frank Wall Street Reform and Consumer Protection Act.

Understanding Plain Vanilla

Plain vanilla describes the simplest form of an asset or financial instrument. There are no frills, extras, and it can be applied to options or bonds.

Plain vanilla can also describe more generalized financial concepts, such as trading strategies or modes of thinking in economics. For example, a plain vanilla card is a credit card with defined terms. Plain vanilla debt comes with fixed-rate borrowing and no convertibility rights for the borrower.

A plain-vanilla approach to financing is called a vanilla strategy. Calls for this came after the 2007 economic recession when risky mortgages contributed to the housing market collapse. During the Obama administration, many pushed for a regulatory agency to incentivize a plain vanilla approach to financing mortgages, stipulating among other tenets that lenders would have to offer standardized, low-risk mortgages to customers.

Plain Vanilla Instruments

A vanilla option gives the holder the right to buy or sell the underlying asset at a predetermined price within a specific timeframe. This call or put option comes with no special terms or features. It has a simple expiration date and strike price. Investors and companies use them to hedge their exposure to an asset or speculate on its price movement.

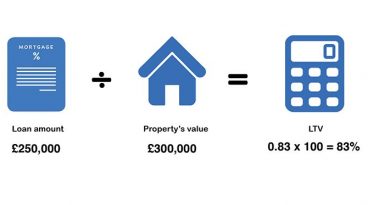

A plain vanilla swap can include a plain vanilla interest rate swap where two parties enter into an agreement, with one party paying a fixed rate of interest on a specified amount on specified dates and for a specified time period.

The counterparty makes payments on a floating interest rate to the first party for the same period of time. This is an exchange of interest rates on certain cash flows and is used to speculate on changes in interest rates. There are also plain vanilla commodity swaps and plain vanilla foreign currency swaps.

Plain Vanilla vs. Exotic Options

In the financial world, plain vanilla is the opposite of exotic. An exotic option involves more complicated features or special circumstances that separate them from common American or European options.

Exotic options are associated with more risk as they require an advanced understanding of financial markets to execute correctly or successfully, and as such, they trade over-the-counter (OTC).

Examples of exotic options include binary or digital options, which offer a final lump sum payout rather than a payout that increases incrementally as the underlying asset’s price rises. Other exotic options include Bermuda options and quantity-adjusting options.

Plain Vanilla and Dodd-Frank

In the wake of the 2007 global financial crisis, the financial system was reformed to make it safer and fairer. This was reflected in the passing of the Dodd-Frank Wall Street Reform and Consumer Protection Act in 2010, which enabled the creation of the Consumer Financial Protection Bureau (CFPB). The CFPB enforces consumer risk protection by regulating financing options that call for a plain-vanilla approach.

In 2018, President Donald Trump signed a bill easing restrictions on all banks except the largest ones, raising the threshold for being considered too important to fail from $50 billion to $250 billion and allowing the institutions to forgo stress tests. The CFPB was also stripped of some of its power, notably its enforcement of cases involving discriminatory lending practices.

What Is a Plain Vanilla Interest Rate Swap?

A plain vanilla interest rate swap is where one party pays a fixed interest rate and the other party pays a floating rate. Both rates are based on the same notional amount, and there is no exchange of principal.

What Are Plain Vanilla Foreign Exchange Options?

Plain vanilla foreign exchange options give the holder the right to buy or sell one currency for another currency. The option details the specific amount to be exchanged, and the exchange rate is agreed upon when the option is bought. The goal of plain vanilla foreign exchange options is to protect against adverse movements in foreign exchange rates.

What Is a Plain Vanilla Strategy?

A plain vanilla strategy is an investment strategy that is straightforward without any complex additions. It might involve holding a bond till maturity or purchasing a stock with a long-term view. It may also include passive investing.

The Bottom Line

Plain vanilla refers to the simplest, standard, and basic financial instruments and strategies. They are straightforward and generally less risky compared to their exotic counterparts, which have been altered to bring higher returns.