What Does a Charge-Off Mean Effect on Credit Score and How to Remove

**What Does a Charge-Off Mean? Effect on Credit Score and How to Remove**

**What Does a Charge-Off Mean?**

A charge-off occurs when a company writes off a debt because it believes it won’t be paid. However, you are still responsible for paying the debt.

A charge-off is used by creditors or lenders when a borrower becomes significantly overdue on payments. This can have serious consequences on your credit history and future borrowing ability.

**Key Takeaways**

– A charge-off is when a company writes off a debt as a loss.

– This is done when the borrower becomes delinquent on payments and the company believes it cannot collect the debt.

– You are still legally responsible for paying the debt.

– Charge-offs may be sold to collections companies or debt buyers.

– You will owe the debt until it is paid off, settled, or discharged in bankruptcy.

**How a Charge-Off Works**

A charge-off typically happens when a creditor determines that a debt is uncollectible after 180 days or six months of nonpayment. However, you are still legally responsible for paying the debt.

In addition, if you fail to meet the required minimum payments, the debt may also be charged off. The creditor marks the debt as uncollectible and reports it as a charge-off on your credit report.

Having a charge-off on your credit report can lead to a lower credit score and difficulties in obtaining credit at favorable interest rates in the future.

Paying off or settling the overdue debt does not remove the charge-off status from your credit report. Instead, it is likely to be changed to "charge-off paid" or "charge-off settled."

Regardless, charge-offs remain on your credit report for seven years. To have it removed before that time, you can negotiate with the creditor after paying off the debt. If the inability to repay the debt on time was due to a temporary setback, such as job loss, you can write to the lender explaining the situation and providing proof of a good payment history prior to the job loss.

**What Happens with Charged-Off Debt?**

The statute of limitations determines how long a debt can be collected through the legal court system. Once the statute of limitations has passed, the debt is considered too old to be collected, and the borrower cannot be taken to court for the unpaid debt.

In fact, if a collections agency attempts to take legal action over a time-barred debt, the debtor can countersue. The debtor can also sue if an agency continues to contact them after being asked not to, violating the Fair Debt Collection Practices Act.

However, the removal of a charge-off from your credit report does not mean the statute of limitations has passed. Even if the charge-off is removed after seven years, the statute of limitations may still be in effect. In such cases, the consumer can still be taken to court for the unpaid debt. Each state has its own statute of limitations on debt, which can range from three to fifteen years depending on the type of debt.

It’s important to note that passing the statute of limitations on payment does not absolve the consumer of the debt. It only means that the creditor or debt collector cannot obtain a court judgment for the payment of the old debt.

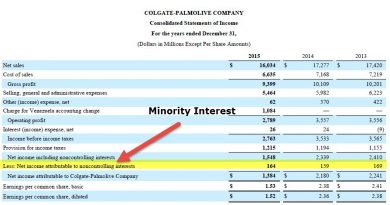

Creditors refer to uncollectible debt as bad debt. When a firm incurs bad debt, it is written off as an expense on the income statement. To qualify as business bad debt, it must be incurred during normal business operations and can be associated with another business or an individual. Bad debt charge-offs are more common with unsecured forms of credit like credit card debts or signature loans.

**Should I Pay Off Charged-Off Accounts?**

You should pay off charged-off accounts because you are still legally responsible for them. You will remain responsible for paying charged-off accounts until you have paid them, settled them with the lender, or discharged them through bankruptcy.

**How Do I Remove Charge-Offs from My Credit?**

To remove a charge-off from your credit, you can try paying off the debt, negotiating a pay-for-delete agreement with the lender, or hiring a credit repair company. However, when you pay off a charge-off debt, the status will often be changed to "paid charge-off," which can still negatively impact your creditworthiness.

**Is a Charge-Off Worse Than a Collection?**

A charge-off is generally considered worse than a collection in terms of credit impact. With collections, you usually have more leverage to have them removed from your credit report.

**The Bottom Line**

A charge-off means that a lender has written off a loan as a loss. However, if you have a charge-off, you are still obligated to pay it.

Having a charge-off on your credit report can have a negative impact on your ability to obtain future loans. Therefore, consider paying off your charge-off loans promptly or negotiating with the lender for a pay-for-delete agreement to remove it from your credit report.