What Are Usury Laws

Contents

What Are Usury Laws?

What Are Usury Laws?

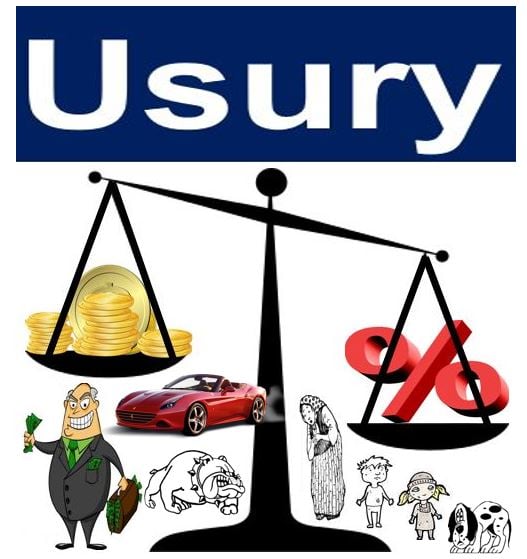

Usury is lending money at an unreasonably high interest rate or above the legal limit. Usury laws govern the interest charged on loans and protect consumers. In the United States, each state is responsible for setting usury laws. Although usury could fall under the Constitution’s commerce clause, Congress has traditionally not focused on it at the federal level.

Key Takeaways

- Usury laws set limits on the interest rates for various types of loans.

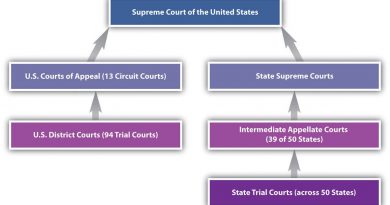

- Usury laws are enforced by individual states rather than at the federal level.

- Interest rate limitations can vary between states.

Examples of Usury Laws By State

Credit card companies charge interest rates permitted by the state where they are incorporated, rather than following the usury laws of the states where borrowers reside. Similarly, nationally chartered banks can apply the highest interest rate allowed by the state of incorporation.

Delaware and South Dakota are often chosen as states of incorporation for financial institutions due to the freedom allowed in setting interest rates. Nevada has no usury limits. Pennsylvania considers interest above 25% as criminal usury. New Jersey’s general usury limit is 30% for individuals and 50% for corporations.

In 2023, the Consumer Financial Protection Board and the New York Attorney General sued Credit Acceptance Corporation for misrepresenting the cost of credit and tricking customers into high-cost loans for used cars.

Legislation

The effectiveness of usury laws is often debated after decisions by the U.S. Supreme Court, and legislation has enabled financial institutions to bypass these limits. The Supreme Court’s decision in the case of Marquette National Bank v. First of Omaha Corp. allowed credit companies to charge out-of-state customers the same interest rates they could charge in the states where they were incorporated.

Delaware’s Financial Center Development Act, which eliminated limits on fees and interest for consumer lending, further encouraged financial institutions to relocate to the state.

In 2023, U.S. Senators Sheldon Whitehouse, Jack Reed, Elizabeth Warren, Bernie Sanders, and Jeff Merkley introduced the Empowering States’ Rights to Protect Consumers Act. The act aims to restore states’ ability to limit consumer loan interest rates and address the substantial amount of debt held by consumers through loans and credit cards.

What Is Predatory Lending?

Predatory lending is defined by the FDIC as imposing unfair and abusive loan terms on borrowers. Predatory lenders charge exorbitant interest rates and demand significant collateral.

When Were Usury Laws First Enacted in the United States?

The first usury laws were adopted by 18th-century American colonies, setting the interest cap at 8%.

How Does the CFPB Help Prevent Usury?

The CFPB identifies abusive conduct against consumers. In 2010, Congress passed the Consumer Financial Protection Act, which enables the CFPB, federal banking regulators, and states to identify wrongdoing and target firms engaged in abusive acts or practices.

The Bottom Line

Usury laws aim to protect consumers from predatory lending and excessively high interest rates. Each state in the U.S. establishes its own usury laws. The first usury laws in the United States were introduced by 18th-century American colonies.