What Are Real Assets vs Other Asset Types

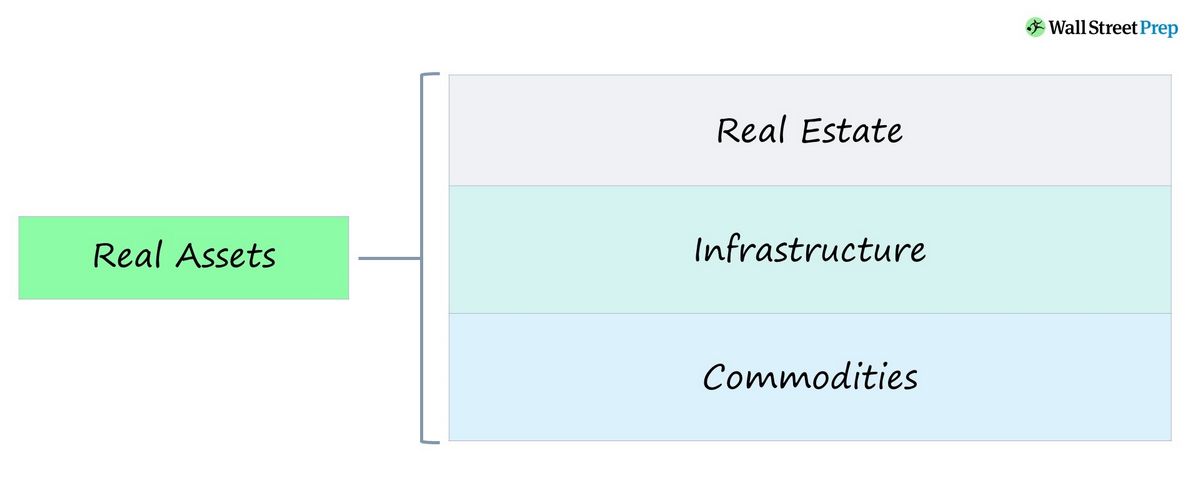

Real assets are physical assets with intrinsic worth due to their substance and properties. They include precious metals, commodities, real estate, land, equipment, and natural resources. These assets are suitable for diversified portfolios because of their low correlation with stocks and bonds.

Assets can be real, financial, or intangible. Real assets have tangible forms and derive their value from their physical qualities. On the other hand, financial assets have value from contractual rights or ownership claims. Intangible assets, like patents, copyrights, and trademarks, have value but are not physical in nature.

Financial and real assets are also referred to as tangible assets. However, they are distinct asset classes. Real assets have intrinsic value, while financial assets derive their value from contractual claims on underlying assets.

Real assets tend to be more stable than financial assets. They are well-suited for investments during inflationary times as they outperform financial assets. Long-lived real assets increase in value over time due to rising replacement costs and operational efficiency. They also provide predictable and steady income streams.

However, real assets have lower liquidity than financial assets. They take longer to sell and have higher transaction fees. Additionally, carrying and storage costs for real assets, such as physical gold bullion, can be higher.

Advantages of real assets include portfolio diversification, inflation hedge, and income streams. Disadvantages include illiquidity and storage fees.