What Are Operating Activities and What Are Some Examples

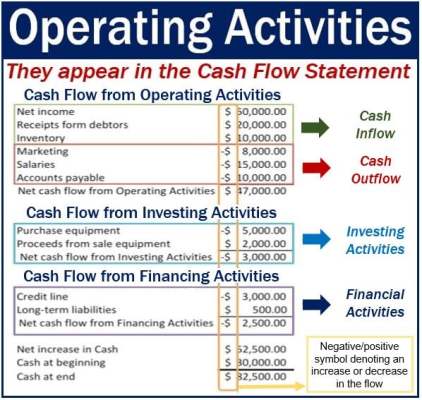

Operating activities are the primary functions of a business that involve providing goods and/or services to the market. These activities, such as manufacturing, distributing, marketing, and selling, are essential for a company’s cash flow and profitability. Common examples include cash receipts from sales, employee payments, taxes, and supplier payments, which are reflected in a company’s financial statements, specifically the income statement and cash flow statement.

Operating activities are distinct from investing or financing activities, which are not directly related to the provision of goods and services. Investing and financing activities contribute to the long-term functioning of a company, but activities like issuing stock or bonds are not considered operating activities.

Key operating activities include manufacturing, sales, advertising, and marketing. These activities, along with general administrative and maintenance tasks, form the daily operations of a company. Operating income, shown on financial statements, is the profit remaining after subtracting operating expenses from revenues. This income excludes interest expenses and is determined by costs like research and development, selling and marketing, and depreciation.

Operating activities can be identified by their classification in financial statements. For example, a company may report operating income or income from operations as a distinct line item on the income statement. Operating income is calculated by subtracting costs like cost of sales, research and development expenses, and administrative expenses.

Expenses associated with key operating activities include manufacturing costs and costs related to advertising and marketing. Manufacturing costs cover direct production costs, while advertising and marketing costs encompass expenses incurred from promoting the company and its products or services.

Cash flows from operating activities are a significant metric used by financial analysts and investors. They are presented separately from investing and financing activities on a company’s statement of cash flows. Operating activities contribute to a company’s cash flow, and a breakdown of these activities can shed light on a company’s financial health.

Operating revenues are generated by manufacturing and selling products or services. Sales activities also include the sale of in-house manufactured products or products supplied by other companies. Companies that primarily offer services may also sell products for additional revenue.

Operating expenses include manufacturing costs and costs associated with advertising and marketing. Manufacturing costs are included in the cost of goods sold, while advertising and marketing costs cover expenses for promoting the company and its products or services.

Investors pay attention to cash flow from operating activities because it reflects recurring income, rather than assets being sold off for one-time gains. This highlights the company’s true financial situation, which can be further assessed through the balance sheet and income statement.

To illustrate, let’s examine the cash flow details of Apple Inc. for the fiscal year ended September 2017. Apple reported a net income of $48.35 billion, depreciation and amortization of $10.16 billion, deferred taxes and investment tax credit of $5.97 billion, and other funds of $4.67 billion. These figures totaled $69.15 billion in funds from operations. The net change in working capital for the same period was -$5.55 billion. When added to the funds from operations, the cash flow from operating activities for Apple amounted to $63.6 billion.