What Are Hard Assets Definition Examples and Other Assets Types

Contents

What Are Hard Assets? Definition, Examples, and Other Asset Types

What Is a Hard Asset?

A hard asset refers to a tangible asset or resource with fundamental value. Examples include a fleet of trucks for delivering consumer goods, land, real estate, and commodities. Businesses purchase hard assets to improve production, increase revenues, and act as a buffer against soft asset losses. Sometimes, the value of hard assets decreases along with the value of soft assets.

Key Takeaways

- A hard asset is a tangible or physical item or resource owned by an individual or company.

- Often, the value of hard assets moves opposite to the value of soft assets, creating a buffer against losses.

- Hard assets can be long-term assets, such as machinery, or short-term assets, such as raw materials or inventory.

Understanding Hard Assets

Hard assets are fixed assets that aid in the production of goods and services. They have a life of more than one year and are typically classified as property, plant, and equipment on a company’s balance sheet.

Examples of hard assets include buildings, vehicles such as trucks or cars, machinery and equipment, and office furniture.

Short-term hard assets, called current assets, may be used up within one year. For example, inventory can be a hard asset for a company. If a company manufactures machinery, the raw materials or inventory, such as machine parts, would also be considered hard assets.

Paying for Hard Assets

Fixed hard assets usually require capital investment decisions by a company’s executive management team. These assets involve a large outlay of cash or capital and are considered long-term funding decisions. Funding for big-ticket hard assets can come from banks, venture capital firms, the issuance of corporate bonds or debt, or issuing new shares of stock. Investing in hard assets, such as a new manufacturing plant, indicates that the company plans to use the facility for many years to generate revenue.

The Value of Hard Assets

Hard assets are considered valuable because they can be used to produce or purchase other goods or services. They can also be sold to generate cash in the event of financial difficulties. When analysts calculate a company’s intrinsic value, a portion of this value is derived from its hard assets.

The intrinsic value of a company is a calculation of its worth using various models that analyze cash flow, assets, future revenue streams, and cost structure. Hard assets play a role in valuing a company as they can be sold for cash to pay off debts, bondholders, and shareholders in case of financial distress or liquidation.

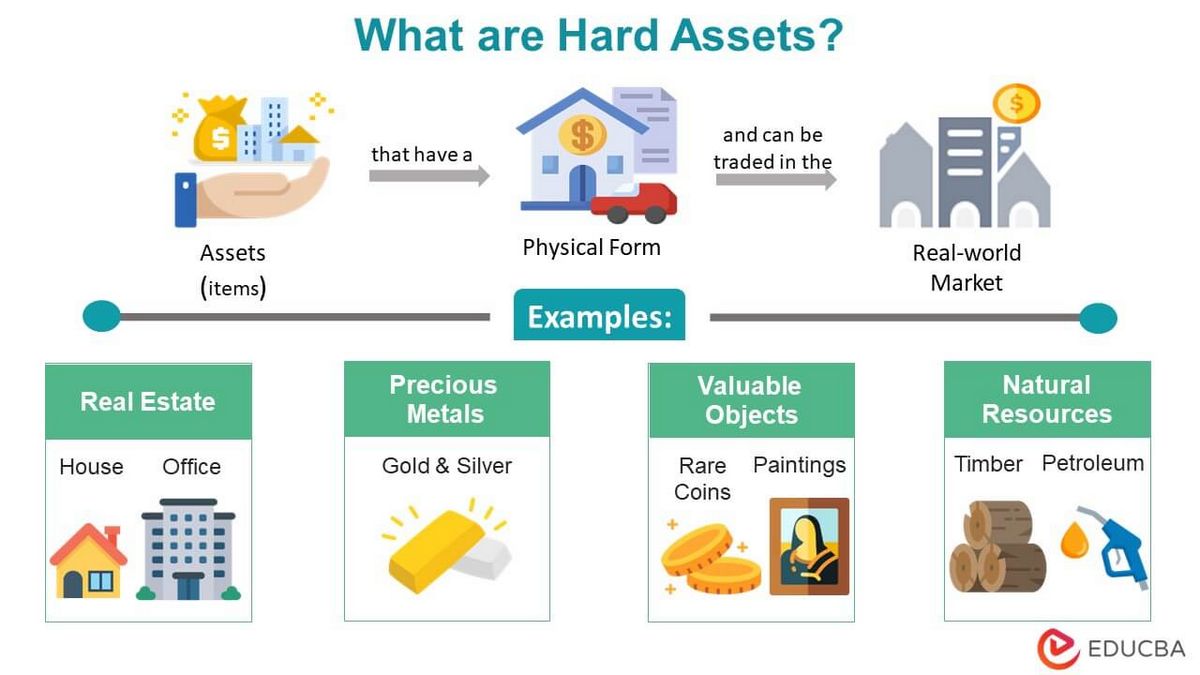

Hard Assets vs. Intangible Assets

Hard assets are physical assets, while intangible assets are non-physical assets used over the long-term. Examples of intangible assets include a company’s brand, investments in securities, trademarks, patents, copyrights, and franchises.

Technology companies often possess many intangible assets, such as patents for their products and significant capital invested in research and development. On the other hand, oil-producing companies have numerous hard assets, such as oil rigs and drilling machinery.

Example of Hard Assets

Ford Motor Company (NYSE: F) is a US automotive company that produces various cars and trucks. The company’s executive management team intends to buy new machinery for their assembly line and steel and aluminum for the rivets. All these assets, including the machinery, steel, and aluminum, are considered hard assets.

The assembly machinery is a long-term hard asset, while the steel and aluminum raw materials are current assets since their inventory will likely be used up within one year. Any patents on the equipment are considered intangible assets.