What Are General Provisions and How Do They Work

Contents

What Are General Provisions and How Do They Work?

What Are General Provisions?

General provisions are funds set aside by a company to pay for anticipated future losses. For banks, a general provision is considered supplementary capital under the first Basel Accord. General provisions on the balance sheets of financial firms are considered higher risk assets because it is assumed that the underlying funds will be in default in the future.

Key Takeaways

- General provisions are funds set aside by a company to pay for anticipated future losses.

- The amounts set aside are based on estimates of future losses.

- Lenders are required to set up general provisions every time they make a loan in case borrowers default.

- The act of creating general provisions has been declining since regulators prohibited basing provision level estimates on past experiences.

Understanding General Provisions

In the business world, future losses are inevitable, whether for the falling resale value of an asset, malfunctioning products, lawsuits, or a customer that can no longer pay what it owes. Companies must ensure they have enough money set aside to account for these risks.

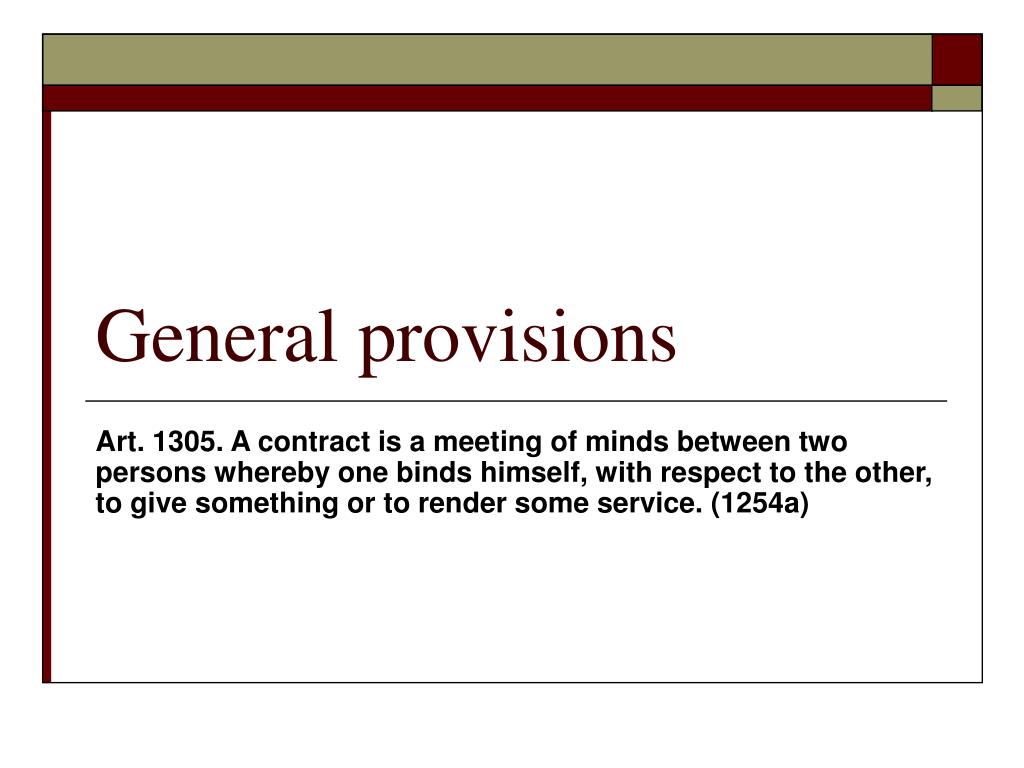

Companies cannot simply recognize a provision whenever they see fit. Instead, they must follow criteria laid out by regulators. Both generally accepted accounting principles (GAAP) and International Financial Reporting Standards (IFRS) lay out guidelines for contingencies and provisions. GAAP lays out its information in Accounting Standards Codification (ASC) 410, 420, and 450, and IFRS lays out its information in International Accounting Standard (IAS) 37.

Recording General Provisions

Provisions are created by recording an expense in the income statement and establishing a corresponding liability in the balance sheet. Account names for general provisions vary with the type of account or may be listed as a consolidated figure in parentheses next to accounts receivable, the balance of money due to a firm for goods or services delivered or used but not yet paid for by customers.

A company that records transactions and works with customers through accounts receivables may show a general provision on the balance sheet for bad debts or doubtful accounts. The amount is uncertain since the default has not yet occurred, but it is estimated with reasonable accuracy.

In the past, a company might have analyzed write-offs from the prior accounting year when establishing general provisions for doubtful accounts in the current year. However, IAS 39 now prohibits creating general provisions based on past experiences due to the subjectivity involved in creating the estimates. Instead, the reporting entity is required to carry out an impairment review to determine the recoverability of the receivables and any associated provisions.

Companies providing pension plans may also set aside a portion of business capital for meeting future obligations. If recorded on the balance sheet, general provisions for estimated future liability amounts may be reported only as footnotes on the balance sheet.

Banks and Lenders Requirements

Due to international standards, banks and other lending institutions are required to carry enough capital to offset risks. This may be met by indicating on the balance sheet either an allowance for bad debts or a general provision. The reserve funds provide backup capital for risky loans that may default.

General Provisions vs. Specific Provisions

Specific provisions are created when specific future losses are identified. Receivables may be logged as such if a certain customer faces serious financial issues or has a trade dispute with the entity.

The balances may be noted by examining an aged receivable analysis detailing the time elapsed since creating the document. Long-outstanding balances may be included in the specific provision for doubtful debts.

However, specific provisions may not be made for the entire amount of the doubtful receivable. For example, if there is a 50% chance of recovering a doubtful debt for a certain receivable, a specific provision of 50% may be required.

For banks, generic provisions are allocated at the time a loan is approved, while specific provisions are created to cover loan defaults.

Special Considerations

Provisions have often created controversies. In the past, creative accountants have used them to smooth out profits, adding more provisions in a successful year and limiting them when earnings were down.

Accounting regulators have been cracking down on this. New requirements prohibiting subjective estimates have led to a decline in the number of general provisions created.