What Are Agency Costs Included Fees and Example

Agency Costs: Included Fees and Example

Agency costs are internal expenses resulting from an agent’s actions on behalf of a principal. These costs arise from core inefficiencies and conflicts of interest between shareholders and management. The payment of agency costs is made to the acting agent.

Key Takeaways:

– Agency costs are internal expenses incurred when an agent takes action for a principal.

– Core inefficiencies and conflicts contribute to these costs.

– Agency costs that include managing conflicting parties are called agency risk.

– An agent-principal relationship exists between a company’s management and its shareholders.

Understanding Agency Cost:

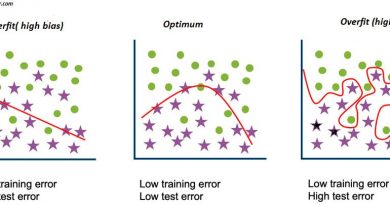

Agency costs occur when the interests of executive management conflict with shareholders. Shareholders may want management to increase shareholder value, but management may pursue other growth strategies that contradict the shareholders’ interests. These conflicting interests lead to agency costs.

In 1932, economists Gardiner Coit Means and Adolf Augustus Berle introduced the concept of corporate governance, discussing the relationship between an "agent" and a "principal." This concept applied to large corporations where the interests of directors and managers differed from those of owners.

Principal-Agent Relationship:

The principal-agent relationship primarily refers to the relationship between shareholders and management personnel. Shareholders are principals, and management is the agent. This relationship can also apply to other pairs of parties with similar power dynamics, such as politicians (agents) and voters (principals). In this case, agency costs arise when politicians fail to fulfill promises made during elections.

A Closer Look at Agency Costs:

Agency costs include fees associated with managing conflicting parties and resolving disputes. These costs, also known as agency risk, are necessary expenses in organizations where principals do not have complete autonomous power. To align the interests of stakeholders, agency costs may include performance bonuses, stock options, and other incentives to motivate agents.

Dissatisfied Shareholders:

When shareholders disagree with management’s direction, they may be less inclined to hold onto the company’s stock. If a specific action triggers mass sell-offs, the stock price may decline. Companies have a financial interest in benefiting shareholders and improving financial position to prevent stock price drops. A significant purge of shares can also discourage new investors from entering the market.

In cases where shareholders are distressed with management’s actions, they may attempt to elect new members to the board of directors. This can result in financial costs, as well as time and resource expenditure. Such changes cause disruptions and recalibration of power.

Real-World Example of Agency Costs:

One notorious example of agency risks is the Enron scandal in 2001. The company’s board of directors and senior officers sold their stock shares at inflated prices due to fraudulent accounting information, causing a significant loss for shareholders when the stock prices plummeted. The Enron debacle resulted from individual and collective greed in an atmosphere of market euphoria and corporate arrogance.

Note:Examples of articles related to the topic