Weighted Average Maturity WAM Definition and Calculation

Weighted Average Maturity (WAM) Definition and Calculation

Weighted average maturity (WAM) is the average amount of time until the maturities on mortgages in a mortgage-backed security (MBS). This term is also used to describe maturities in a portfolio of debt securities, including corporate debt and municipal bonds. The higher the WAM, the longer it takes for all the mortgages or bonds in the portfolio to mature. WAM is used to manage debt portfolios and assess the performance of debt portfolio managers.

Key Takeaways:

– WAM is a measure of the overall maturity of the mortgages in an MBS.

– A longer WAM implies greater interest rate and credit risk.

– WAM is the inverse of another MBS duration metric: weighted average loan age (WALA).

Understanding Weighted Average Maturity

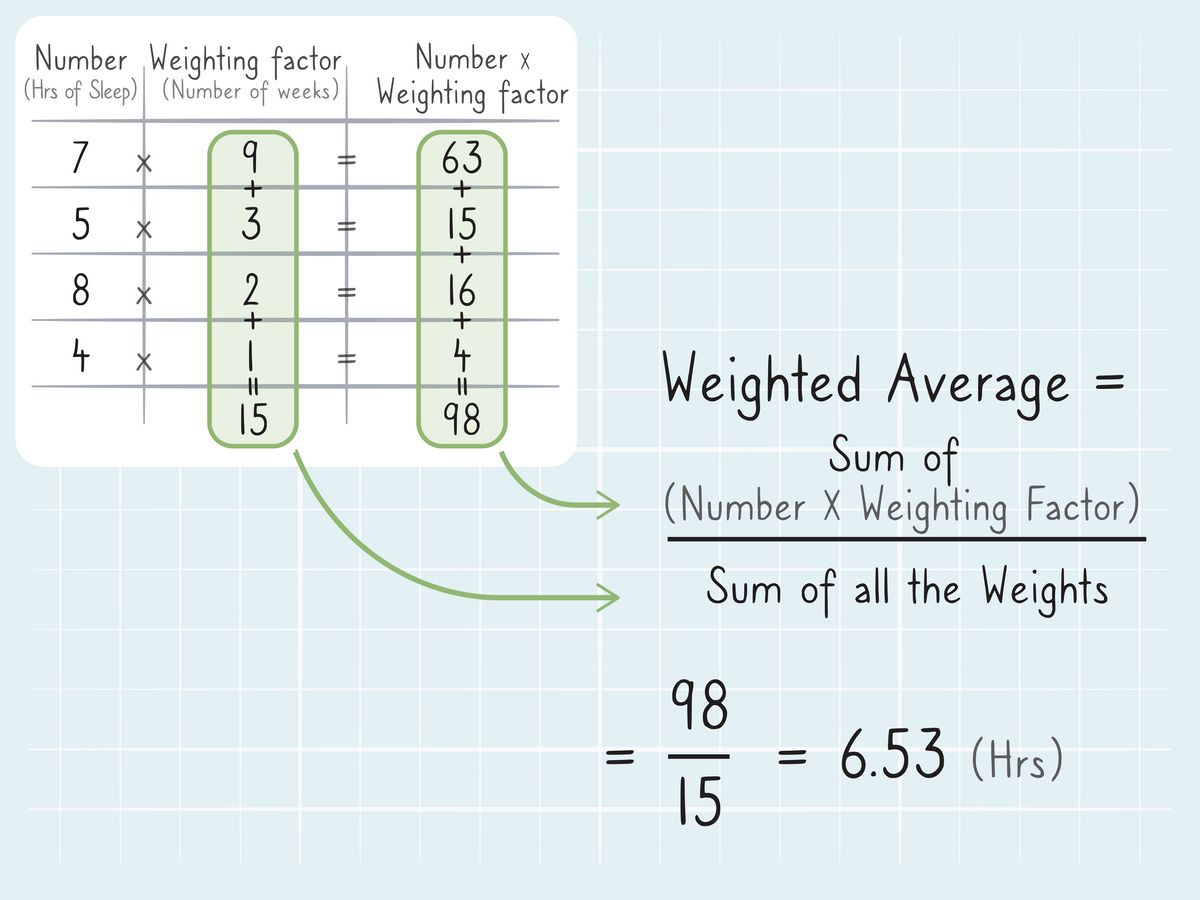

WAM is calculated by multiplying the percentage value of each mortgage or debt instrument in the portfolio by the number of months or years until its maturity. The sum of these subtotals gives the weighted average maturity of the bonds in the portfolio.

WAM is used to manage bond portfolios and evaluate portfolio managers’ performance. Mutual funds, for example, offer bond portfolios with a variety of WAM guidelines, ranging from as short as five years to as long as 30 years. Investors can select a bond fund that matches their investing time frame. The fund’s investment objective includes a benchmark, such as a bond index, and investors and portfolio managers can access the benchmark portfolio’s WAM. A portfolio manager’s investment performance is assessed based on the fund’s bond portfolio’s rate of return and WAM.

Bond laddering is an investment strategy that involves purchasing bonds with different maturity dates. This strategy allows the investor to reinvest bond maturity proceeds at current interest rates over time, reducing the risk of reinvesting the entire portfolio when interest rates are low. Income-oriented investors utilize WAM to evaluate a bond portfolio’s interest rate.

Example of How WAM Is Computed

Suppose an investor owns a $30,000 portfolio consisting of three bond holdings:

– Bond A: $5,000 bond (16.7% of the total portfolio) with a maturity of 10 years

– Bond B: $10,000 investment (33.3%) that matures in six years

– Bond C: $15,000 bond (50%) with a maturity of four years

To compute WAM, each percentage is multiplied by the years until maturity. Applying the formula, we get: (16.7% X 10 years) + (33.3% X 6 years) + (50% X 4 years) = 5.67 years, or about five years and eight months.

Weighted Average Maturity vs Weighted Average Loan Age

WAM and weighted average loan age (WALA) are both used to estimate the profitability of investments in mortgage-backed securities. However, WAM is a more commonly used measure for the maturity of pools of mortgage-backed securities. It measures the average time it takes for securities in a debt portfolio to mature, weighted by the dollar amount invested. Portfolios with higher WAMs are more sensitive to interest rate changes.

WALA is actually calculated as the inverse of WAM. WAM computes the percentage value of each mortgage or debt instrument in the portfolio, multiplies it by the number of months or years until maturity, and sums up the subtotals to determine the weighted average maturity of the bonds in the portfolio.