Weighted Average Cost of Capital WACC Definition and Formula

Weighted Average Cost of Capital (WACC): Definition and Formula

Weighted average cost of capital (WACC) represents a company’s after-tax cost of capital from all sources, including common stock, preferred stock, bonds, and other forms of debt. WACC is the rate that a company expects to pay to finance its business.

WACC determines required rate of return (RRR) as it expresses the return that bondholders and shareholders demand to provide the company with capital. A company’s WACC is higher if its stock is volatile or if its debt is risky because investors will want greater returns.

Key Takeaways

– WACC represents a company’s cost of capital with each category of capital proportionately weighted.

– WACC can be calculated by multiplying the cost of each capital source by its relevant weight in terms of market value and then adding the results together.

– WACC is commonly used as a hurdle rate to gauge the desirability of a project or acquisition.

– WACC is also used as the discount rate for future cash flows in discounted cash flow analysis.

Understanding WACC

Calculating WACC is useful for investors, stock analysts, and company management for different reasons.

In corporate finance, WACC can be used as the discount rate for estimating the net present value of a project or acquisition. If a merger generates a return higher than its cost of capital, it’s a good choice. Otherwise, the company might want to put its capital to better use.

To investors, WACC assesses a company’s potential for profitability. A lower WACC indicates a healthy business that’s able to attract money from investors at a lower cost. A higher WACC usually coincides with riskier businesses that need to compensate investors with higher returns.

If a company obtains financing through one source, calculating its cost of capital is simple. However, when a company uses both debt and equity financing, WACC comes in.

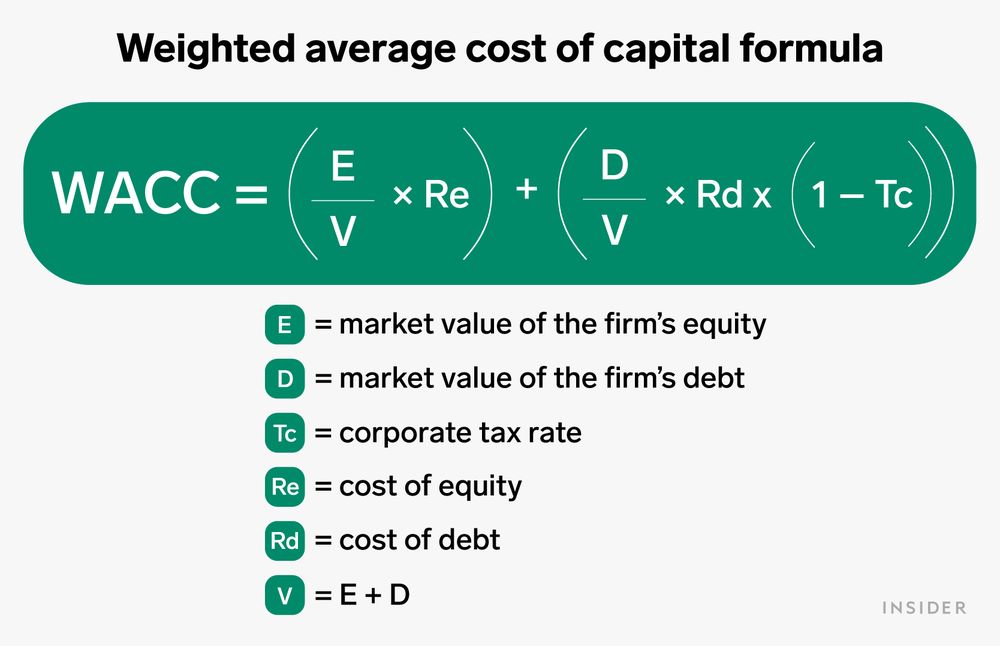

WACC = ( E V x R e ) + ( D V x R d x ( 1 − T c ) )

where:

E = Market value of the firm’s equity

D = Market value of the firm’s debt

V = E + D

R e = Cost of equity

R d = Cost of debt

T c = Corporate tax rate

WACC is calculated by multiplying the cost of each capital source by its relevant weight and adding those results together. E/V represents the proportion of equity-based financing, while D/V represents the proportion of debt-based financing. The WACC formula involves the summation of two terms: E/V x R e and D/V x R d x ( 1 − T c ). The former represents the weighted value of equity capital, while the latter represents the weighted value of debt capital.

For example, if a company obtained $1 million in debt financing and $4 million in equity financing, E/V would equal 0.8 and D/V would equal 0.2. The WACC would be 0.0875 or 8.75% (0.08 weighted cost of equity + 0.0075 weighted cost of debt).

Explaining the Formula Elements

Calculating the cost of equity (Re) can be tricky because share capital does not have an explicit value. The cost of equity is the expected return that investors demand based on the stock’s volatility. Shareholders require a certain return on their investment, which is a cost from the company’s perspective.

Determining the cost of debt (Rd) is a more straightforward process. It can be done by averaging the yield to maturity for a company’s outstanding debts. For privately owned companies, the company’s credit rating and a relevant spread over risk-free assets can be used.

The net cost of a company’s debt is the amount of interest it is paying minus the amount deductible on its taxes. This is why Rd x (1 – the corporate tax rate) is used to calculate the after-tax cost of debt.

WACC vs. Required Rate of Return (RRR)

The required rate of return is the minimum rate that an investor will accept. It can be determined using the capital asset pricing model (CAPM) or by calculating WACC. The advantage of using WACC is that it takes the company’s capital structure into account.

Limitations of WACC

The WACC formula is not easy to calculate accurately. Elements like the cost of equity can have different values reported by different parties. Therefore, WACC should be used along with other metrics for investment decisions.

Calculating WACC becomes more difficult with complex balance sheets and multiple types of debt. Additionally, there are many inputs, such as interest rates and tax rates, that can be affected by market and economic conditions.

Example of How to Use WACC

Suppose a hypothetical manufacturer called XYZ Brands obtained $1 million in debt financing and $4 million in equity financing. E/V would equal 0.8, and D/V would equal 0.2. The weighted cost of equity would be 0.08, and the weighted cost of debt would be 0.0075. The WACC would be 0.0875 or 8.75%.

What Is a Good Weighted Average Cost of Capital (WACC)?

A good WACC varies from company to company, depending on factors like its stage of development, capital structure, and industry. Comparing a company’s WACC to the industry average can provide insight into its attractiveness for investment.

What Is Capital Structure?

Capital structure refers to how companies mix debt and equity financing to obtain the capital they need.

What Is a Debt-to-Equity Ratio?

The debt-to-equity ratio is another way to assess the risk of investing in a company. A higher ratio indicates higher risk.

The Bottom Line

WACC is a useful measure for investors and company executives but should not be relied on alone. Its calculation can be complex, and it should be used in conjunction with other metrics for investment decisions.