Water Damage Legal Liability Insurance What It is How It Works

Contents

Water Damage Legal Liability Insurance: What It is, How It Works

What Is Water Damage Legal Liability Insurance?

Water damage legal liability insurance provides financial protection to individuals or businesses that unintentionally cause water damage to another person’s property.

For individuals, water damage legal liability insurance is typically included in renter, homeowners, and condo insurance policies.

Key Takeaways

- Water damage legal liability insurance protects individuals or businesses if they cause unintentional water damage to someone else’s property or possessions.

- This insurance is generally part of a homeowners or renter’s insurance policy.

- The water damage usually has to be caused by a sudden event or accident to be covered.

How Water Damage Legal Liability Insurance Works

Water damage legal liability insurance is a type of liability insurance that protects individuals or businesses from being sued or held legally responsible for damages or injuries they cause. It covers legal costs and payouts for destruction, damage, or injury, regardless of intent.

There are various situations when water damage legal liability insurance could help protect an individual from significant costs. For example, if the owners of a second-floor condo unit experience a water heater explosion, and the water leaks into units on the first floor, this insurance would cover the cost of repairing the damage to the first-floor units.

Homeowners Policies and Water Damage Legal Liability Insurance

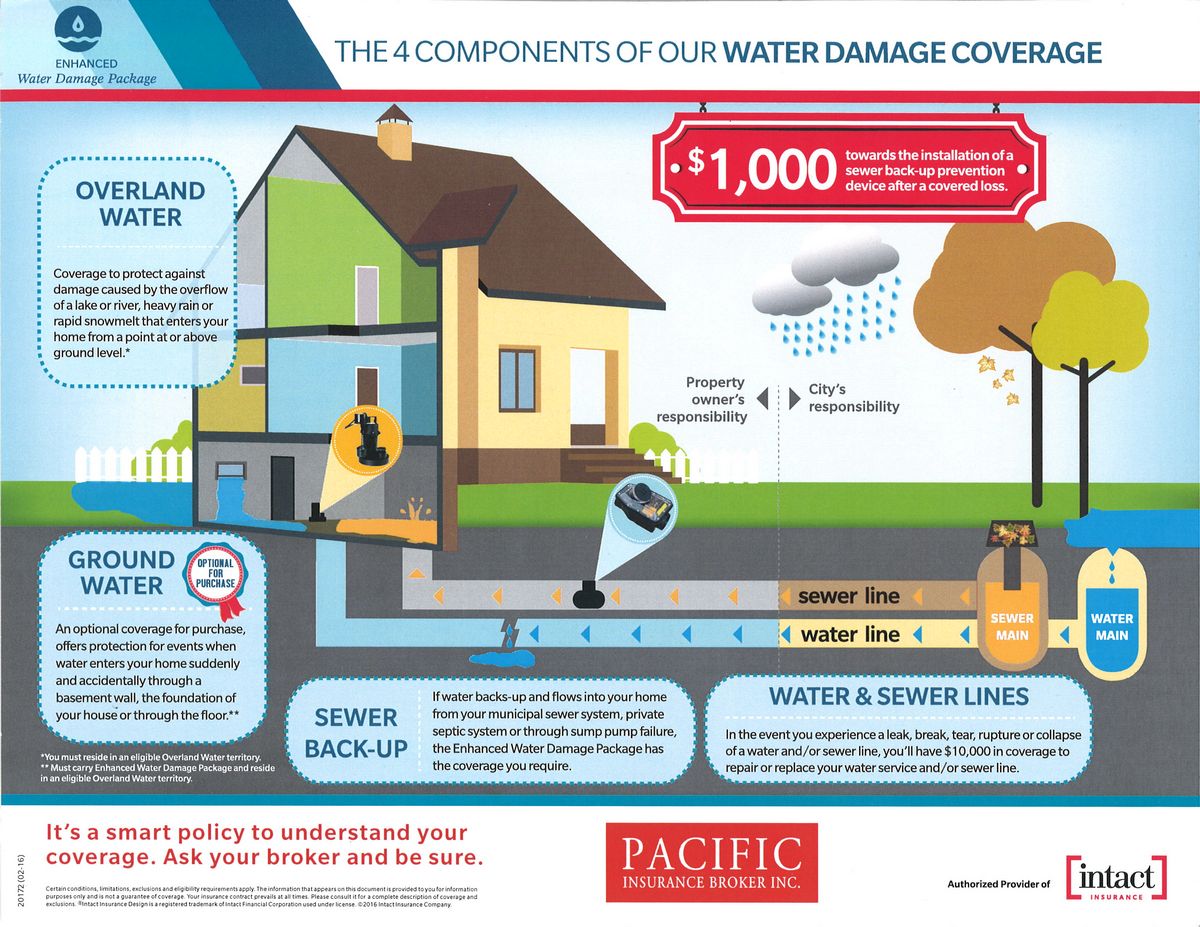

Homeowners insurance policies generally include water damage legal liability either as part of the personal liability coverage or in a separate rider. The water damage must result from a sudden, unforeseen, and inadvertent event like a leaking air conditioner, burst pipe, malfunctioning washing machine, or water heater rupture. The liability extends to damage, destruction, or injury to others’ structures, belongings, or persons.

However, if the water damage is caused by poor maintenance, malfeasance, or deliberate carelessness, the liability coverage might not apply or the insurance company might reject the claim.

How to Increase or Improve Your Coverage

It is essential to read the insurance contract carefully because not all policies include water damage legal liability insurance. The extent of the coverage is also a common issue. Most standard homeowners policies provide a basic limit of liability of $300,000 for property damages or injuries. This limit can be increased by purchasing an umbrella insurance policy.

An umbrella insurance policy provides broader liability coverage than homeowners insurance. It includes payments on the policyholder’s behalf in cases of home and auto accidents, libel, slander, vandalism, invasion of privacy, and injuries that occur at secondary residences, rental properties, or on a boat or watercraft owned by the policyholder.