VIX Option What it is How it Works in Options Strategy

Contents

VIX Option: What it is, How it Works in Options Strategy

What Is VIX Option?

A VIX option uses the Cboe Volatility Index as its underlying asset.

Key Takeaways

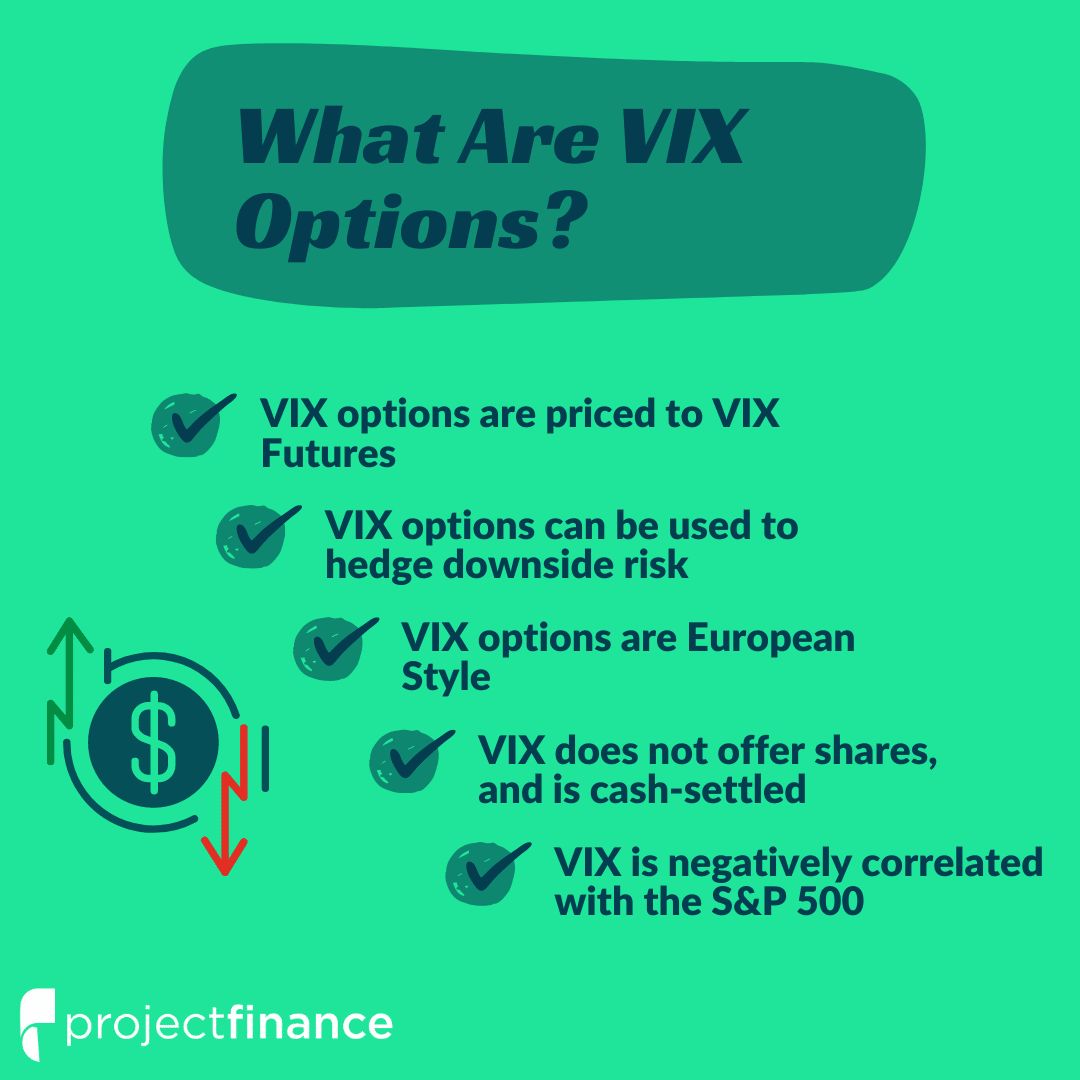

- VIX Options trade with the S&P 500 Volatility Index as their underlying.

- VIX call options hedge against downward price shocks.

- VIX put options can be problematic because the S&P 500 index does not often rise rapidly.

- VIX options trade as European-style options.

Understanding VIX Options

VIX options allow traders and investors to speculate on future moves in volatility.

The VIX option gives individual investors the ability to trade on market volatility.

By purchasing a VIX call option, traders can profit from a rapid increase in volatility.

A volatility increase often coincides with a downward trending market, making VIX call options a natural hedge and more efficient than equity index options.

VIX put options can be profitable for traders who correctly anticipate a market turnaround from a downward trend to an upward trend.

VIX options settle in cash and trade in the European style, limiting exercise until expiration.

Advanced options traders can incorporate various strategies using VIX options, but calendar spreads may be problematic since different expiration series do not track each other closely.

VIX Explained

The VIX shows the market’s expectation of 30-day volatility in the stock market.

The VIX is a calculated index based on the price of options on the S&P 500.

Introduced in 1993, the VIX expanded in 2004 to use options based on the broader S&P 500 index, providing a more accurate view of investors’ expectations on future market volatility.

VIX values above 30 indicate significant volatility due to investor fear or uncertainty, while values below 15 correspond to less stressful times in the markets.

The VIX is also known as the "fear index" because it tends to move significantly higher during periods of market fear and uncertainty.