Visa Card Definition Types How They Work vs Mastercard

Visa Card: Definition, Types, How They Work, vs. Mastercard

What Is a Visa Card?

A Visa card uses the Visa network and bears the Visa logo. Originally focused on credit cards, the San Francisco-based company now offers debit, prepaid, and gift cards as well. However, Visa cards are not directly issued by the company itself. Instead, they are issued by partner financial institutions.

Key Takeaways

- Visa cards utilize the Visa network for transactions.

- They are issued by partner financial institutions.

- Visa cards have a 16-digit account number, microchip, magnetic stripe, and other features.

- Types of Visa cards include credit cards, debit cards, prepaid cards, and gift cards.

How Visa Cards Work

Visa is a global processing network accepted in over 200 countries and territories. Other major networks include Mastercard, American Express, and Discover.

Financial institutions partner with a single processing network provider, such as Visa, for their payment card products. Each issuer sets their own terms and conditions for the Visa cards they offer and select their customers. Visa cards are available through various financial institution partnerships.

Visa also partners with merchants through service agreements. Merchants accepting Visa cards pay Visa Inc. a transaction fee for each customer’s usage.

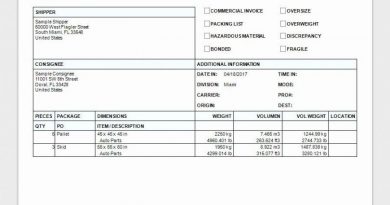

All Visa cards have a unique 16-digit number, microchip, magnetic stripe, and a panel for the cardholder’s signature and validation code. Despite being branded with the Visa name, they are issued by financial institutions, not by Visa itself.

Types of Visa Cards

Visa offers different payment cards branded with their logo and utilizing their processing network. These include credit cards, debit cards, prepaid cards, and gift cards. Let’s explore how each of them works.

Visa Credit Cards

Financial institutions issue Visa credit cards to consumers based on their creditworthiness. These cards provide convenience and security worldwide, allowing purchases at merchants and ATMs.

Visa credit cards may include features like 0% introductory APRs, cash back rewards, and special benefits at certain retailers. All Visa credit cards benefit from the Visa Zero Liability Policy, reducing cardholders’ liability for unauthorized transactions to $0.

Visa credit cards have various fees, such as annual fees, foreign transaction fees, and cash advance fees. The interest rate is determined by the issuer.

Visa Debit Cards

Visa debit cards are linked to a cardholder’s checking account. They can be used for purchases, as well as routine bank transactions at branches or ATMs. Unlike credit cards, debit cards don’t provide credit but are limited to the funds available in the account.

Visa debit cards also benefit from the Visa Zero Liability Policy for unauthorized transactions.

Visa Prepaid Cards

Prepaid cards, not associated with a bank account, have a specific preloaded amount acting as a credit limit. These cards can be used wherever Visa is accepted and can be reloaded for future use.

In addition to all-purpose prepaid cards, Visa offers specialized prepaid cards. These include payroll cards, used by employers to pay employees, and government payment cards, used for distributing benefits.

Visa Gift Cards

Visa gift cards are preloaded with a specific amount, like prepaid cards, but can’t be reloaded. They can be used wherever Visa is accepted.

Visa vs. Mastercard

Both Visa and Mastercard are large, worldwide payment networks. They partner with banks and financial institutions that issue their credit cards. Consumers won’t notice significant differences between Visa and Mastercard. In contrast, American Express and Discover issue their own credit cards.

Are There Secured Visa Credit Cards?

Yes, some financial institutions issue secured credit cards with the Visa logo. Secured cards are tailored to people with poor or no credit history. To qualify, individuals must deposit a sum of money, serving as their credit line. After using a secured card responsibly, cardholders can often upgrade to a regular, unsecured credit card.

What Do Visa Card Microchips Do?

The microchips embedded on Visa cards carry encrypted information about the cardholder and account, providing additional security compared to magnetic stripes. Although most cards have both chips and stripes, some merchants still rely on stripe-compatible terminals.

The Bottom Line

Visa is a major payment card processing network, accepted globally. Whatever type of card consumers are seeking, they can likely find a Visa-affiliated issuer.

Visa is a major payment card processing network, accepted globally. Whatever type of card consumers are seeking, they can likely find a Visa-affiliated issuer.