Variance Swap Definition Vs Volatility Swap and How It Works

Contents

Variance Swap: Definition and Comparison to Volatility Swap

What Is a Variance Swap?

A variance swap is a financial derivative used to hedge or speculate on the magnitude of a price movement of an underlying asset. These assets can include exchange rates, interest rates, or the price of an index. In simple terms, variance represents the difference between expected and actual results.

A variance swap is similar to a volatility swap, which uses realized volatility instead of variance.

Key Takeaways

- A variance swap is a derivative contract where two parties exchange payments based on the underlying asset’s price changes or volatility.

- Directional traders use variance trades to speculate on future volatility levels, spread traders use them to bet on the difference between realized and implied volatility, and hedge traders use them to cover short volatility positions.

- If realized volatility exceeds the strike, payoffs at maturity are positive.

How a Variance Swap Works

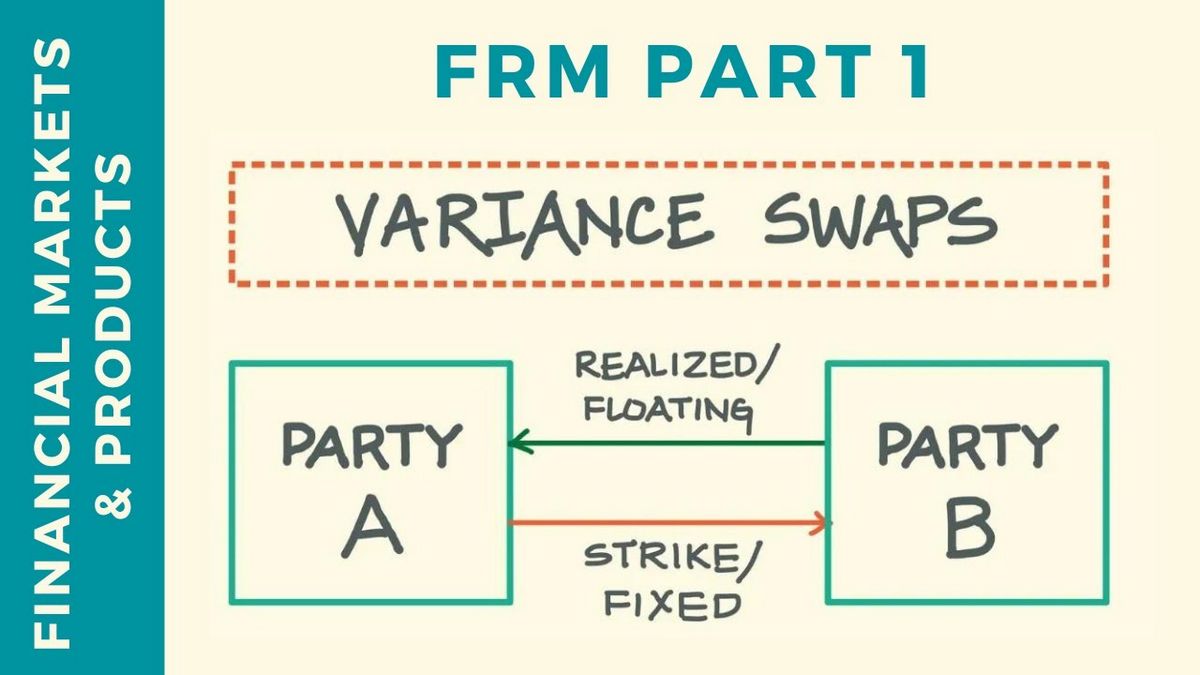

In a variance swap transaction, one party pays an amount based on the actual variance of price changes of the underlying asset. The other party pays a fixed amount called the strike, defined at the contract’s start. The strike is usually set to ensure a net present value (NPV) of zero.

At the end of the contract, the counterparties’ net payoff is a theoretical amount multiplied by the difference between variance and a fixed amount of volatility, settled in cash. Payments may occur during the contract’s life if the contract’s value moves beyond agreed limits due to margin requirements specified in the contract.

The variance swap is the arithmetic average of the squared differences from the mean value in mathematical terms. The square root of variance is the standard deviation. Consequently, a variance swap has a larger payout compared to a volatility swap since it is based on variance rather than standard deviation.

A variance swap provides exposure solely to an underlying asset’s volatility. Options also enable speculation on asset volatility, but they carry directional risk and their prices depend on various factors, including time, expiration, and implied volatility. Therefore, implementing an equivalent options strategy requires additional risk hedging. Variance swaps are also comparatively cheaper to initiate since an option’s equivalent involves a strip of options.

There are three main classes of users for variance swaps:

- Directional traders use these swaps to speculate on future volatility levels for an asset.

- Spread traders bet on the difference between realized volatility and implied volatility.

- Hedger traders use swaps to cover short volatility positions.

Additional Variance Swap Characteristics

Variance swaps are well-suited for volatility speculation or hedging. Unlike options, they do not require additional hedging, as options may necessitate delta-hedging. Furthermore, the long holder of a variance swap always experiences a positive payoff at maturity when realized volatility exceeds the strike.

Buyers and sellers of volatility swaps should be aware that significant jumps in the underlying asset’s price can skew the variance and yield unexpected outcomes.