Variable Annuity Definition How It Works and vs Fixed Annuity

Variable Annuity: Definition, How It Works, and vs. Fixed Annuity

Anthony Battle is a CERTIFIED FINANCIAL PLANNER™ professional. He earned the Chartered Financial Consultant® designation for advanced financial planning, the Chartered Life Underwriter® designation for advanced insurance specialization, the Accredited Financial Counselor® for Financial Counseling, and both the Retirement Income Certified Professional® and Certified Retirement Counselor designations for advance retirement planning.

Skylar Clarine is a fact-checker and expert in personal finance with experience in veterinary technology and film studies.

What Is a Variable Annuity?

A variable annuity is a type of annuity contract, the value of which can vary based on the performance of an underlying portfolio of sub accounts. Sub accounts and mutual funds are conceptually identical, but sub accounts don’t have ticker symbols for research purposes.

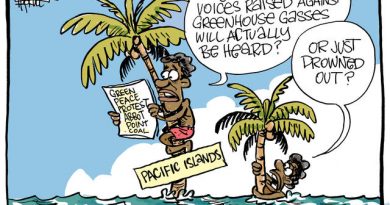

Among annuities, variable annuities differ from fixed annuities, which provide a specific and guaranteed return.

Key Takeaways

– The value of a variable annuity is based on the performance of underlying sub accounts selected by the annuity owner.

– Fixed annuities provide a guaranteed return.

– Variable annuities offer the possibility of higher returns and greater income than fixed annuities, but there’s also a risk of value decline.

Understanding Variable Annuities

Two elements contribute to the value of a variable annuity: the principal, which is the amount of money you pay into the annuity, and the returns on that principal delivered by the annuity’s underlying investments over time.

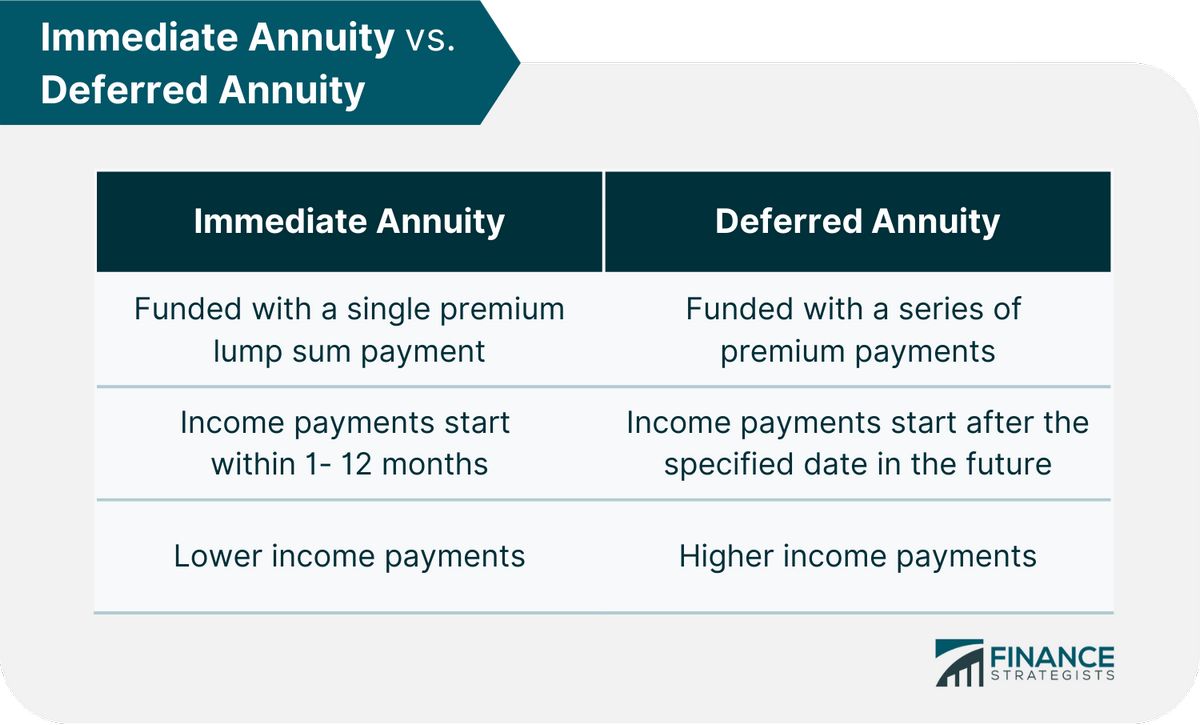

The most popular type of variable annuity is a deferred annuity. It is often used for retirement planning purposes and provides a regular income stream starting in the future. Immediate annuities, on the other hand, begin paying income immediately.

Variable Annuity Basics

You can buy an annuity with a lump sum or a series of payments, and the account’s value will grow accordingly. In deferred annuities, this is called the accumulation phase. The payout phase is triggered when the annuity owner asks the insurer to start the flow of income. Some annuities do not allow additional fund withdrawal once the payout phase begins.

Variable annuities should be considered long-term investments due to withdrawal limitations. Typically, they allow one withdrawal per year during the accumulation phase. However, withdrawal during the contract’s surrender period, which can be up to 10 years, generally incurs a surrender fee. Withdrawals before the age of 59½ result in a 10% tax penalty, similar to other retirement account options.

Variable Annuities vs. Fixed Annuities

Variable annuities were introduced in the 1950s as an alternative to fixed annuities, which offer a guaranteed—though often low—payout during the annuitization phase. The exception is fixed income annuities, which have a moderate to high payout that increases with the annuitant’s age.

Variable annuities allow buyers to benefit from rising markets by investing in a menu of mutual funds offered by the insurer. The upside is the possibility of higher returns during the accumulation phase and a larger income during the payout phase. The downside is exposure to market risk and potential losses. With fixed annuities, the insurance company assumes the risk of delivering the promised return.

Variable Annuity Advantages and Disadvantages

In deciding whether to invest in a variable annuity vs. other types of investments, it’s worth weighing these pros and cons.

Advantages:

– Tax-deferred growth

– Flexible income stream to suit your needs

– Guaranteed death benefit for beneficiaries

– Creditor protection

Disadvantages:

– Riskier than fixed annuities due to potential investment losses

– Surrender fees and penalties for early withdrawal

– High fees

What Is an Annuity?

An annuity is an insurance product that promises to pay out income in the future based on invested funds. Annuities are similar to other investments, but they come with higher fees.

Which Earns More: Variable or Fixed Annuities?

There is no clear answer to this. Variable annuities have greater potential for earnings but also can lose money and have fees that impact profits. Fixed annuities typically earn at a lower, stable rate. Carefully consider your options when choosing an annuity.

Are Annuities FDIC-insured?

No, annuities are not insured by the Federal Deposit Insurance Corp. (FDIC) since they are not bank products. However, they are protected by state guaranty associations if the insurance company providing the product goes out of business.

The Bottom Line

Before buying a variable annuity, carefully read the prospectus to understand the expenses, risks, and formulas for calculating investment gains or losses. Annuities are complicated products. Due to numerous fees and charges, a variable annuity’s expenses can quickly add up, potentially affecting returns compared to other types of investments.