VantageScore Meaning Model Components

VantageScore is a credit scoring model introduced by the three major credit bureaus (Equifax, Experian, and TransUnion) in 2006 as an alternative to the FICO score. Both VantageScore and FICO scores are widely used today.

Key Takeaways:

– VantageScore assigns consumers a score between 300 and 850 based on their credit history, serving as an alternative to FICO scores.

– It was developed by Equifax, Experian, and TransUnion and also uses FICO scores.

– VantageScore claims to use "machine learning" techniques to provide a more accurate and predictive assessment of a consumer’s creditworthiness.

How VantageScore Works:

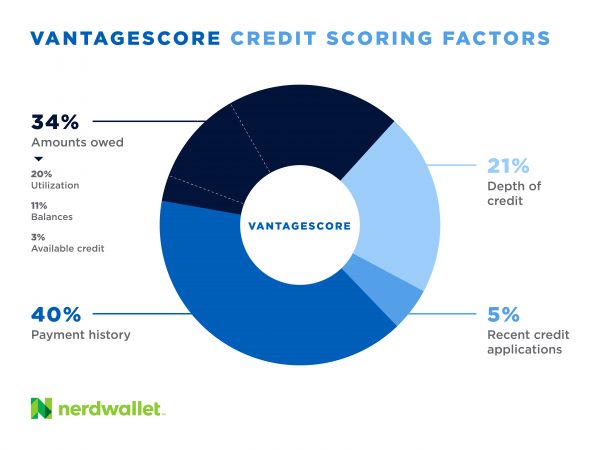

– The latest version of VantageScore is VantageScore 4, which is calculated based on six factors with their own weightings.

– The most important factors are payment history (41%), age/mix of credit (20%), and credit utilization (20%).

– VantageScore obtains information from all three credit bureaus and uses trended data to assign credit scores.

What Is a Good VantageScore?

– VantageScores range from 300 to 850, with higher scores indicating greater creditworthiness.

– Experian categorizes VantageScores as Excellent (750-850), Good (700-749), Poor (550-649), and Very Poor (300-549).

Differences Between FICO Scores and VantageScores:

– FICO scores are more widely used, but VantageScores are gaining adoption.

– FICO scores rely on five factors with different weightings.

– VantageScores combine information from all three credit bureaus, while FICO scores are based on each bureau’s data.

– FICO scores have multiple versions tailored for different lenders, whereas VantageScore is a single model.

– VantageScore can score more consumers, including those with thin credit histories.

How Can You Obtain Your Credit Score?

– Many banks, credit card companies, and websites offer free credit scores, often VantageScores.

How Can You Obtain Your Credit Reports?

– By law, you are entitled to one free copy of your credit report from each of the three major credit bureaus annually. Visit AnnualCreditReport.com.

How Can You Improve Your Credit Score?

– Pay credit bills on time and keep credit utilization under 30% to improve and maintain a good credit score.

The Bottom Line:

– VantageScore is capable of scoring 94% of adults and differs from FICO scores. However, it is important to pay attention to credit habits regardless of the scoring model used.