Underwriting Income What it is How it Works

Underwriting Income: What it is, How it Works

What Is Underwriting Income?

Underwriting income is the profit generated by an insurer’s underwriting activity over a period of time. It is the difference between premiums collected on insurance policies and expenses incurred and claims paid out. Huge claims and disproportionate expenses may result in an underwriting loss. The level of underwriting income accurately measures the efficiency of an insurer’s underwriting activities.

Key Takeaways

– Underwriting income is the profit generated by an insurance company through its business.

– The difference between premiums collected on insurance policies and business expenses plus claims paid out is the underwriting income.

– Underwriting income can indicate the amount of new business a company brings in or the accuracy of its risk analysis process in predicting insurance claims.

– Positive underwriting income allows a company to rely less on investment income or writing riskier policies.

Understanding Underwriting Income

When an insurance company writes or renews a policy, it receives an insurance premium as payment. This is their revenue. The difference between revenue and costs is the underwriting income. Underwriting income is an indicator of how well an insurance company performs, except during extreme events like earthquakes and hurricanes. A consistently negative underwriting income could indicate a lack of new business. It could also suggest that the policies being written are risky, resulting in frequent claims payouts.

For an insurance company, finding a balance is important. Constantly paying out more in claims than earning revenue through underwriting could lead to insolvency.

Underwriting Income vs. Investment Income

Underwriting income is calculated by subtracting expenses and claims from earned premiums. Investment income is derived from capital gains, dividends, and other investments. When analyzing an insurance company’s performance, it is crucial to focus on underwriting income to understand how well the core operations are performing, rather than overall income or profits.

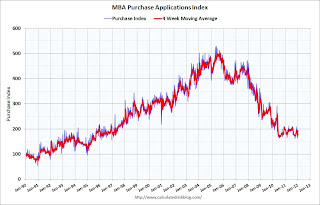

Underwriting Income and the Underwriting Cycle

The underwriting cycle refers to the periodic rise and fall of the insurance industry’s underwriting income. Fluctuations in underwriting income drive this cyclical rise and fall, as investment income swings are mild. Large drops in underwriting income can indicate under-priced insurance policies or the writing of risky policies. Insurance companies with strong underwriting income are financially stronger because they don’t need to compensate for poor performance by increasing investment risks or underwriting riskier policies.