Understanding Revaluation Reserve and How It Is Recorded

Contents

Understanding Revaluation Reserve and Recording It

Revaluation reserve is an accounting term used when a company creates a line item on its balance sheet to maintain a reserve account tied to certain assets. This line item is used when a revaluation assessment finds a change in the carrying value of the asset.

Revaluation reserves are used when an asset’s market value fluctuates or is volatile due to currency relationships.

Key Takeaways

- Companies use revaluation reserve lines on the balance sheet to account for value fluctuations in long-term assets.

- Revaluation reserves are used when an asset’s market value greatly fluctuates or is volatile due to currency relationships.

- Revaluation reserves have an offsetting expense that is debited or credited depending on the change from revaluation.

Understanding Revaluation Reserve

Companies have the flexibility to create reserves on the balance sheet when necessary for proper accounting presentation. Reserves can be used for various reasons, including asset revaluation. Like other reserve line items, the revaluation reserve either increases or decreases the total value of balance sheet assets.

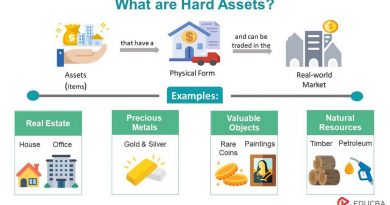

Revaluation reserves are used when the value of certain assets is expected to fluctuate beyond established schedules. The standard procedure for identifying the carrying value of assets on the balance sheet involves marking assets down on a scheduled basis, usually based on a depreciation schedule.

In general, revaluation reserves increase or decrease the carrying value of the asset based on estimates of its fair value.

Companies may establish a revaluation reserve if they believe an asset’s carrying value needs closer monitoring and assessment due to market situations, such as increasing real estate value or fluctuating foreign assets due to currency changes. A company can add to or subtract from the revaluation reserve throughout the year without waiting for monthly or quarterly adjustments. This line item helps maintain accurate value.

Companies may use reserve lines instead of or in association with write-downs or impairments. Write-downs and impairments are usually one-time expense charges due to an unexpected decrease in the value of a long-term asset.

Recording Revaluation Reserves

The revaluation reserve refers to the specific adjustment required when an asset’s revaluation takes place. In most cases, the reserve line either increases a liability or reduces the value of an asset. When an entry to a reserve account is made, an offsetting entry must be made to an expense account, which will show up on the income statement.

If the asset decreases in value, the revaluation reserve is credited on the balance sheet to decrease the carrying value of the asset, and the expense is debited to increase total revaluation expense. If the asset increases in value, the offsetting reserve expense would be decreased through credit, and the revaluation reserve on the balance sheet would be increased through a debit.

Book Value vs. Fair Value

The carrying value of assets for most companies is the book value, after deducting accumulated depreciation. The carrying value may be adjusted to fair value after the depreciation period ends. The decision to record an asset’s carrying value at book value rather than fair value is often made for long-term assets. Shorter-term assets are usually more liquid and can easily be carried on the balance sheet at their fair market value.

The carrying value of assets for most companies is the book value, after deducting accumulated depreciation. The carrying value may be adjusted to fair value after the depreciation period ends. The decision to record an asset’s carrying value at book value rather than fair value is often made for long-term assets. Shorter-term assets are usually more liquid and can easily be carried on the balance sheet at their fair market value.