Undercapitalization Definition Causes and Examples

Contents

Undercapitalization: Definition, Causes, and Examples

What Is Undercapitalization?

Undercapitalization occurs when a company does not have sufficient capital to conduct normal business operations and pay creditors. This can happen when the company is not generating enough cash flow or is unable to access financing through debt or equity.

Undercapitalized companies also tend to choose high-cost sources of capital, such as short-term credit, instead of lower-cost options like equity or long-term debt. Investors should be cautious when dealing with undercapitalized companies because the risk of bankruptcy increases when a company can’t service its debts.

How Undercapitalization Works

Undercapitalization is most commonly found in young companies that fail to anticipate the initial costs associated with starting a business. Being undercapitalized can impede growth, as the company may lack the resources for expansion, eventually leading to failure. Large companies can also become undercapitalized when they accumulate significant debt and face unfavorable operating conditions.

Key Takeaways

- Undercapitalized companies cannot pay creditors and often need to borrow more money.

- Youthful companies that underestimate initial costs are sometimes undercapitalized.

- Entrepreneurs starting a business should assess their financial needs, expenses, and err on the side of caution.

- If a company fails to generate capital over time, the risk of bankruptcy increases as it loses the ability to service its debts.

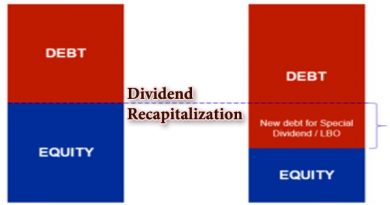

If undercapitalization is recognized early, and if a company has positive cash flows, it can replenish its funds by selling shares, issuing debt, or obtaining long-term credit arrangements. However, if a company fails to produce net positive cash flow or access financing, it is likely to go bankrupt.

Undercapitalization can have various causes, such as:

- Poor macroeconomic conditions that make fundraising difficult during critical times.

- Failure to secure a line of credit.

- Funding growth with short-term capital instead of permanent capital.

- Poor risk management, including lack of insurance coverage or insufficient coverage against predictable business risks.

Examples of Undercapitalization in Small Business

When starting a business, entrepreneurs should assess their financial needs and expenses, erring on the side of caution. Common expenses for a new business include rent, utilities, salaries or wages, equipment, licenses, inventory, advertising, and insurance, among others. Startup costs can present a significant hurdle, making undercapitalization a common issue for young companies.

Therefore, small business startups should create a monthly cash flow projection for their first year of operation, balancing it with projected costs. By combining equity contributions from the entrepreneur and funds raised from outside investors, the business should achieve sufficient capitalization.

In some cases, undercapitalization can expose entrepreneurs to liability for business-related matters. This risk increases when corporate and personal assets are mixed, when the corporation’s owners defraud creditors, or when adequate records are not maintained.