Mortgage Credit Certificates What They are How They Work

Contents

Mortgage Credit Certificates: What They Are and How They Work

What Are Mortgage Credit Certificates?

In North America, a mortgage credit certificate (MCC) is a document provided by the originating mortgage lender to the borrower that converts a portion of the mortgage interest into a non-refundable tax credit. Low-income homebuyers can use an MCC program to purchase a home. MCCs can be issued by loan brokers or lenders, but they are not a loan product.

How Mortgage Credit Certificates Work

Mortgage credit certificates help first-time homebuyers qualify for a home loan by reducing their tax liabilities. Eligible borrowers can receive a dollar-for-dollar tax credit for a portion of the mortgage interest paid each year.

Key Takeaways

- Qualified borrowers with limited incomes can use an MCC to make buying a home more affordable.

- Borrowers must meet specific guidelines, including income limits, to qualify.

- MCC programs may vary by state and are most often beneficial to first-time homebuyers, although other buyers shouldn’t rule out qualifying for them.

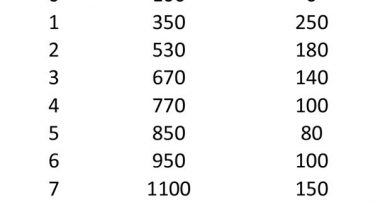

Borrowers can receive a maximum tax credit of $2,000 each year. The credit amount is calculated using a formula that considers the mortgage amount, interest rate, and the MCC percentage. The credit rate depends on the original mortgage loan amount.

Special Considerations

Borrowers apply for MCCs with the originating lender after signing the purchase contract and before closing. There is a non-refundable fee for this service. The approved certificate is transferable to another property if the current loan doesn’t close and is valid for up to 120 days. MCC programs have income and purchase price criteria that homebuyers must meet.

Non-first-time homebuyers may still qualify for an MCC if they purchase a property in an economically distressed area.

The mortgage credit certificate reduces the buyer’s federal tax liability, helping subsidize a portion of the monthly mortgage payment and potentially assisting in loan approval. The certificate can be used annually as long as the borrower pays interest on the loan, resides in the home, and continues to use it as their principal residence. In most cases, it can be reissued if the loan is refinanced.