Unscheduled Property Floater

Cierra Murry is an experienced banking consultant, loan signing agent, and arbitrator specializing in banking, credit cards, investing, loans, mortgages, and real estate. With over 15 years of experience in financial analysis, underwriting, loan documentation, loan review, banking compliance, and credit risk management, she is a trusted expert.

Ariel Courage is a former fact-checker and an experienced editor and researcher. She has provided editing and fact-checking services to prominent finance publications including The Motley Fool and Passport to Wall Street.

What Is an Unscheduled Property Floater?

Having adequate property insurance coverage is crucial. One way to ensure sufficient coverage is through an unscheduled property floater. This addition to an existing property insurance policy provides coverage for personal property items without individual itemization or valuation.

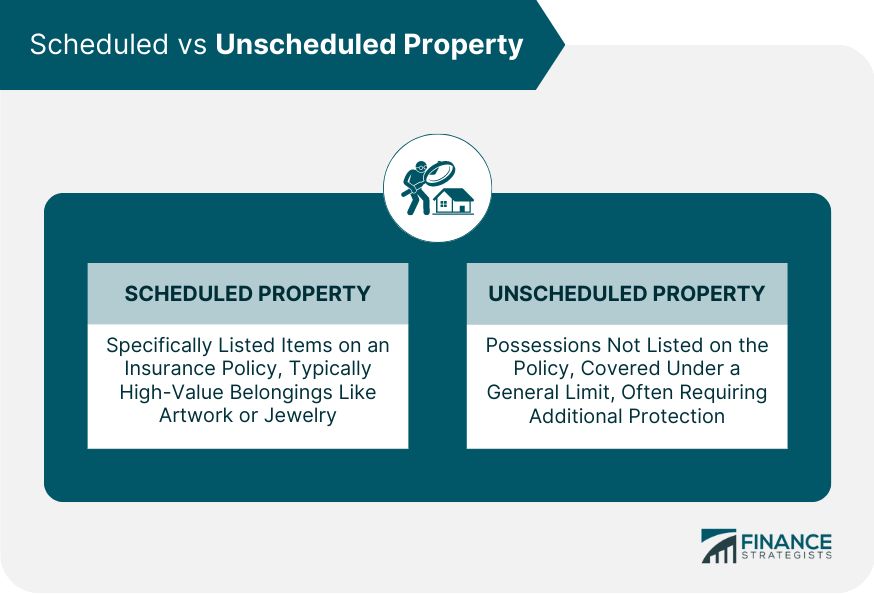

An unscheduled personal property floater, also known as a "blanket" floater, covers damage, theft, or loss of these items. It is cost-effective compared to the original policy premium. In contrast, a scheduled property floater specifies all properties covered in the policy and their respective value.

Key Takeaways:

– An unscheduled property floater covers a group of items without individual valuation or listing.

– It has a predetermined coverage limit and deductible.

– While the floater’s cost is lower than the original premium, it increases the overall premium payment.

– It is the opposite of a scheduled property floater that itemizes different properties and their value.

– Examples of items covered by an unscheduled property floater for homeowners insurance include clothes, jewelry, high-end electronics, and sports equipment.

Understanding an Unscheduled Property Floater

Unscheduled personal property refers to items covered in the main policy but not individually itemized or valued. These items typically don’t require separate insurance due to their low individual value.

Under homeowners insurance, unscheduled property can include clothes, jewelry, sports equipment, and cameras. In the event of a covered loss like a fire, the policyholder would calculate the total value of these unscheduled items for compensation. Even if these items were damaged, lost, or stolen outside the home (e.g., while on vacation), they would still be covered depending on the policy.

"Floater" refers to an additional policy to ensure coverage for specific valuables. People purchase these add-on policies to cover property that may not be adequately covered by general insurance policies, sometimes including extra benefits. Adding a floater typically increases the insurance premium.

Unscheduled Property Floater vs. Scheduled Property Floater

Floater policies can also be scheduled, unlike unscheduled ones. Scheduled policies individually list each item with an estimated value. Unscheduled jewelry coverage, for instance, may not sufficiently compensate for the loss of expensive pieces, necessitating a separate scheduled jewelry floater.

Scheduled floaters allow policyholders to cover personal property exceeding the coverage limit specified in the unscheduled property floater contract.

Under an unscheduled property floater, payment for an item is typically its replacement cost or its cash value after the deductible is paid.

Unscheduled property floaters are advantageous when there are numerous items to insure, each valued at approximately $1,000 or less. Such policies have a set deductible and coverage ceiling for all items. Conversely, scheduled property floaters are suitable for fewer, more valuable items that can be listed separately in the policy.

Unscheduled floaters may be limited to specific losses like theft or fire. They provide a predetermined amount of coverage for any item within the policy’s scope. Scheduled floaters may cover more loss types but only for explicitly listed items.

It is possible to have both scheduled and unscheduled policy floaters in the same policy. Some policies even require one or more scheduled items to qualify for unscheduled coverage.