Micro Risk What it Means and how it Works

Contents

Micro Risk: Understanding Its Meaning and Impact

Ariel Courage is an experienced editor, researcher, and former fact-checker who has contributed to leading finance publications, including The Motley Fool and Passport to Wall Street.

What Is Micro Risk?

Micro risk refers to firm-specific political risks that can negatively affect the operations of international companies in a foreign country. These risks can arise from events that are within or beyond the control of the local government. They pose challenges to generating revenue for companies in countries outside their own. Before entering a foreign market, companies often conduct risk analyses to identify possible political risks they may face.

Key Takeaways

- Micro risks are specific to individual companies doing business outside their home country.

- These risks result from political, economic, governmental, or societal events in the host country.

- Micro risks impact a company’s revenue generation and an investor’s profit potential.

- Macro risk, unlike micro risk, affects all businesses or industries in a geographic region or country.

- International companies face various risks, including political and civil unrest, war and terrorism, exchange rate fluctuations, and changes in government regulations and taxation.

Understanding Micro Risk

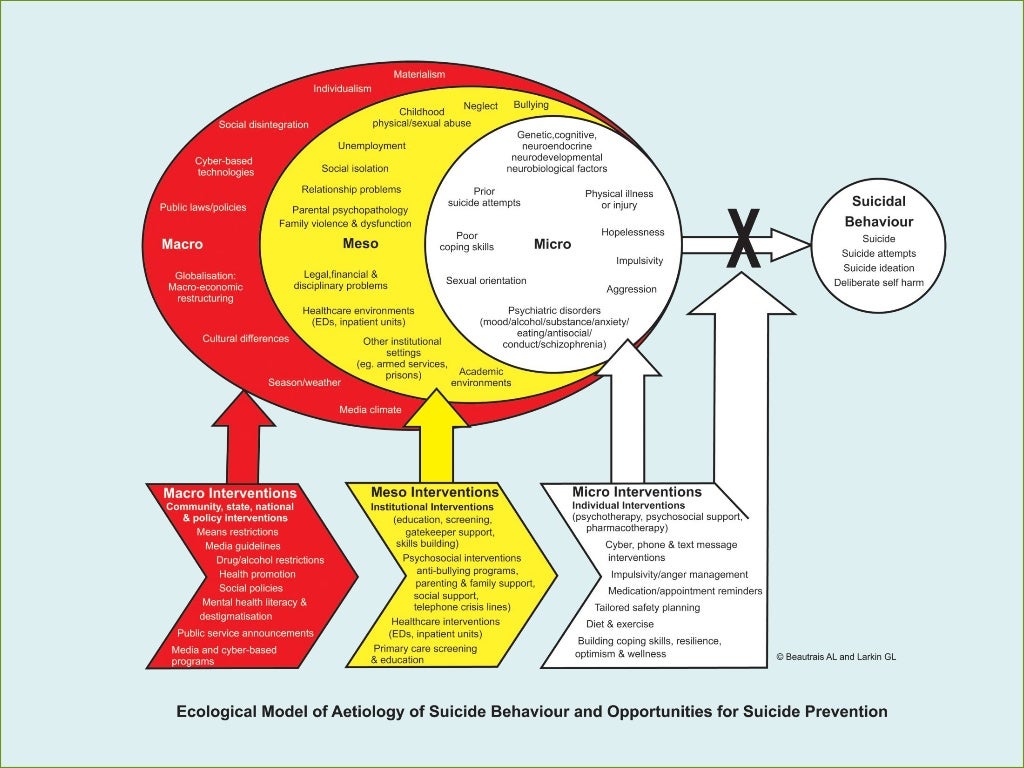

Micro risks are firm-specific political risks that impact businesses operating outside their home country. They are not applicable to all companies or industries in a foreign market, but only to specific firms. Micro risks can also affect individual projects undertaken by a company in a foreign country. These risks arise from political, economic, governmental, or societal changes or events in the host country.

For instance, if Company A establishes a manufacturing facility in a foreign country to benefit from lower labor costs, and the workers at that facility go on strike for better wages and benefits, Company A may experience reduced revenue due to the strike. In this case, only Company A is affected, while operations of other companies remain unaffected.

Micro Risk vs. Macro Risk

Macro political risk differs from micro risk as it affects all businesses or industries in a geographic region or country, rather than being specific to a particular firm. Macro risks arise from changes in government leadership, political and civil unrest, shifts in monetary policy, and changes in government regulations and taxation.

For example, if a country’s government introduces new environmental regulations imposing additional fees and taxes on all factories to discourage pollution, it represents a macro risk. These regulations require all factories in the industrial sector to redesign their facilities, affecting multiple companies operating in that sector.

Political Risk

Political risk refers to the potential impact on investment returns due to political changes or instability in a country. This instability can arise from changes in government, legislative bodies, foreign policymakers, or military control. Political risk is also known as "geopolitical risk" and becomes more significant over longer investment horizons.

Multinational corporations (MNCs), also known as companies operating internationally, can purchase political risk insurance to mitigate or eliminate certain political risks. This allows management and investors to focus on business fundamentals while avoiding or minimizing losses from political risks. Insurance coverage typically includes protection against war and terrorism.

Country Risk

A related concept is country risk, which encompasses various risks associated with investing in a specific country. Country risk differs from one country to another and may include political risk, exchange rate risk, economic risk, and transfer risk. Specifically, country risk refers to the risk of a foreign government defaulting on its financial commitments. It also reflects how political and economic unrest affects securities issued by companies operating in that country.

Considering country risk is crucial when investing internationally. Political instability and other factors can cause significant turmoil in financial markets and reduce the expected ROI of securities. Most multinational companies face these risks and opt for insurance coverage to mitigate them to some extent.

While some country risks, such as exchange rate risk, can be hedged, others, like political instability, do not have effective hedging options.

Special Considerations

Companies disclose the micro and macro risks they face in their filings with the Securities and Exchange Commission (SEC). For instance, in Apple Inc.’s 2019 Form 10-K filing, the company outlines various risks affecting its financial performance. Apple states that a majority of its supply chain, manufacturing, and assembly activities are located outside the United States. Therefore, its performance and operations are significantly dependent on global and regional economic and political factors. The company faces ongoing risks, both micro and macro, in foreign countries that could disrupt its manufacturing capabilities.

Overall, understanding micro risk, macro risk, and related concepts like political risk and country risk is crucial for businesses and investors operating in international markets.