Fund Overlap What it Means in Investment Strategy

Contents

Fund Overlap and its Impact on Investment Strategy

What is Fund Overlap?

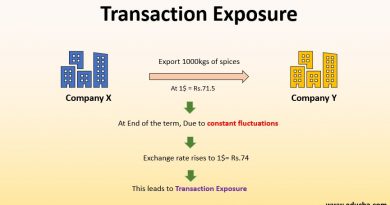

Fund overlap refers to the situation where an investor owns shares in multiple mutual funds or exchange traded funds (ETFs) that have overlapping positions. For example, if an investor owns both an S&P 500 index mutual fund and a technology sector ETF, there would be significant overlap with the FAANG stocks (Meta, formerly known as Facebook, Apple, Amazon, Netflix, and Google), as these stocks are major components of both funds’ portfolios. This concentration in a small number of companies’ shares can pose potential risks.

Fund overlap undermines the benefits of diversification and may introduce unseen risks for investors.

Key Takeaways

- Fund overlap occurs when an investor holds multiple mutual funds or ETFs that invest in the same or similar securities.

- It can reduce portfolio diversification and create concentrated positions without the investor’s awareness.

- To mitigate overlap, investors should identify the securities held by each fund before making investment decisions.

Understanding Fund Overlap

While some overlap is expected, extreme cases of fund overlap can expose investors to unexpectedly high levels of company or sector risk, which can distort portfolio returns in comparison to relevant benchmarks.

Maintaining awareness of individual fund holdings can be challenging for retail investors. However, conducting periodic checks, such as quarterly or annual reviews, can help investors understand each fund’s strategy and enable comparisons of top holdings.

For instance, if two separate mutual funds both overweight the same stock, it may be beneficial to replace one with a similar fund that doesn’t have that stock as a major holding. When two funds have an overweight position in a specific sector, such as technology relative to the S&P 500, investors should carefully consider the benefits and risks associated with increased exposure.

Overweighting Sectors

Overweighting occurs when an investment portfolio holds an excess amount of a specific security compared to its weight in the benchmark portfolio.

Portfolio managers overweight securities to potentially achieve higher returns. It can also reflect an investment analyst’s belief that the security will outperform its industry, sector, or the overall market.

Securities are typically overweighted when the portfolio manager expects them to outperform others in the portfolio. For example, a security normally weighted at 15% might be increased to 25% to enhance portfolio returns. Overweighting can also serve as a hedge or risk reduction strategy.

Alternatively, the recommendations for weighting are equal weight or underweight. Equal weight implies performance in line with the index, while underweight suggests lagging behind the index in question.

Fund Overlap and Diversification

Fund managers and investors commonly diversify their investments across various asset classes. They determine the percentages to allocate to each, encompassing stocks, bonds, real estate, ETFs, commodities, short-term investments, and alternative asset classes. Within these asset classes, they diversify further by selecting stocks with low return correlation in different sectors or with different market capitalizations.

In the case of bonds, investors choose among investment-grade corporate bonds, U.S. Treasuries, state and municipal bonds, high-yield bonds, and other fixed income securities.

Fund overlap should be carefully managed to ensure effective portfolio diversification and minimize concentrated positions. Regular review and consideration of fund holdings are essential for successful investment strategies.