Full Faith and Credit What it is How it Works

Contents

Full Faith and Credit: Understanding the Commitment

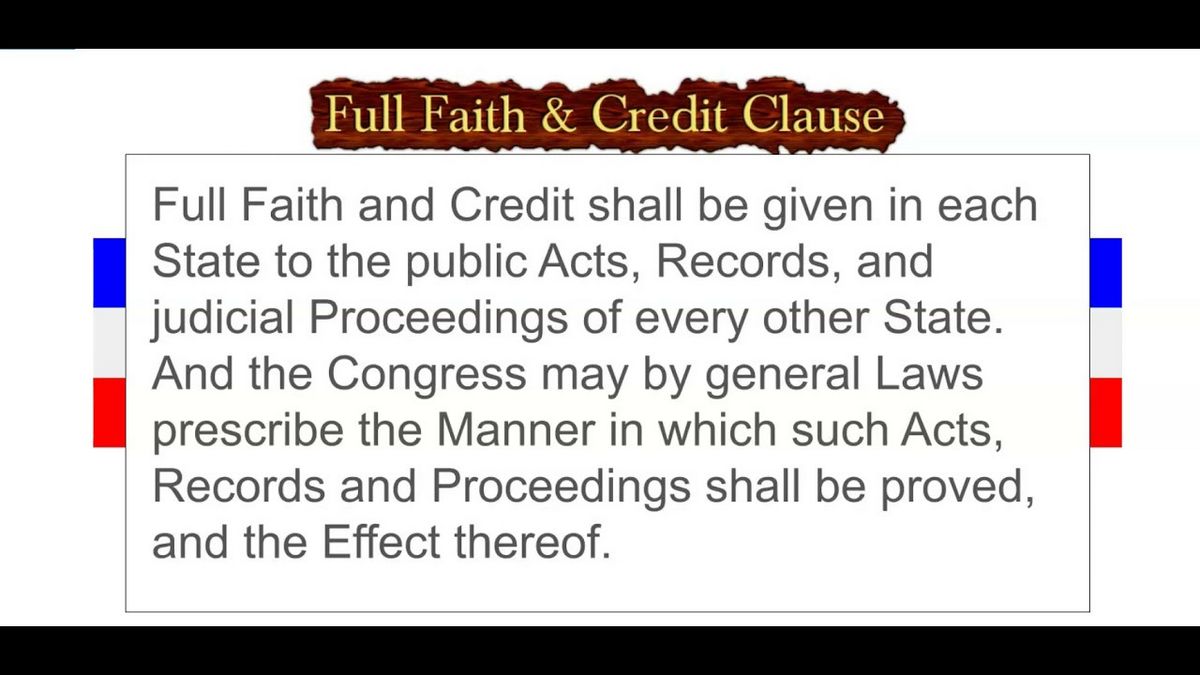

What Is Full Faith and Credit?

Full faith and credit describes one entity’s unconditional guarantee to support another entity’s debt. This commitment is commonly used by a government to lower borrowing costs for less stable governments or government-sponsored agencies.

Key Takeaways

- Full faith and credit is an unsecured method of backing debt based on trust and reputation.

- Governments issue bonds backed only by their ability to collect future revenue.

- These bonds are considered low-risk due to a government’s unlimited revenue collection capacity.

- The Government National Mortgage Association (Ginnie Mae) is an example of an agency backed by the full faith and credit of the U.S. government.

Understanding Full Faith and Credit

Full faith and credit refers to a government’s borrowing power and its commitment to meet payment obligations on time. The U.S. Treasury borrows money from the public by issuing bills, notes, and bonds to fund government projects.

These securities require periodic interest payments and full repayment of the face value at maturity. To attract investors, the Treasury backs these securities with the full faith and credit of the government, assuring fixed income investors that expected payments will be made regardless of the economic situation.

As Treasury securities have the government’s full faith and credit, they are considered risk-free. The government cannot default on its obligations as it can generate revenue through money printing or increased taxes. Additionally, the interest rate on these securities acts as the benchmark for other fixed income securities with varying levels of risk.

Risk-averse investors prefer securities backed by the government’s full faith and credit due to their lower yield and higher capital preservation.

Government Debts

Smaller government entities, like municipalities, may also issue debt backed by their full faith and credit. These general obligation (GO) municipal bonds are payable from the municipality’s general funds and can be supported by the unlimited authority to tax residents.

Occasionally, the federal government may provide additional backing for municipal obligations through its full faith and credit. For example, during the credit crisis in 2009, the U.S. Treasury subsidized interest payments on municipal bonds through the Build America Bonds (BABs) program.

The federal government can also back debt obligations of government-sponsored agencies with its full faith and credit. This means the agency assumes the credit quality of the U.S. government. Ginnie Mae is an example of such an agency, offering mortgage-backed securities with lower yields due to the federal government’s backing.