U S Debt Ceiling Definition History Pros Cons and Clashes

Contents

- 1 U.S. Debt Ceiling: Definition, History, Pros, Cons, and Clashes

- 1.1 What Is the Debt Ceiling?

- 1.2 Understanding the Debt Ceiling

- 1.3 Advantages and Disadvantages of the Debt Ceiling

- 1.4 Debt Ceiling Showdowns and Shutdowns

- 1.5 Debt Ceiling During the Obama and Trump Administrations

- 1.6 Ex-House Speaker McCarthy’s Effect on the Debt Ceiling

- 1.7 What Happens if the U.S. Defaults on Its Debts?

- 1.8 What Is the Current Debt Ceiling?

- 1.9 How Many Times Has the Debt Ceiling Been Raised?

- 1.10 What Happens if the Debt Gets Too High?

- 1.11 Is There a Limit to the National Debt?

- 1.12 The Bottom Line

U.S. Debt Ceiling: Definition, History, Pros, Cons, and Clashes

Tim Smith has over 20 years of experience in the financial services industry, as both a writer and a trader.

What Is the Debt Ceiling?

The debt ceiling—also known as the debt limit—is the maximum amount that the United States can borrow cumulatively to meet its legal obligations. It was created under the Second Liberty Bond Act of 1917.

If U.S. government national debt levels reach the ceiling, the Treasury Department must resort to other measures to pay government obligations and expenditures until the ceiling is raised again.

The debt ceiling has been raised or suspended multiple times over the years to avoid a U.S. government default on its debt.

Key Takeaways

- The debt ceiling is the maximum amount that the U.S. government can borrow to meet its legal obligations.

- If the Treasury Department can’t pay expenses when the debt ceiling is reached, there is a risk of a U.S. default on its debt.

- The debt ceiling has been raised or suspended several times to avoid default.

- There have been many showdowns over the debt ceiling, some of which have led to government shutdowns.

- Shutdowns result from conflict between the White House and Congress, with the debt ceiling used as leverage to push budgetary agendas.

Understanding the Debt Ceiling

Congress had control over the country’s finances before the debt ceiling was created. In 1917, the debt ceiling was created during World War I to ensure fiscal responsibility.

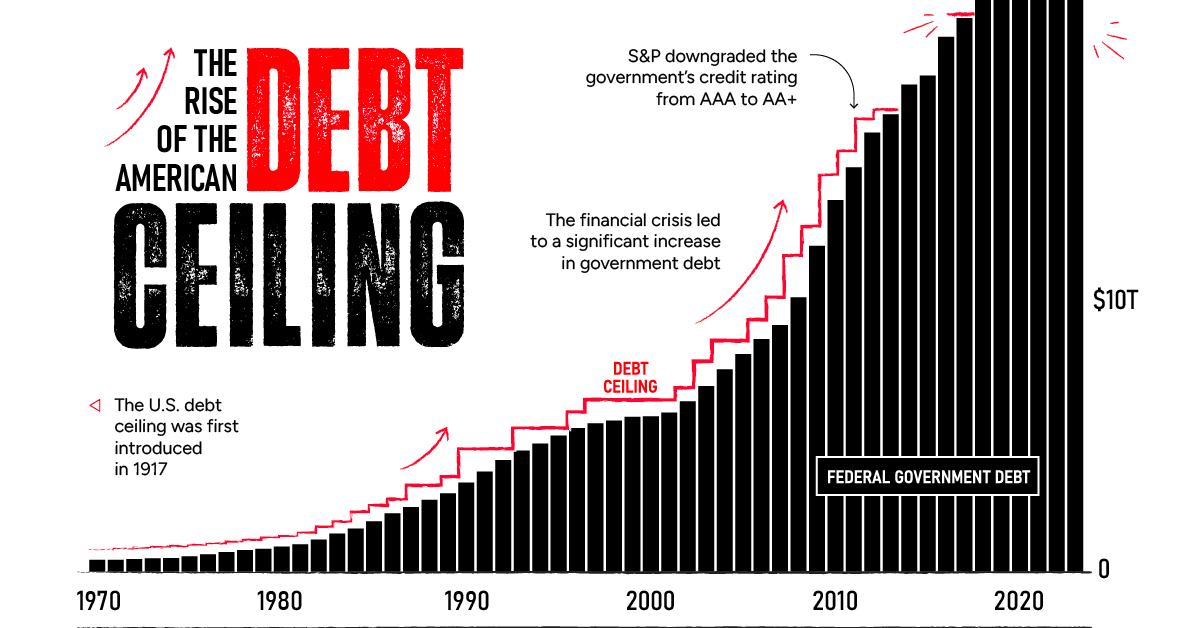

Over time, the debt ceiling has been raised whenever the United States approaches the limit. By hitting the limit and failing to pay interest payments to bondholders, the United States would be in default, lowering its credit rating and increasing the cost of its debt.

Controversy exists over the constitutionality of the debt ceiling. According to the 14th Amendment of the Constitution, “The validity of the public debt of the United States, authorized by law, shall not be questioned.” The majority of democratic countries do not have a debt ceiling, making the United States one of the few exceptions.

$34.39 trillion

Advantages and Disadvantages of the Debt Ceiling

Advantages

A debt ceiling is believed to be practical as it keeps the nation’s finances in check. It allows the U.S. Treasury to issue bonds without needing Congress’s approval each time the government needs to raise money, streamlining the monetary approval process.

Raising the debt ceiling allows the country additional flexibility to fund federal operations and important social programs like Social Security and Medicare.

Disadvantages

The debt ceiling can easily be raised, raising questions about its effectiveness in ensuring fiscal responsibility. The U.S. has accumulated record-high levels of debt over time.

Increasing the debt ceiling can lead to a downgrade of the U.S. credit rating, increasing the overall cost of its debt.

Some argue that the debt ceiling is unconstitutional and that it puts pressure on the country’s ability to meet financial obligations.

- Holds the nation’s finances in check

- Can be used to fund federal operations

- Improves efficiency in funding obligations including Social Security and Medicare benefits

- Can be easily raised, encouraging fiscal irresponsibility

- Lowers the U.S. credit rating and increases its cost of debt

- Controversy over the constitutionality of the debt ceiling

Debt Ceiling Showdowns and Shutdowns

There have been many showdowns over the debt ceiling, some of which have led to government shutdowns. The conflict usually arises between the White House and Congress, with the debt ceiling used as leverage to push budgetary agendas.

In 1995, Republican members of Congress, led by then-House Speaker Newt Gingrich, used the threat of refusing to allow an increase in the debt ceiling to negotiate increased government spending cuts.

Then-President Bill Clinton refused to make the cuts, resulting in a government shutdown. Eventually, the White House and Congress agreed on a balanced budget with modest spending cuts and tax increases.

In August 2023, Fitch Ratings downgraded the United States’ credit ratings from AAA to AA+ due to the country’s rising national debt and potential financial deterioration.

Debt Ceiling During the Obama and Trump Administrations

President Barack Obama faced similar issues during his two terms. In the 2011 debt ceiling crisis, Republicans in Congress demanded deficit reductions to approve an increase in the debt ceiling. The U.S. Treasury debt lost its AAA rating by Standard & Poor’s for the first time in more than 70 years.

In 2013, the government shut down for 16 days after conservative Republicans attempted to defund the Affordable Care Act (ACA) by leveraging the debt ceiling. An agreement to suspend the debt limit was passed within a day, as the Treasury was estimated to run out of money.

The debt ceiling was raised again in 2014, 2015, and early 2017. In September 2017, U.S. government debt exceeded $20 trillion for the first time. In December 2017, then-President Donald Trump signed a bill extending the debt ceiling to December 8, 2017. The ceiling was later suspended for 13 months as part of a bill enacted in February 2018. In March 2019, the ceiling came into effect and was increased again when U.S government debt topped $22 trillion.

Suspending the ceiling eliminated the risk of default for another two years, increasing spending to $320 billion for the 2020 and 2021 fiscal years. In December 2021, the debt ceiling was raised to $31.4 trillion.

Ex-House Speaker McCarthy’s Effect on the Debt Ceiling

In early 2023, some economists and Wall Street analysts predicted that the election of Californian Republican Kevin McCarthy as House Speaker increased the possibility of lawmakers voting against raising the debt ceiling, potentially leading to a U.S. default on its debts.

Yellen’s Warning to Congress

“Failure to meet the government’s obligations would cause irreparable harm to the U.S. economy, the livelihoods of all Americans, and global financial stability,” she wrote. “I respectfully urge Congress to act promptly to protect the full faith and credit of the United States.”

Debt Default Averted

Despite the ongoing political brinkmanship, most debt ceiling showdowns end with a last-minute compromise and spending cuts. President Biden successfully made deals with Republicans in 2021 to pass critical legislation, including the $1.2 trillion infrastructure package.

In 2023, a newly elected Republican House majority indicated that it would leverage the debt ceiling for deep spending cuts. In January 2023, insights and market perspectives site AGF projected a 60% chance of Congress striking an 11th-hour deal to avoid a default, indicating the likelihood of macroeconomic uncertainty ahead.

The crisis was ultimately resolved in yet another last-minute agreement that suspended the debt limit until 2025, along with a cap on federal spending and restrictions on some poverty assistance programs. The deal was rushed through the House and Senate by June 1.

What Happens if the U.S. Defaults on Its Debts?

A default on government debt would send shockwaves through global financial markets as confidence in U.S. borrowers falls. According to credit analysis firm Moody’s Analytics, a four-month default would:

- Shave around 4% from U.S. gross domestic product (GDP)

- See stock prices fall by a third

- Result in companies slashing nearly six million jobs

Moody’s analysis also reveals that a default on U.S. Treasury bonds could lead to a downturn similar to the Great Recession.

A breakdown in trust in the U.S. Treasury or a credit freeze would likely cause sharp falls in the greenback and an exodus of U.S. investments by foreign investors. Even the possibility of default has the potential to unnerve financial markets.

In 2011, then-President Obama and House Republicans narrowly avoided reaching the debt ceiling, a crisis that saw stock prices plunge and volatility soar, prompting credit agency S&P Global Ratings to downgrade the U.S. credit rating for the first time. The crisis also dented consumer confidence and small business optimism.

Moreover, a U.S. debt default would hinder the government from carrying out critical functions, such as issuing Social Security benefits, maintaining national defense, and adequately funding the public health system.

What Is the Current Debt Ceiling?

The debt ceiling was raised to $31.4 trillion under President Joe Biden in 2021. Although spending officially reached that limit in January 2023, Congress suspended the debt ceiling until 2025.

How Many Times Has the Debt Ceiling Been Raised?

According to the U.S. Department of the Treasury, the debt ceiling has been raised, extended, or revised 78 times since 1960. This occurred 49 times under Republican presidents and 29 times under Democratic presidents.

What Happens if the Debt Gets Too High?

Hitting the debt limit and failing to pay interest payments to bondholders would have severe economic consequences. The U.S. government would be in default, lowering its credit rating and increasing the cost of its debt, plunging the U.S. economy into turmoil.

Is There a Limit to the National Debt?

The Bottom Line

The debt ceiling was created during World War I to regulate U.S. government spending and to ensure fiscal responsibility. Since then, it has been raised or revised 78 times to avoid default and keep the U.S. economy running. Despite questions about its effectiveness, there are no signs of Congress turning to other options.