Mental Accounting Definition Avoiding Bias and Example

Mental Accounting: Definition, Avoiding Bias, and Example

What Is Mental Accounting?

Mental accounting refers to the different values a person places on money, based on subjective criteria. It is a concept in behavioral economics developed by economist Richard H. Thaler. Individuals classify funds differently, leading to irrational decision-making in their spending and investment behavior.

Key Takeaways

– Mental accounting, introduced by Nobel Prize-winning economist Richard Thaler, refers to different values people place on money based on subjective criteria.

– It often leads to irrational investment decisions and financially detrimental behavior, such as funding low-interest savings accounts while carrying large credit card balances.

– To avoid the mental-accounting bias, individuals should treat money as completely interchangeable across different accounts, whether for everyday living expenses, discretionary spending, or savings and investments.

Understanding Mental Accounting

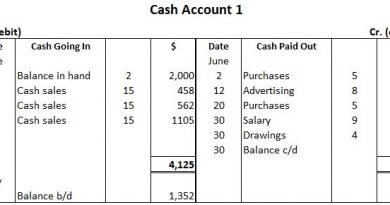

In his 1999 paper "Mental Accounting Matters," Richard Thaler defined mental accounting as “the set of cognitive operations used by individuals and households to organize, evaluate, and keep track of financial activities."

Underlying this theory is the concept of the fungibility of money, meaning that regardless of its origins or intended use, all money is the same.

To avoid the mental-accounting bias, individuals should treat money as perfectly fungible when allocating it among different accounts, whether for everyday expenses, discretionary spending, or savings and investments. They should value a dollar the same, regardless of how it was earned or received.

Thaler observed that people often violate the fungibility principle, especially when they receive a windfall, such as a tax refund. Treating the refund as "found money" leads to discretionary spending. However, the money rightfully belongs to the individual, and it should be viewed as regular income.

To avoid the bias, people should value every dollar they receive equally and avoid considering tax refunds as windfalls.

Example of Mental Accounting

The mental-accounting line of thinking seems logical but is, in fact, illogical. Some people keep a special "money jar" for a vacation or a new home while also carrying substantial credit card debt. They treat the money in the special fund differently from the money used to pay down debt, even though diverting funds from debt payments increases interest payments and reduces net worth.

It is illogical to maintain a low-interest savings jar while simultaneously holding high-interest credit card debt. In many cases, the interest on the debt erodes any interest earned in a savings account. The best move is to use the saved funds to pay off the expensive debt.

The solution seems straightforward, but many people do not behave rationally due to the personal value they place on specific assets. They consider money saved for important goals too precious to use for debt repayment, even if doing so would be logical and beneficial.

Professor Thaler made a cameo appearance in the movie "The Big Short" to explain the "hot hand fallacy" during the housing bubble.

Mental Accounting in Investing

Investors also experience mental-accounting bias. Some divide their assets between safe portfolios and speculative ones to prevent negative returns from impacting the total portfolio. However, the net wealth remains the same, regardless of portfolio separation.

An investor may own two stocks, one with a gain and the other with a loss, and needs to raise cash by selling one of them. Mental accounting is biased toward selling the winner, although selling the loser would likely be the rational decision. This bias arises from loss aversion, as investors avoid the pain of realizing a loss.

Why Do We Do Mental Accounting?

People have a natural tendency to treat money differently based on factors such as origin and intended use. However, this way of thinking becomes less sensible upon analysis and is detrimental to our finances.

Is Mental Accounting a Behavioral Bias?

Yes, mental accounting is a behavioral bias. It results in illogical ways of viewing and managing money.

How Can Mental Accounting be Prevented?

To avoid succumbing to mental accounting, treat money as interchangeable and avoid labeling it. Don’t consider certain money less important because of its source. Also, don’t leave money in a low-interest account when there are higher-cost debts to repay.

The Bottom Line

Many of us, including seasoned investors, fall into the trap of mental accounting. Assigning subjective value to money based on its origin and intended use can work against us and leave us economically worse off.