What Are Fungible Goods Meaning Examples and How to Trade

Contents

Fungible Goods: Meaning, Examples, and Trading

What Are Fungible Goods?

Fungible goods are securities or items that are interchangeable because they are equivalent or consist of many identical parts. Material items, securities, and financial instruments can be considered fungible goods. Goods sold by weight or number are probably not fungible.

Key Takeaways

- Fungible goods are interchangeable because they are identical to each other.

- Examples of fungible goods include commodities, common shares, options, and dollar bills.

- Diamonds, land, and baseball cards are not fungible because each unit has unique qualities.

Understanding Fungible Goods

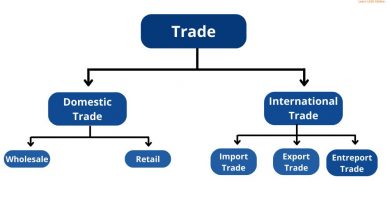

In finance and investing, commodities, common shares, options, and dollar bills are examples of fungible goods. The term "fungible" is not identical to barter or liquidity. Bartered goods can have different or incomparable value. Liquid goods are easily exchangeable for money or another good, but not all fungible goods are liquid.

Commodities must be fungible to be traded on a commodities exchange. For example, No. 2 yellow corn is fungible because it is the same product regardless of its origin. All No. 2 yellow corn is valued equally.

Stocks are fungible goods, regardless of previous ownership. Cross-listed stocks are also fungible goods, regardless of where they are purchased.

Options are fungible goods, allowing for closing out positions by taking offsetting positions. Buying a call option with the same underlying asset, expiration date, and strike price as a sold call option is known as buying to close.

Fungible goods are not necessarily liquid.

Non-Fungible Goods

Diamonds, land, and baseball cards are not fungible because each unit is unique, with qualities that affect its value. Real estate, even if identical, has varying characteristics that make it non-fungible.

Fungibles and Enumeration

Assigning unique numbers to fungibles, such as gold bars, and distinguishing them can make them no longer fungible in certain cases.

Gold is naturally fungible, but when bars are given unique serial numbers and allocated to specific investors, they are no longer considered fungible goods. Allocated gold provides better legal protections in bankruptcy.

Gold is naturally fungible, but when bars are given unique serial numbers and allocated to specific investors, they are no longer considered fungible goods. Allocated gold provides better legal protections in bankruptcy.