Understanding Callable Preferred Stock Its Benefits

Understanding Callable Preferred Stock & Its Benefits

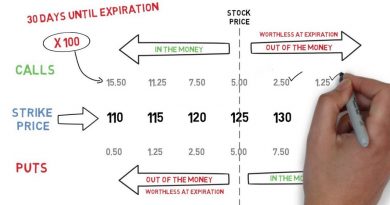

Callable preferred stock is a type of preferred stock that the issuer has the right to call in or redeem at a pre-set price after a defined date. Callable preferred stock terms, such as the call price, the date after which it can be called, and the call premium (if any), are defined in the prospectus and cannot be changed later.

Key Takeaways:

– Callable preferred stock is preferred shares that may be redeemed by the issuer before the maturity date.

– Issuers use this type of preferred stock for financing purposes, as it allows them the flexibility to redeem it.

– Investors enjoy the benefits of preferred shares and usually receive a call premium to compensate for reinvestment risk if the shares are redeemed early.

Understanding Callable Preferred Stock

Callable preferred stock, also known as redeemable preferred stock, is a popular means of financing for large companies, combining elements of equity and debt financing.

Redeemable preferred shares trade on many public stock exchanges. These preferred shares are redeemed at the discretion of the issuing company, giving them the option to buy back the stock at any time after a certain set date at a price outlined in the prospectus.

This is beneficial for the company if they have issued 5% preferred shares but could now offer preferred shares at 3% because interest rates or preferred share yields have dropped. They can call in their more expensive preferred shares and issue lower dividend rate ones.

Benefits of Callable Preferred Stock

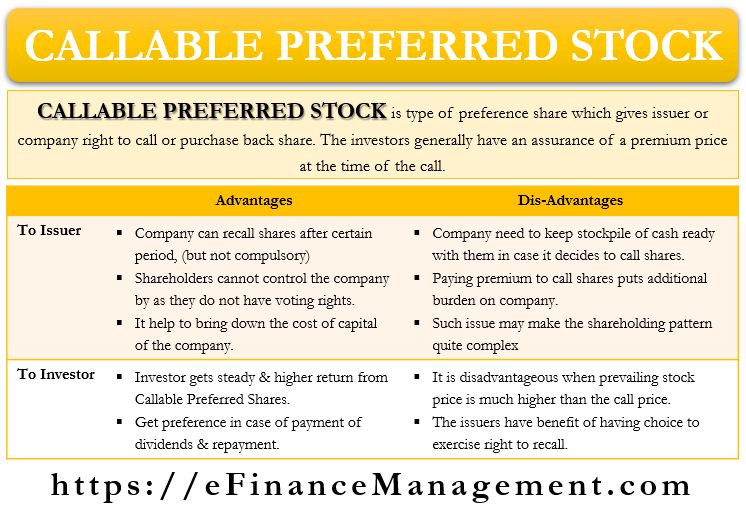

Issuer Advantages:

A callable preferred stock issue offers the flexibility to lower the issuer’s cost of capital if interest rates decline or if they can issue preferred stock later at a lower dividend rate. For example, a company that has issued callable preferred stock with a 7% dividend rate will likely redeem the issue if it can then offer new preferred shares carrying a 4% dividend rate. The proceeds from the new issue can be used to redeem the 7% shares, resulting in savings for the company.

Conversely, if interest rates rise after issuing the 7% preferred callable shares, the company will not redeem them and instead continue to pay the 7%. The company is protected from rising financing costs and market fluctuations.

Investor Advantages:

An investor owning a callable preferred stock has the benefits of a steady return. However, if the preferred issue is called by the issuer, the investor will most likely be faced with the prospect of reinvesting the proceeds at a lower dividend or interest rate.

Issuers usually pay a call premium at the redemption of the preferred issue, compensating the investor for part of this reinvestment risk. Investors assure themselves of a guaranteed rate of return if markets drop, but they give up some of the upswing potential of common shares in exchange for greater security.

Callable vs. Retractable Preferred Shares

While callable shares may be redeemed by the issuer, retractable preferred shares are a type of preferred stock that allows the owner to sell the share back to the issuer at a set price.

Sometimes, instead of cash, retractable preferred shares can be exchanged for common shares of the issuer. This may be referred to as a “soft” retraction, compared with a “hard” retraction where cash is paid out to the shareholders.