Turtle What It Means How It Works Trading System

Contents

Turtle: What It Means, How It Works, Trading System

What Is a Turtle?

Turtle is a nickname given to a group of traders who were part of a 1983 experiment run by famous commodity traders, Richard Dennis and Bill Eckhardt. Dennis named the participants turtles in reference to the farm-grown turtles that he witnessed during his travels abroad.

The goal of the experiment was to determine whether trading is an innate skill or something that can be taught. Dennis believed that, like farm-grown turtles, successful traders can be deliberately raised as such. Eckhardt, on the other hand, believed that successful training requires innate skill and cannot be taught. Their experiment was designed to settle their disagreement.

Key Takeaways

- Turtle is a nickname given to a group of traders who were part of an experiment in 1983.

- The experiment was run by Richard Dennis and Bill Eckhardt, who wanted to test if successful trading could be taught to novices.

- Dennis and Eckhardt taught the turtles a trading system that resulted in positive results among the study participants.

- Some traders continue to use their trading system, or version of it, to this day.

Understanding Turtles

In the early 1980s, Richard Dennis and Bill Eckhardt took out a large newspaper ad looking for trading apprentices in Barron’s, The Wall Street Journal, and The New York Times. Since Richard was a famous trader, the team received more than 1,000 applications. They then culled this list to produce their group of 10 turtles. These 10 participants were then invited to Chicago for two weeks of training. Once trained, they were given money and trading accounts to implement the trading strategy.

The turtles became one of the most famous experiments in financial history because they ended up generating returns in excess of an 80% compounded rate over the next four years. Dennis’s experiment seemed to demonstrate that traders could be taught a relatively simple set of rules with little or no trading experience and become excellent traders. Since then, several books and subscription services have been published offering to teach investors how to use the turtle trading system.

The turtle experiment has been criticized over the years. One area of criticism relates to the lack of clarity regarding how and why the 1,000 applicants were reduced to just 10 participants. It may be that the methodology used to select the 10 participants chose only those individuals most predisposed to diligently following rules, for example. If so, this could have caused the results of the study to be overstated because ordinary practitioners might be less capable of following the strategy than the study participants.

The Turtle Trading System

The trading system itself came to be known as the turtle trading system, and is purported to cover all the decisions required for successful trading. This includes what markets to trade in, how to determine your position size, and when to enter and exit positions.

The underlying logic behind the system is that traders should not let their own judgment cloud their decision-making. Instead, they should diligently follow the rules set out in the system.

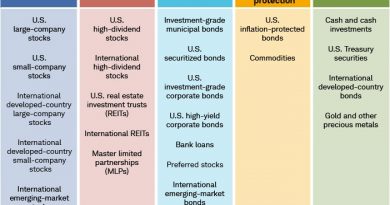

Some of the specific ideas used in the turtle trading system include the use of limit orders instead of market orders, and the use of breakouts from key moving averages as trading signals indicating when to buy and sell. The system also advocates gradually building up experience before trading with larger amounts of money.