Trading Session Find Out When Various Markets Are Open

Contents

Trading Session: Understanding Market Hours

David is an experienced writer in financial and legal research and publishing. As a Dotdash fact checker since 2020, he has validated over 1,100 articles on a wide range of financial and investment topics.

What Is a Trading Session?

A trading session matches the primary daytime trading hours for a given locale. It refers to different hours depending on the markets and locations discussed. Generally, a single day of business in the local financial market, from opening bell to closing bell, is the trading session referred to by individual investors and traders.

Forex, futures, stocks, and bonds have different characteristics that define their trading sessions for a given day. The primary trading hours naturally differ from one country to another due to time zones.

Key Takeaways

- A trading session is the primary trading hours for a given asset class.

- Regular trading in U.S. stocks occurs from 9:30 a.m. to 4:00 p.m. Eastern Time (ET) on weekdays.

- The NYSE’s working hours mark the most active period for trading within a 24-hour time period.

- Foreign exchanges have overlapping sessions across different world time zones.

How a Trading Session Works

Trading session hours vary by asset class and country. Regular trading hours for U.S. stocks start at 9:30 a.m. and end at 4:00 p.m. Eastern Time (ET) on weekdays (holidays excepted). The New York Stock Exchange (NYSE) closes early at 1:00 p.m. ET on some holidays.

Regular weekday trading hours for the U.S. bond market are 8:00 a.m. to 5:00 p.m. ET. Futures markets have different trading hours depending on the exchange and commodity type.

Traders should be aware of trading session hours for securities and derivatives they’re interested in to prevent unexpected problems.

In addition to regular trading hours, some markets may have pre-market or after-hours trading sessions, and some have 24-hour trading sessions.

Pre-Market and After-Hours Trading Sessions

Pre-market trading for U.S. stocks occurs between 4:00 a.m. and 9:30 a.m. ET on weekdays. After-hours trading is from 4:00 p.m. to 8:00 p.m. ET on weekdays, though times may vary slightly by exchange.

Pre-market and after-hours trading can be an opportunity to capitalize on news announcements or other factors outside regular trading hours. However, investors should consider potential risks, as identified by the Securities and Exchange Commission (SEC):

- Inability To See or Act on Quotes: Some brokers only allow investors to view quotes from their own trading system.

- Lack of Liquidity: After-hours trading typically has less liquidity than regular trading sessions.

- Larger Quote Spreads: Less trading activity often means wider bid-ask spreads, making order execution difficult.

- Price Volatility: Breaking news stories can cause greater fluctuations during after-hours trading.

- Uncertain Prices: Prices of stocks traded after-hours may differ from those during regular sessions.

- Bias Toward Limit Orders: Some ECNs only accept limit orders during after-hours sessions.

- Competition with Professional Traders: Many after-hours traders are professionals with access to more information.

- Computer Delays: Less technical support during pre-market or after-hours sessions can cause trade execution delays.

24-Hour Trading Sessions

Some markets have 24-hour trading sessions, such as the global foreign exchange (forex) market. The forex market, the largest and most liquid market in the world, operates without a physical exchange.

The forex market consists of large banks and brokerage firms that trade currencies with one another. It is open 24 hours a day, five days a week, from Sunday evening to Friday night.

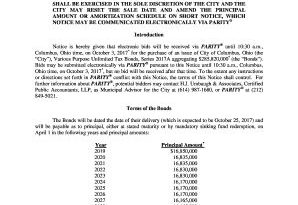

Forex Sessions, in GMT.

Regular Trading Sessions Around the World

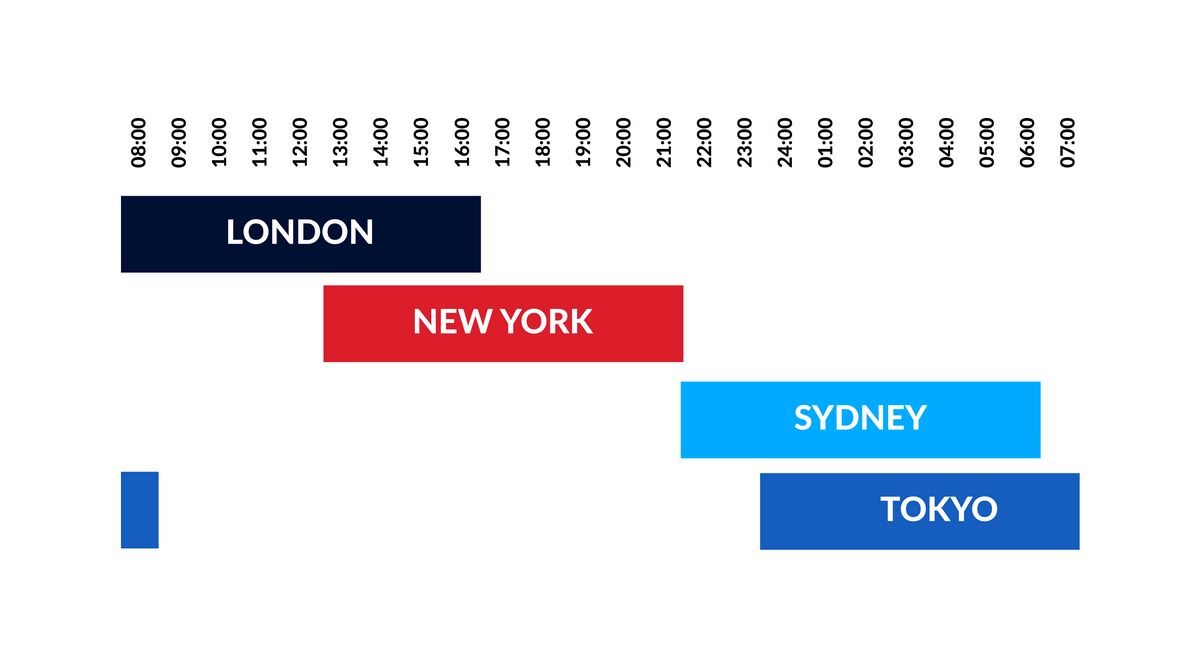

Here are the 20 largest stock exchanges worldwide, grouped by continent, based on market cap: